I don’t have a crystal ball… But I know how to read the room.

And when it comes to markets, there’s no bigger player in the room than the Federal Reserve. When it speaks, the market listens.

Just as Fed policy took a sledgehammer to the markets in 2022, I believe it may do the same for much of 2023.

As I told you in Monday’s essay, the Fed had no choice but to hike rates to rein in record-high inflation. In 2022, the fastest pace of rate hikes since 1980.

Ultimately, the Fed will have no choice but to pause its rate hikes.

In late 2022, we began to see the inflation rate decline. And we’ll likely see political pressure to pause or lower rates due to the rising costs of financing over $31 trillion in government debt.

However it happens, the end of the rate-hike cycle will be bullish for risk assets like tech stocks and crypto.

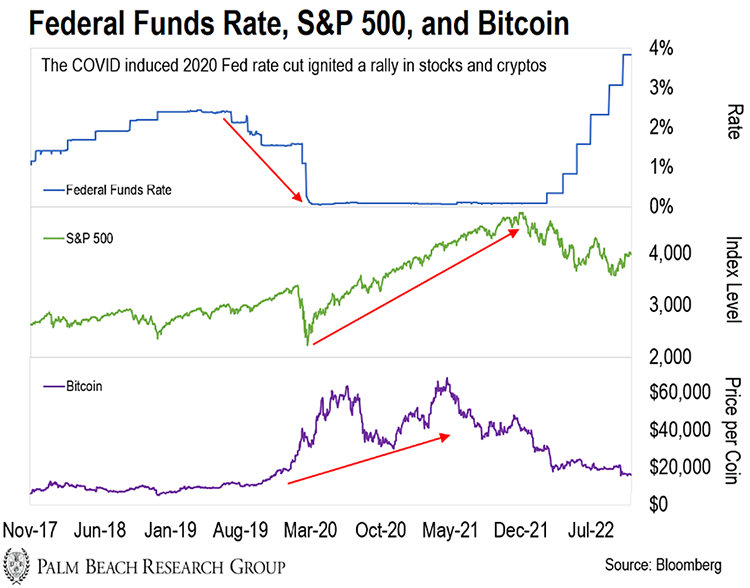

The last time we saw significant rate cuts was during the 2020 COVID-19 pandemic, when the Fed cut rates to near 0%.

As you can see in the chart below, it ignited a rally in stocks and cryptos…

Not only did stocks recover their old highs… they also hit new highs by the end of 2021. We saw the same trend with bitcoin, which also blew past its old highs.

So let’s look at the specific assets that will benefit from the Fed’s pivot in 2023.

Asset No. 1: Bonds

Back in 2016, I warned anyone within earshot to avoid bonds like the plague. I saw them as one of the biggest bubbles in the pre-covid markets.

Why?

The nearly non-existent yields offered no real inflation-adjusted return… unless you were willing to buy bonds with a high risk of default.

But now, it’s a totally different story.

Bonds still aren’t priced to beat today’s levels of inflation. But if inflation comes down in the next two years, as I expect, bonds should provide substantial real returns.

Interest rates and bond prices are inversely correlated. When interest rates go down, bond prices go up. And when interest rates go up, bond prices go down.

As I mentioned above, I expect the Fed to pivot to a rate pause before cutting rates. The biggest reason for this will be the exploding cost of financing the government’s debt.

Right now, the total federal debt (excluding unfunded liabilities) is $31.3 trillion.

It’s estimated that the federal government will spend over $1 trillion in 2023 just paying interest on that debt.

There will be rising political pressure on the Fed to pivot as we hit the psychological barrier of $1 trillion just in interest payments.

Meanwhile, we’ve seen the yield curve invert. When the yield curve inverts, long-term Treasury yields fall below short-term Treasury yields.

And inversions have preceded every recession since the 1950s. That’s a 10-for-10 perfect indicator.

That’s a sign we’ll likely move into a recession next year. And it’s another reason I believe the Fed will have no choice but to stop raising rates.

That’s why I’m confident 2023 will be a great year for bond investors.

Right now, we can lock in the highest bond yields since the housing market bust in 2008.

