Imagine you had a tiny scratch on your right leg… And you decided to amputate the entire limb because you feared it would become infected.

I know the analogy is gruesome. Rational people don’t amputate entire limbs because of a tiny scratch. It just doesn’t make any sense.

But that’s the type of mindset I’m seeing with bitcoin right now.

People are liquidating entire crypto portfolios due to some temporary bad news.

Since hitting its all-time high of nearly $70,000 in November 2021, bitcoin plunged to as low as $26,910 last week. That’s an ugly 62% drop.

I know it’s painful. But if you pull back the camera, you’ll see this drop is one tiny scratch on an otherwise healthy long-term trajectory.

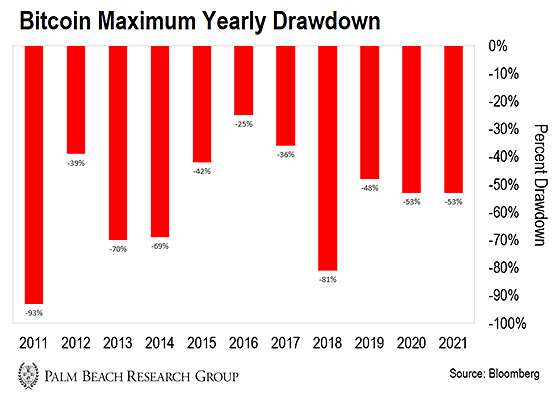

And this isn’t just wishful thinking, either. We’ve seen bitcoin take some serious lumps over the years, only to come back even stronger each time.

Despite numerous annual drawdowns, bitcoin is up 538,100% since 2011.

So, why is bitcoin dropping now?

As you know, the Federal Reserve is terrified about inflation. So it’s raising rates to rein in rising prices.

When interest rates rise, risk-on investments like growth stocks drop. That’s a major reason the Nasdaq is down 25% since the beginning of the year.

Right now, investors are correlating bitcoin to tech stocks. And since the market views bitcoin as a high-risk asset, it’s moving in tandem with the Nasdaq.

Now, is bitcoin actually correlated to tech stocks? I don’t believe so. It’s a completely different asset class.

My thesis is that bitcoin will eventually be a reserve asset like gold or the U.S. dollar. Over time, the world’s central banks will add bitcoin to their balance sheets.

But it doesn’t matter whether or not I believe bitcoin is correlated to tech stocks.

Right now, the market says it is… So over the short term, they’ll move together. And that means more downside ahead.

But when you look over the long term, you’ll realize the current pullback in bitcoin is more akin to a scratch on your leg. If your leg is healthy, there’s no need to amputate it.

And bitcoin’s long-term outlook is very healthy…

As you can see, the long-term trajectory is up, despite incredible volatility. But like a springboard, bitcoin bounces even higher after each drawdown.

The Adoption Story Is Still Intact

Over the years, I’ve learned you can’t just look at price as the sole barometer of long-term value in an asset class. You have to look at the overarching story.

As a young investor, I made that mistake with companies like Microsoft, Oracle, and Apple.

I got in these names when they traded for the split-equivalent of single-digit dollars… But boy, did I sell way too early.

I confused short-term price volatility with a long-term change in fundamentals.

So instead of price, I now look at a technology’s adoption rate as the No. 1 metric to project long-term value.

Think about it…

In the early 1990s, all you needed to know to make a fortune from Microsoft was that the number of personal computers would explode over the next two decades.

It’s the same story with bitcoin…

Crypto.com estimates there are 200 million people who use crypto assets. By the end of this decade, I believe at least 4–5 billion people will be using bitcoin.

And this isn’t just some wild guess, either…

Just last month, Fidelity announced it would allow individuals to put bitcoin in their 401(k) investment plans.

Fidelity is the largest U.S. retirement-plan provider. No one comes close.

About 23,000 companies use its retirement plans… and it has more than $11 trillion in assets under management (AUM).

Here’s why that’s so important for bitcoin adoption…

One study from deVere Group, an independent financial advisory, reported that more than two-thirds of millennials prefer bitcoin over gold as a safe-haven asset.

According to the U.S. Census Bureau, millennials make up about 22% of the population, and Gen Z makes up 20%. Combined, they’ll eventually account for nearly 50% of the workforce.

So Fidelity’s new bitcoin retirement product alone will onboard millions of new investors in the coming years.

Right now, bitcoin’s market cap is about $581 billion. That’s insanely cheap relative to where my research tells me it’s headed…

Once bitcoin becomes a widely held investment asset… and millions of workers add it to their retirement portfolios… we could see BTC eclipse gold’s market cap of $11.5 trillion.

That would suggest a bitcoin price of around $600,000 – a 2,130% move from today’s levels.

So it’s crucially important you understand the adoption cycle and how it works.

Bitcoin’s North Star

Right now, the biggest mistake crypto investors are making is confusing short-term weakness in the markets with a long-term downward spiral.

Rather than understanding this is a temporary ailment that will repair itself… they’re just dumping their bitcoin.

It’s the equivalent of amputating an entire limb because of a tiny scratch.

I’ve seen that type of fear-based selling again, and again, and again throughout my career.

Please understand this: Selling great assets into weakness never ends well. You’ll regret it when bitcoin rallies like it has in the past.

If you own bitcoin, the only thing you need to get right is its adoption story.

I’ve said from the very beginning that bitcoin is unique because it’s a decentralized and anti-inflationary currency.

And because of those properties, billions of people would eventually own it.

That thesis hasn’t changed.

It didn’t change when bitcoin crashed from $20,000 to $3,000 in 2020… or when it dropped from $63,000 to $30,000 last year…

And it won’t change now that bitcoin has dropped from $70,000 back to $30,000.

The key to surviving and thriving through this volatility is understanding that the bitcoin adoption story isn’t going away.

If anything, you should view this pullback as a buying opportunity.

Now, I know I sound like a broken record. But buying world-class assets at discounts is how you profit from volatility.

And bitcoin is a world-class asset.

If you’re looking to buy more bitcoin, I suggest doing so at two price levels. I’d put on half a position here in the $28k range and the other half if we get into the $22k range.

Now, it’s no guarantee bitcoin will drop that far. But we could see a lot more short-term weakness ahead in the equity and crypto markets.

So I want you to mentally prepare yourself.

Friends, since January, I’ve warned you we would be in for an ugly year. And so far, that’s exactly what we’ve seen.

But I’ve also positioned you to profit when the markets rebound.

So ignore the daily price action of bitcoin. We can’t control that.

Focus on the adoption story instead.

It’s the North Star that’s guided me since I started this journey in 2016. And it continues to guide me today.

Let The Game Come to You!

Big T

P.S. Despite the recent drop in crypto, I’ve spotted a catalyst that could give us a shot at life-changing crypto returns in the months ahead…

I call it the “Final Countdown,” and its potential returns will be even greater thanks to the low crypto prices we’re seeing right now… But once everyone is on board, it’ll be too late to act.

To learn more about the Final Countdown – and receive the name of my No. 1 crypto to play it – click here.

If mass adoption plays out like I expect, this is one catalyst we can’t afford to miss.