If you’re a longtime reader, you know one of the reasons I love owning bitcoin is because it improves your overall portfolio performance.

For most of its existence, bitcoin has been uncorrelated to the markets. In other words, its movements aren’t tied to the stock market or overall business cycles.

And research has backed that up…

For example, a 2020 study by Bitwise Asset Management concluded that allocating 1–10% of your portfolio to bitcoin gives better risk-adjusted returns than holding just stocks and bonds.

That’s why I call bitcoin Wall Street’s “Holy Grail.”

By that, I mean it’s an asset that performs well under diverse market conditions while lowering volatility across your entire portfolio.

But recently, we’ve seen bitcoin start to move in the same direction as stocks – particularly high-growth tech stocks.

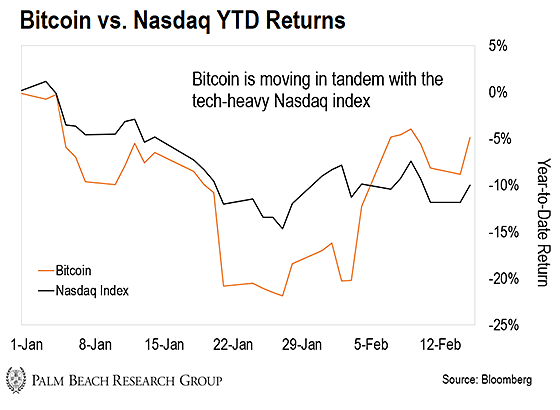

Since the beginning of the year, the market has treated these two assets as one and the same…

Just take a look at the chart below. It shows the year-to-date (YTD) price moves of bitcoin compared to the Nasdaq.

As you can see, bitcoin has sold off in tandem with tech stocks.

This correlation has a lot of people concerned. They’re asking me, “Teeka, is bitcoin now correlated to stocks?”

My answer: Yes. Right now, bitcoin is highly correlated to the tech-heavy Nasdaq.

This is bizarre, considering bitcoin:

-

Trades completely outside of the traditional financial market.

-

Isn’t directly correlated to other assets like equities, bonds, or gold.

-

Isn’t directly affected by monetary policy in any way, shape, or form.

So what’s causing this correlation? Is it something we should worry about? And does it portend a long-term shift in how we should view bitcoin?

These are the big questions I’ll answer today…

Bitcoin Is Moving in Tandem With Stocks – For Now

Historically, bitcoin is an asset that’s very sensitive to specific sets of data… or a particular set of actors.

These specific influences have changed over time. But whatever the data or actors say can have an outsized impact on its price.

For years, the No. 1 driver of bitcoin’s price was the People’s Bank of China (PBOC).

If the PBOC said anything negative about bitcoin, the price would crash.

For instance, when the PBOC banned crypto mining in China, the price of bitcoin dropped as much as 9% in 24 hours.

And we saw similar dips when the PBOC outlawed initial coin offerings, banned crypto exchanges, and curbed mining power in the country.

Today, that fixation has shifted to the U.S. Federal Reserve. And its policies are now having an outsized effect on the price of bitcoin.

As you now know, the Fed is threatening to hike interest rates to tame runaway inflation. Generally, when the Fed raises rates, growth stocks take a hit.

Investors will accept higher market valuations on tech stocks if they expect interest rates to stay very low.

It all has to do with the “discounted cash flow” (DCF) model… It’s a formula used to model future prices.

I won’t go into the weeds of DCF modeling.

Suffice it to say, as the risk-free rate goes higher (i.e., the yield on the 10-year Treasury)… the model revalues future cash flows lower.

So higher rates mean analysts must reprice their discounted cash flow models. And that results in their models pointing to lower prices for tech stocks. So they sell.

Big institutions like hedge funds, pension funds, and insurance companies rely heavily on the DCF model.

Well, guess what?

Some of the biggest new crypto buyers have been hedge funds, pension funds, and insurance companies.

These new players have no frame of reference to gauge bitcoin’s price. And they do the easy thing and lump bitcoin in with the rest of their tech investments.

In their minds, they consider bitcoin an asset like PayPal, Meta, and Square. Since the start of the year, those companies are down 40%, 35%, and 30%, respectively.

Does this mean bitcoin is now correlated to tech growth stocks?

Right now, yes. These sellers are treating them as the same asset.

Will they be right in the long term?

No. They will be proven horribly wrong. The decision to sell bitcoin will haunt them for the rest of their careers.

When the Narratives Fade, Bitcoin Soars

Given my experience with bitcoin’s narratives… I don’t believe the Fed’s action will continue to drive its price action.

Just look at the PBOC today. Its proclamations are much less influential on bitcoin’s price than they were three years ago.

I anticipate the same will be true with Wall Street’s reaction to Fed policy.

Here’s why…

Despite the recent sell-off, bitcoin miners still hold 88% of their bitcoin. (I call this phenomenon the “Super Halving.”)

The miners aren’t selling their bitcoin… even with the Fed threatening rate hikes.

And they’ll continue to hoard nearly all newly mined bitcoin… pushing its price to $500,000 in the coming years.

So my thesis is proving correct.

The miners are smart. They’ve seen a variation of this movie before. And they’re not buying into this “bitcoin is just like a tech stock” narrative.

Remember, we’ve been in bitcoin since 2016. Institutions arrived just a little over a year ago.

They’re still figuring out stuff we figured out five years ago. So I expect lots of volatility as they catch up to what we already know.

Don’t be scared by that volatility. That’s just the nature of this asset.

It’s inherently volatile. And thank goodness it is… That’s the price we pay for life-changing gains.

So, if you’re a long-term holder like me, this short-term correlation to tech stocks isn’t a big deal.

As the cycle of institutional bitcoin adoption gains traction… I believe the market will get smarter. And Fed policy will have less of an impact on bitcoin’s price.

Of course, it matters now… Just like it mattered when the PBOC banned crypto mining. But eventually, that narrative faded.

And so will the narrative surrounding the Fed and bitcoin.

The “bizarre” correlation between bitcoin and tech stocks is just temporary. Use the sell-off to buy more bitcoin.

Because when the dust settles on this volatility… and the market realizes that interest rates have no bearing on bitcoin… it’ll be well on its way to new all-time highs.

Let the Game Come to You!

Teeka Tiwari

Editor, Palm Beach Daily

P.S. The same volatility that’s causing sell-offs in bitcoin is also creating another phenomenon I call an “Anomaly Window.”

These events are like a window in time when the normal rules around making money in the market become suspended… and the gains you can see from seemingly ordinary, boring, blue-chip stocks become life-changing.

My Anomaly Window strategy is so successful it’s been right 362 times in a row… and past trades have been enough to recapture 21 years of S&P 500 returns in as little as three months.

For reasons I’ll explain on Wednesday, February 23 at 8 p.m. ET, I expect those gains to accelerate. That’s why I’m hosting a free live event where I’ll share details on the coming Anomaly Window.

I’ll even give away names and tickers of the stocks you can use to play it – no strings attached… All you have to do is join me.