And as yields fall (remember, bond prices move inversely to bond yields), you could see double-digit capital gains.

The market has changed so fast that you can make a ton of money in bonds in a short time. You don’t need to take an insane amount of risk.

So bonds are a category I’ll be looking into for the first time in 15 years.

Asset No. 2: Income-Producing Stocks

As investors turned away from growth stocks in 2022, we found refuge from market volatility with a renewed focus on income-producing stocks.

And we’ll continue to do so in 2023.

That’s because companies that grow their dividends over time offer many attractive features.

First, dividend stocks have lower volatility than the market on average. That’s perfect for volatile markets, and it offsets some of the highly explosive moves we often see in positions in cryptos and tech stocks.

Second, dividend growers tend to be in mature industries with steady growth. That gives them tremendous cash flows to pass on to investors.

At its core, that’s what we want to see in a traditional investment. Over the long term, you can close in on the certainty of a bond-like return but with growing payouts instead.

Third, dividend stocks are ideal for any long-term investment environment because of the magic of compounding.

You want to get to the point where your investments are returning ever-increasing wealth back to you. Reinvested dividends make that process happen much more quickly.

Much like bonds, income-producing stocks took a hit this year as interest rates rose. But lower stock prices also translated into higher yields.

Even better, many companies grow their dividend payments annually. These dividend growth stocks are well-run, industry-leading companies.

This is another category my team and I will be looking into in 2023.

Asset No. 3: Crypto

I know it seems insane for me to recommend cryptos as a major theme in 2023… Especially after the beating they took in 2022.

But as I wrote on Monday, what we’re seeing is not a crypto problem. It’s a greed problem.

The biggest players, like bitcoin and Ethereum, dropped 75%. And several major crypto exchanges imploded and filed for bankruptcy last year.

But crypto exchanges are not crypto.

In fact, the underlying technology behind crypto projects is decentralized. So these projects remove the need for potentially corrupt middlemen in online transactions.

The exchanges under fire are centralized. These exchanges service crypto users and allow them to store their crypto. But their business models make profits for and enrich the insiders.

So yes, some bad actors were working in these centralized exchanges. But we’ve seen bad actors like that time and time again in any centralized Wall Street bank or firm.

And in bear markets, they get flushed out.

The point is what we’re experiencing in the crypto market isn’t new.

The FTX implosion in November 2022 is similar to the Mt. Gox hack in 2014 – when 840,000 BTC was stolen (worth $460 million at the time).

For those who’ve been in this space for more than one cycle… it’s unfortunately just another day in crypto.

That’s not to say I’m accepting of the type of reckless behavior that led to the implosion of FTX in 2022 or the hack of Mt Gox back in 2014… Rather, I want to show you just how resilient bitcoin and the crypto ecosystem really are.

Crypto’s technology is working to remove centralization. And it’s still as promising as ever.

While we may still have a few lingering brokerage issues in the crypto ecosystem in 2023, I expect prices to trend higher.

Even during 2022’s bear market:

-

The bitcoin hash rate rose to a record high.

The hash rate is a measure of computational power on the bitcoin network. Generally, the higher the hash rate, the more secure and stable the network.

A record-high hash rate suggests interest in the network remains strong and growing in size… even as the price of bitcoin faltered.

-

Institutions continued to come into the space.

Fidelity launched a way for investors to invest directly in cryptos in their 401(k) plan in November.

And in August, BlackRock announced it partnered with Coinbase to allow its institutional clients access to the crypto market.

Fidelity has 35 million customers. And Blackrock manages more than $10 trillion in assets.

Looking forward…

-

The bitcoin halving is on the horizon.

The next bitcoin halving is in 2024. These events have historically led to a sharp rise in bitcoin’s price.

When that happens, other cryptos tend to rally, too. That makes 2023 a great year for accumulating cryptos on the cheap.

And demographics will become a greater catalyst for adoption.

One study from deVere Group – an independent financial advisory – reported that more than two-thirds of millennials prefer bitcoin over gold as a safe-haven asset.

According to the U.S. Census Bureau, millennials make up about 22% of the population, and Gen Z makes up 20%. Combined, they’ll eventually account for nearly 50% of the workforce.

