During the holiday season, you might be looking for ways to give back to others.

You could volunteer in a local soup kitchen. Pay someone’s layaway balance. Or donate Christmas gifts to a children’s organization.

If you have the time and/or money, these options are all great ideas.

But there are also ways to do good and earn an above-average return while doing so.

Yesterday, I gave you one idea… It’s called “impact investing.”

Impact investing is a term that came around about 10 years ago. It’s a catch-all for ESG (Environmental, Social, Governance), SRI (Socially Responsible Investing), and VBI (Values-Based Investing).

It’s a type of investment that allows you to do good and make money at the same time.

This trend started with institutions and high net worth individuals. And it’s trickled down to financial advisors and everyday investors.

According to the US SIF Forum’s 2020 report, total US-domiciled assets using ESG strategies tallied $17.1 trillion. And there are close to 1,000 ESG-related mutual funds and ETFs in the marketplace to choose from.

Today, I’ll tell you about an alternative type of “impact investing.” It’s a fixed-income platform that lets you invest in causes near and dear to your heart.

It has a more direct impact than any of the hundreds of ETFs and mutual funds in this space. And it will allow you to potentially earn up to 33 times the interest you’d receive on other short-term vehicles.

Become an Impact Investor in Main Street America

Founded in 2016, CNote is a women-led impact fintech firm on a mission to close the wealth gap through financial innovation.

The platform enables corporations and foundations to reach their diversity, equity, and inclusion goals.

With CNote, 100% of your money is invested with non-profit lenders that finance under-served communities and spur U.S. economic development.

Here are just a few CNote success stories:

-

In Maine, the Knox County Homeless Coalition used CNote funding to develop and support permanent affordable housing and facilities for the homeless.

-

In St. Louis, CNote funding was used to fund an early-childhood development center that provides affordable childcare and education services in underserved communities.

-

And in San Diego, Fern Street Circus used a CNote loan to fund a non-profit that serves local families and transforms neighborhoods via performance and art.

CNote is a Certified B Corporation, so it must meet the highest standards of balancing profit and purpose.

And as a business, it is legally required to consider the impact of its decisions on its workers, customers, suppliers, community, and the environment.

CNote focuses on 26 themes in line with UN Sustainable Goals… Think racial justice, climate crisis, immigration, refugee issues, and gender equality.

The company helps corporations and foundations invest in community development financial institutions (CDFIs), low-income designated (LID) credit unions, and minority deposit institutions (MDIs).

It offers the Flagship Fund (for everyday investors), Wisdom Fund (for accredited investors), Promise Account (for institutional investors), and customized impact investments.

For simplicity’s sake, I’ll focus on the Flagship Fund, a Regulation A+ investment open to everyone. (Regulation A+ is a private company that can accept investments from the general public.)

Getting Started

In addition to being CNote’s most accessible offering, the Flagship Fund features competitive returns, no minimum investment, and quarterly liquidity.

And it directs 100% of invested dollars to federally certified CDFIs.

These are private financial institutions that provide affordable lending to low-income and other disadvantaged people and communities.

And while a large bank can take six months to perform due diligence on a CDFI, CNote can bring a CDFI partner onto its platform in six weeks. These partners have existed for decades. And they haven’t lost a single investor dollar, ever.

Since the Flagship Fund’s debut, investments on CNote’s platform have created or maintained over 4,000 jobs.

And from April 2020 to April 2021, over 40% of newly deployed capital has gone to women-led businesses and over 50% to Black, Indigenous, and borrowers of color.

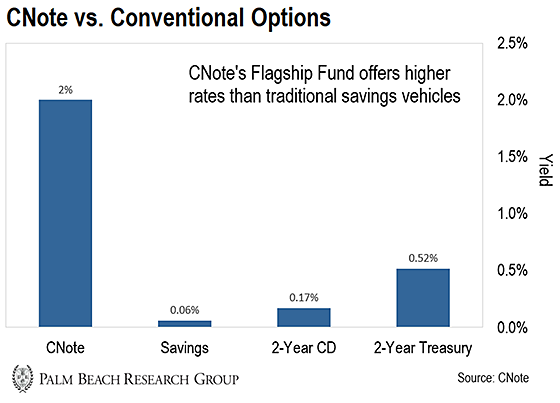

But remember, this is not a donation. Beyond a social return, CNote’s Flagship Fund provides an attractive financial return: a 2% annual rate over a 30-month term.

There is no minimum investment. And the fund offers flexible quarterly liquidity.

Now you might think the 2% return above looks low.

But by comparison, it has a much higher rate – anywhere from 4x to 33x greater – than traditional fixed income vehicles, like savings accounts, CDs, and Treasuries. (Note: Unlike savings accounts and CDs, CNote’s Flagship Fund is not federally insured.)

For instance, if you put $10,000 in a 2-year CD, you’d make $17 in income per year at the national average rate. That’s a total of $34 over 2 years.

But if you put $10,000 in CNote’s Flagship Fund, you’d make $200 in income per year. That’s a total of $400 over 2 years. (If you kept in for the full 30 months, you’d earn a total of $500.)

So, by investing in a good cause, on a comparable two years, you’d make 1,076% more in income. Take a look…

A Win-Win Scenario

If you’re looking for an easy entry into impact investing, consider the CNote.

Not only does your money go to a good cause… but you also earn a higher interest rate than traditional options. And at the end of the term, you get your money back.

Best of all, CNote’s Flagship Fund doesn’t charge any fees.

If you want to learn more about CNote’s offerings, click here. As always, do your homework before making any investment.

It feels good to help someone else in need. But if you can also make money while doing so, it’s a win-win scenario.

Regards,

Grant Wasylik

Analyst, Palm Beach Daily

P.S. Let us know if you plan to take part in an “impact investment” this holiday season. Send your story to us right here.