It’s rough out there…

Inflation is at a 40-year high. According to the Consumer Price Index (CPI), everyday goods are now 9.1% more expensive than one year ago.

We’re seeing shortages of everyday goods. We have a war in Eastern Europe destabilizing the world’s oil and gas markets.

And stocks have been absolutely no help this year for investors looking to grow their wealth. All three major American indices are solidly in “bear market” territory.

I know these are trying times.

That’s why I’ve been sharing alternative ways for investors to protect and grow their wealth in these uncertain times over the last few weeks.

Today, I’ll share four of my favorite strategies for thriving in the current market environment…

1. Fixed Income Investments

Right now, interest rates are rising. In June, the Federal Reserve (Fed) raised its benchmark interest rate (the fed funds rate) by another 75 basis points… the biggest increase since 1994. That brings us up to a range of 1.5–1.75%.

While the fed funds rate is still near historic lows, the upside of rising rates is that it makes fixed income investments more attractive. And one area of fixed income I’m particularly interested in is convertible corporate debt.

Here’s how it works…

A convertible bond is a fixed-income investment that delivers a yield to its investors. Like a traditional bond, a convertible bond delivers regular income and will return all your principal investment at its maturity date. But these bonds can do something else as well.

As the name suggests, these bonds can be “converted” into shares in the company that issues them. The conversion happens at a predetermined conversion ratio and conversion price. And you can convert them at any time during the bond’s life.

And after reviewing the inventory of convertible debt currently on offer, it might surprise you to see the kind of opportunities out there.

Already we’ve begun to put together a core database of safe convertible debt offerings for technology companies… offers that yield anywhere from 5% to over 7%.

This is an area my team and I are actively investigating. And we’ll be sharing more research with readers in the weeks ahead.

2. Timberland

My second idea to preserve and grow your wealth in the years ahead will probably come as a surprise. It’s timberland. That’s right. It’s land… with trees on it.

Timberland can be a great asset to help preserve and grow your wealth. For starters, the asset is not correlated with stocks. Timberland can also produce a reliable income stream because it can be harvested at regular intervals.

A large enough parcel of timberland can be managed to produce annual harvests that will produce regular income. And that income can more than cover taxes associated with the land.

After a period of time, timberland investments can also produce large capital gains.

For example, the value of timberland in the Pacific Northwest – as measured by the NCREIF Timberland Index – returned 14.42% last year.

I recently had dinner with a colleague who purchased a large piece of property in rural Michigan. He commissioned a forester to survey his land. He was told he could reclaim close to 30% of his purchase price by selectively harvesting the trees on his property. Bear in mind that this didn’t mean harvesting all the trees but just “tidying up.”

In this environment, I’m actively looking into the idea right now. Perhaps one day, I’ll have my own forest to manage and harvest.

And I have to say, there’s something appealing about owning your own plot of timberland and watching your investment literally grow in front of your eyes.

3. Agriculture Operations

Along the same lines as timberland, agricultural land can be a great way to insulate your wealth in the years ahead. Many would argue that food and water are the most essential “assets” for life.

And similar to timberland, agricultural land is a “real” asset. Unlike fiat currency, these types of assets will keep pace with inflation.

With the invasion of Ukraine, I predict, sadly, that the world is on the verge of serious food shortages. In developing countries, we could be looking at a serious famine in late 2022.

That’s because Ukraine and Russia supply roughly one-quarter of the world’s wheat. Every year, 32 million hectares are cultivated within the Ukrainian border. The area has long been known as the “breadbasket of Europe” for this very reason.

At the same time, the sudden supply shock for natural gas is having knock-on effects on agriculture. Fertilizer, a key component to promoting soil health, requires inputs like urea and ammonia.

Both molecules are derived from natural gas and can account for 40–70% of the cost of producing agricultural fertilizers. As natural gas soars, the price of fertilizer has gone vertical.

The Green Markets Fertilizer Index – which tracks a blend of global fertilizer prices – shows that the cost of fertilizer has soared 118% since this time last year.

All of this suggests that the prices for agricultural products are about to go higher… perhaps much higher. And we can safely assume the value of food-producing land will rise as well.

These three ideas are excellent places to start in this market environment. But it’s my last idea that I’d ask you to pay special attention to.

4. Turn to the Private Markets

Investors are looking for anything to help them meaningfully grow their wealth right now.

This was the only topic in readers’ minds at the annual Legacy Investment Summit earlier this year. And here’s what I told them…

My No. 1 recommendation to seek shelter from the storm is to turn away from public markets and look towards the private markets.

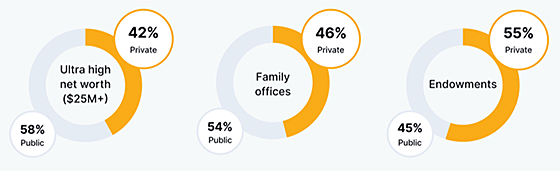

During my presentation, I shared this graphic…

It shows how much wealthy investors are allocating to private investments.

And you can see that wealthy investors and family offices have nearly half of their portfolios in private investments… while endowment funds have more than half of their portfolios in private investments.

And what exposure does the average retail investor have? Zero percent. That’s right – absolutely nothing.

Investing in private companies during volatile times like this may seem counterintuitive. After all, investing in private investments is not a traditionally conservative strategy.

As an angel investor, I can tell you that private investing is not for the faint of heart. Many private investments will deliver small returns to investors, while others will fail altogether. But there is a handful that will deliver truly life-changing returns.

And it’s this last group – the “home run” investments – that can make an entire portfolio. It’s a form of asymmetric investing that only requires small amounts of capital for the potential to see outsized returns.

And because these investments are not buffeted by the daily gyrations of equity markets, I view them as the purest form of “set it and forget it” investing. And they are the best way I know how to build generational wealth in the years ahead.

That’s why tonight at 8 p.m. ET, I’m hosting a special investing event to share my favorite ideas in the private markets right now.

Even if you’ve never been interested in private investing, I encourage you to attend. I believe the analysis I share will be well worth your time.

You can sign up right here for free access to tonight’s special presentation.

Regards,

Jeff Brown

Editor, The Bleeding Edge