David Swensen is regarded as an investment god in the endowment world.

If you haven’t heard of him, he’s managed Yale University’s endowment since 1985. And from 1985–2019, Swensen grew the endowment from $1 billion to $30.3 billion.

Under his lead, Yale’s endowment fund has nearly doubled the average return of college and university endowment.

And it’s not just endowments he’s beating…

Over 30 years, he’s grown the endowment portfolio at 12.6% per year. That easily outpaces Wall Street’s 60/40 model (60% stocks and 40% bonds). Over the same span, this classic model returned 8.7% per year.

The beauty of Swensen’s outperformance is it comes with less risk.

What’s the key to his success? Asset allocation.

“Asset allocation is the tool that you use to determine the risk and return characteristics of your portfolio. It’s overwhelmingly important in terms of the results you achieve,” he says.

Swensen has spearheaded broad diversification during his tenure. He’s added multiple alternatives to Yale’s mix. When he started in 1985, alternatives made up 12% of Yale’s portfolio. Today, they account for 89% of Yale’s portfolio.

The “Yale Model” has eight asset classes: Absolute return, Domestic equity, Foreign equity, Leveraged buyouts, Natural resources, Real estate, Venture capital (VC), and Cash and fixed income.

At PBRG, we have a similar portfolio. One we have fine-tuned to become the best-performing, long-term newsletter in the industry…

Our Secret Sauce

In June 2016, former Wall Street executive and world-renowned cryptocurrency expert Teeka Tiwari took over our flagship Palm Beach Letter (PBL) newsletter.

And just like Swensen did at Yale, Teeka overhauled The Palm Beach Letter’s asset allocation model.

The first change he made was to add “Cryptos.” Next came “Private Markets.” And “Collectibles” followed.

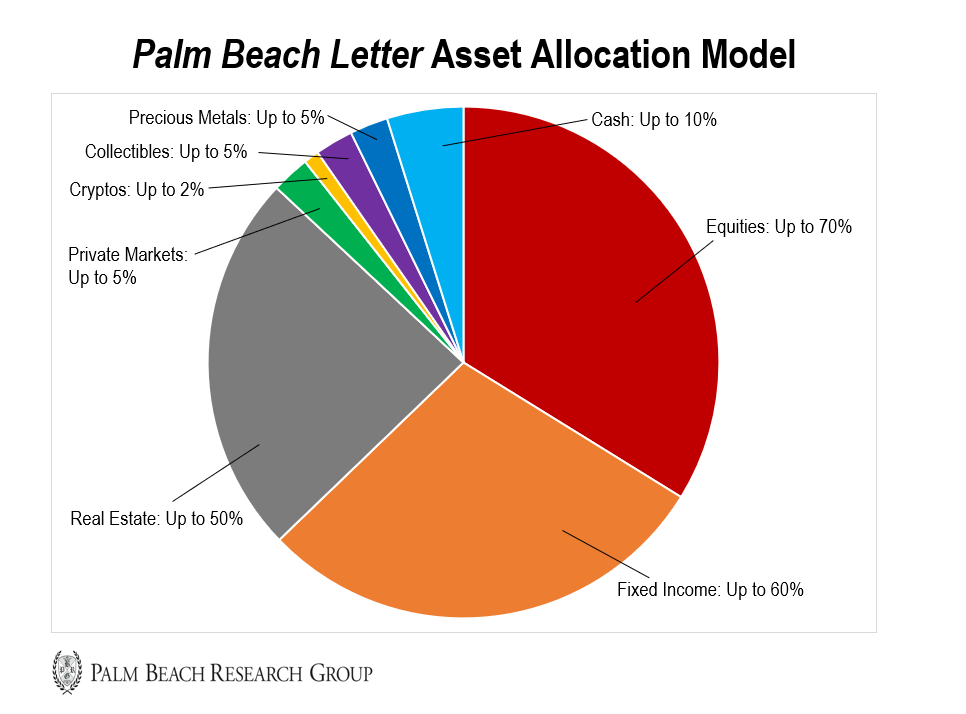

Under his guidance, the PBL asset allocation model has expanded to eight unique asset classes. See for yourself…

The result is a broadly diversified model with higher return potential and lower risk.

And our subscribers have been handsomely rewarded…

So far this year, the PBL portfolio is up 87%, while the S&P 500 is up just 11%.

And since Teeka took over in June 2016, the portfolio has posted an average annual return of 176.1% for his subscribers. Over the same span, the S&P 500 has logged an average annual return of 15.6%.

That’s no typo. The PBL portfolio has done over 11x better than the market.

And it gets even better…

Those outsized returns have come with about 20% less volatility than the broad market.

Adding small, uniform positions in crypto assets has been the key behind PBL’s market-crushing returns. But other alternative assets – such as collector cars, gold stocks, small business loans, and private markets – have boosted returns while tamping down volatility, too.

Here’s why I’m telling you this…

Asset allocation is the most important factor in determining your long-term wealth. Various studies show it accounts for 90%-plus of your investment returns.

But some of you may be under-allocated – or have no allocation at all – to assets with life-changing potential.

If you follow Teeka, you know he’s bullish on cryptos. So many of our readers have positioned themselves in this explosive asset class.

But there’s another asset class that Teeka believes has the same low-risk/high-reward potential as crypto…

The Private Playground of the Rich

I’m talking about private markets.

According to several reports, the private market has over $5.5 trillion in assets under management. But for years, Wall Street has walled it off from you.

And for good reason: The gains it’s pocketing are truly massive – far bigger than what you can make from publicly traded stocks.

According to our research, early-stage, private companies have returned over 12x what public companies have during the past two decades.

And a report by asset manager Blackstone found that private equity consistently outperforms public markets… while providing diversification, lower volatility, and protection in times of market stress.

That’s why Swensen has raised his allocation percentage to venture capital each of the last three years.

And it’s why Teeka calls private equity the best setup he’s seen since the crypto bull run in 2017.

Now, most investors can’t easily access private shares like the Yale endowment.

You can’t buy them from your brokerage account. Your investment adviser probably won’t ever tell you about them, either. And without hundreds of hours of research, it’s difficult to separate the good private deals from the bad.

So on Wednesday, September 9, at 8 p.m. ET, Teeka’s holding his first-ever Set for Life Summit.

During this event, he’ll show you how to get into the lucrative private market. And why your current net worth or background will no longer stop you from getting in.

Now, I can’t reveal all the details here. But what I can tell you is, Teeka has found a pre-IPO deal in an industry Forbes calls “the most profitable sector” in the country right now.

If you’re looking to diversify your assets, we recommend you allocate up to 5% of your portfolio to private markets.

And then click here to join Teeka’s Set for Life Summit. He’ll show you how a tiny grubstake in private markets investing can lead to crypto-like returns.

Regards,

Grant Wasylik

Analyst, Palm Beach Daily

P.S. If you RSVP today, you’ll automatically be registered for Teeka’s free pre-IPO workshop. Get all the details here…