So over the coming years, we’ll see a flood of cash pouring into bitcoin from top-tier institutional firms and everyday millennial investors.

But also know this. Even without collapsing exchanges, cryptos have always proven to be volatile.

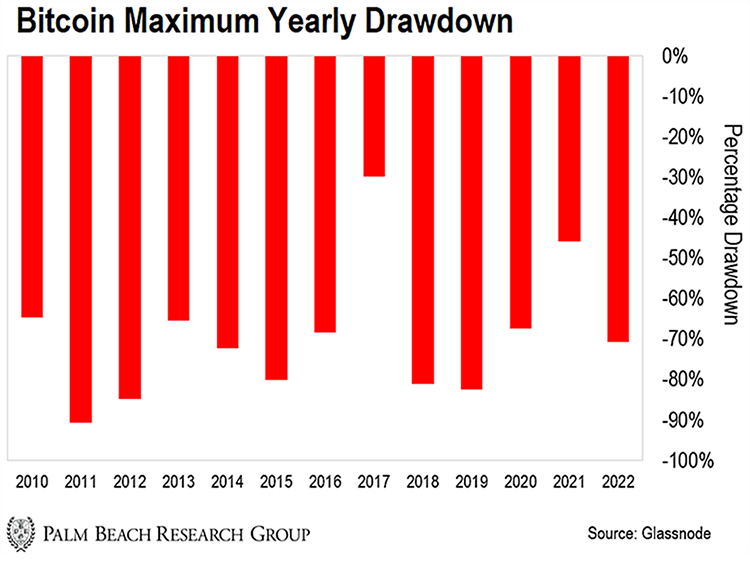

As the chart above shows, on average, bitcoin has pullbacks of 50% at least once every year. It’s just the nature of this asset class.

Although the drawdowns can be gut-wrenching, the rallies are mind-blowing – as we saw in 2017 and 2020 when BTC hit new highs.

Right now, bitcoin’s market cap is about $320 billion. That’s insanely cheap relative to where our research tells us bitcoin is headed.

Once bitcoin becomes a widely held investment asset, we could see it eclipse gold’s market cap of $11.5 trillion.

That would suggest a bitcoin price of around $550,000 – a 3,240% move from today’s levels.

The Market Will be Like Your Drunk Neighbor in 2023

From a market standpoint, 2022 was a bust.

After years of massive gains, the entire market screeched to a halt as the Fed finally decided to get serious about taming inflation.

After over a decade of easy money policies, I was surprised to see how quickly Fed Chair Jay Powell could switch from a mild-mannered bureaucrat to a chest-beating, bandana-wearing, gun-toting incarnation of 1980s superhero John Rambo.

As burly-chested as Jay Powell may feel, there are only so many rounds in that big interest-rate gun he carries.

This isn’t 1980 when federal debt was just 34% of GDP, and you could take rates to 20%.

With our current debt sitting at 130% of GDP and over $31 trillion – if the Fed hiked rates to 20% today – the federal government would have to pay $6.2 trillion in interest payments annually.

That’s more than the government’s fiscal 2022 budget of $6 trillion. At those rates, government coffers would be depleted within 90 days, factoring in all other spending.

So that’s not happening.

What’s more likely is Powell will hike as hard and as heavy as he can now. And then he’ll likely keep rates high for much of 2023. When he finally tells the market he’s stopping all rate hikes, the market will have put in a bottom.

Between now and then, expect a lot of hoping and praying to take over in market psychology. That will result in a lot of volatility… but not much else.

It’ll be like watching a drunk neighbor through the window knocking over his own furniture as he stumbles from room to room. By the morning, he’ll have slept it off and will be much better.

Over the next year, the market will look similar in how it behaves as it gets its collective head wrapped around rates staying higher for longer than it would like them.

While 2022 was disappointing, and much of 2023 will look the same, it will lead to an incredible bull run in the final quarter of next year.

If you’ve been practicing patience, continue doing so.

Across 2023 and beyond, I’ll continue to do everything I can to shelter you from what’s to come…

While also putting you in a position to profit from the abundance of life-changing opportunities that can only come about during a nasty bear market.

Let the Game Come to You!

Big T