Over the last 30 years, the best 12-month performance for the S&P 500 occurred over the one-year period that ended March 31.

Since the pandemic outbreak, the S&P 500 gained 56.4% and it hit an all-time high of 4,290 on June 28.

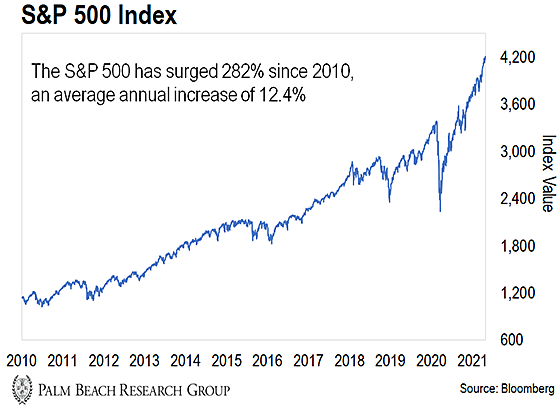

Pulling out even further, you can see the S&P 500 has surged 282% since 2010… an average increase of about 12.4% per year.

If you just owned a simple S&P 500 index fund over the last decade, you would’ve nearly quadrupled your money…

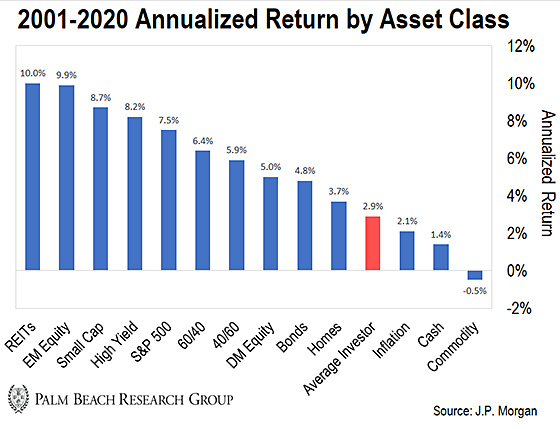

Unfortunately, the average investor hasn’t enjoyed this ride. As you can see below, they’ve done worse than just about everything else over the last two decades…

So why is the average investor doing so badly when the market is reaching new all-time highs?

Emotions.

You see, the emotional roller coaster ride shakes many investors out of the market. They buy at tops and sell at bottoms…

The greatest opportunities often come from ideas that are new or hated, and when market panic and despair is high. That’s when people are most uncomfortable…

But it’s also the best time to buy.

Today, I’ll show you how to conquer the market fear curve by protecting yourself from the greatest risk of loss… and positioning yourself for the greatest opportunity for gain.

Five Rules to Protect You From Greatest Risk of Loss

Now, the best way to do this is to avoid the emotional roller coaster. And these five rules will help you make more rational investing decisions…

-

Diversify your assets.

The secret to building wealth – and keeping it – is diversification. That’s why we publish an asset allocation guide each January. It’s our most important issue of the year. (PBL subscribers can read our 2021 guide here.)

We recommend a mix of stocks, bonds, cash, real estate, collectibles, cryptos, and other alternatives.

Not only does diversification lead to better returns, it also lowers risk. Numerous studies show that asset allocation accounts for 90%-plus of your investment returns.

-

Tune out short-term forecasts.

The market’s short-term direction is unknowable. No one has a crystal ball. Even experts get it wrong more often than right.

Whether it’s stocks or crypto, unless you’re a day trader, daily volatility shouldn’t bother you. So don’t get sidetracked by the noise. Just focus on the big picture.

-

Have a risk management plan.

Before you can grow wealth, you need to protect what you have first. The best way to do that is with position-sizing.

Position-sizing refers to the size of a position within your portfolio (or the dollar amount you’re going to trade). Our simple rule of thumb is: If an investment gets stopped out of your portfolio, your maximum loss should be no more than 2.5–5% of your portfolio’s value.

If you know your downside is capped, then you can sleep easily at night. This way, you won’t panic-sell at the worst time.

-

Use systematic investing.

Systematic investing simply means investing money regularly. Sign up for a direct deposit in a taxable brokerage account.

Take advantage of a retirement plan where you can allocate part of your paycheck to investments (maybe even get an employer match). And switch your mutual funds, ETFs, and dividend-paying stocks to “dividend reinvestment” if you don’t need the income.

-

Create a plan and stick to it.

Other than annual adjustments and periodic rebalancing, you shouldn’t deviate much from your investing plan. If you have a life-changing event, revaluate your plan at that time. But sticking to a plan will keep you from making emotional investment decisions.

Now, these five rules will protect you from the greatest risk of loss. The next two will put you in position to reap the greatest opportunities for gain.

Two Rules to Position Yourself for the Greatest Opportunity for Gain

It’s one thing to protect yourself from losses. Making money is an entirely different beast.

And if you want to make life-changing gains in the market, Daily editor Teeka Tiwari says you need to do two things:

-

Find a massive trend in its early stages.

-

Develop a network of industry experts who can help guide you into the right companies riding that trend.

It’s the same strategy he used when picking his first two trillion-dollar trades.

His first trillion-dollar trade was in 2003 when he identified Apple, the world’s first trillion-dollar company. Buying Apple at his recommended price could have turned $1,000 into $364,973.

His second trillion-dollar trade happened when he found cryptocurrencies in 2016 – today worth over $1 trillion. If you had listened to just one of Teeka’s crypto recommendations… you could have turned that same $1,000 into $1.5 million.

Unfortunately, you might not have heard about either one of these.

Teeka reserved his research on Apple for his Wall Street clients. And while his crypto trade was available to everyone… it started all the way back in 2016.

But here’s the good news…

Teeka’s unearthed what he believes will be his third trillion-dollar trade. It’s a massive trend he believes will make early investors life-changing returns just as Apple and crypto did.

That’s why on Thursday, July 8 at 8 p.m. ET, he’s holding his Third Trillion-Dollar Trade event.

During this event, Teeka will reveal this $1 trillion trend… and tell you how you can access the right companies to profit from it.

This idea is so big… he’s even invited some special guests to help you understand the sheer size of the opportunity.

And not only are the stars coming out from the worlds of entertainment… sports… and global politics…

Teeka’s partnered with the world’s leading expert in the space to bring this idea to you. A man who athletes… movie stars… word-class doctors… and even Oprah Winfrey rely on as the most-trusted source of information in this emerging trillion-dollar trend.

Over the next 18 months, Teeka believes a handful of companies this expert has advised on could pull forward a century’s worth of stock market gains.

Now, due to the sensitive nature of this opportunity, we can’t reveal his identity until Thursday, July 8, at 8 p.m. ET. So click here to reserve your seat.

And to recap, if you want to beat the market’s fear curve, follow my seven rules. The first five will protect you from the greatest risk… while the final two will put you in position for the greatest gains.

And I’ll add one more step to the list: Mark down Thursday, July 8 on your calendar.

Because during Teeka’s Third Trillion-Dollar Trade event, he’ll share an idea that could beat a century’s worth of average market stock returns in 18 months. And help turn you from an ordinary investor into an extraordinary investor.

Regards,

Grant Wasylik

Analyst, Palm Beach Daily

P.S. As a bonus for attending, Teeka will give away a never-before-released pick with the potential to 10x your money from this $1 trillion trend. You’ll get the name and ticker symbol during the event, no strings attached.

To date, Teeka’s past free picks have an incredible average peak gain of 1,691%. So you’ll want to come just for that.

Plus, event VIPs get Teeka’s special bonus report. Click here to learn how to become a VIP for free.