Have you bought oil tankers yet?

My gut says we may have just seen the bottom of a 12-year bear market in tanker stocks…

From this point on, I believe these stocks will move significantly higher.

If you buy now – and you have the stomach for the incredibly high volatility of tanker stocks – you will make great returns… and dividends, too. (More below.)

Our American Road Trip

Greetings from our latest campground.

Nearly three weeks ago, my family and I broke quarantine. We hit the road with a car, a pop-up camper, and some sleeping bags to explore America and sleep in campgrounds.

We started in West Palm Beach, Florida. So far, we’ve spent time in Florida, Alabama, Georgia, North Carolina, and Tennessee.

Next week, we turn west and head for the Great Lakes and the Midwest. Final destination: Alaska.

Every few days, we pack up our campsite and hit the road again.

We’ve done this so many times, we all know our roles now… and we all know where everything lives. We can pack up and pull out in about half an hour…

As far as the lockdown goes, every state seems to be different. In Florida, many of the state and city campgrounds remain closed. In Alabama, they’re all open. In Georgia, some of them are open and some are closed.

We’re using an app called Campendium. It filters out all the campsites that remain closed from the government lockdown…

Here we are eating our supper Monday night, during a break from the rain…

|

Our campsite in the Georgia backcountry |

The Only Investment I’ll Make Today That’s Not Gold

Back to oil tankers…

The global monetary system is terribly broken. We’re seeing greater and greater acts of desperation from the government and central bank to keep the bubble inflated and the banking system functioning.

The stock and bond markets have become completely divorced from reality.

And now, we’re in a severe recession. I don’t know exactly how the economy will get healthy again, but it’s not going to be gentle or easy.

This is not a good time to be an investor.

Two years ago, Kate and I withdrew entirely from the stock market. We put our entire retirement savings into gold, where we’ll remain until the stock market is a bargain again (in terms of gold).

Tanker stocks are the only investments I’m willing to make an exception for.

The Trick to Investing in Oil Tankers

The tanker thesis is pretty simple.

Transporting oil is a terrible business. According to one book on shipping I read recently, shipping has the lowest returns with the highest volatility of any “heavy” industry.

“How do you make a small fortune in shipping? Start with a large one,” goes the old shipping joke.

Brutal competition… chronic overcapacity… heavy capital reliance… and a never-ending flow of destabilizing events…

From my research, it seems tankers only make money for two or three years per decade. Then they lose money the rest of the time.

The trick to investing in tankers, therefore, is to hold them for the good years, and stay away for the bad years.

Seems obvious enough. But how do you know when the bad years are going to turn into good years?

How I Know It’s Time

There’s an old saying in the shipping business: “There are either too many ships or there are too few ships.”

Most of the time, there are too many ships. The shipping companies don’t make any money. But occasionally, there are too few ships. And that’s how you know it’s time to invest in shipping.

Between 2008 and 2019, there were generally too many ships. (There was a huge boom in new shipbuilding leading up to 2008, spurred by low interest rates and a flood of private equity money entering the sector.)

But towards the end of 2019, we finally entered a period of too few ships.

Over the last nine months, tanker companies have made fortunes. They’ve used this money to pay down their debts, increase their cash balances, buy back shares, and pay dividends.

They’ve completely transformed their balance sheets over the last nine months.

But will this situation last?

Investors Haven’t Noticed This New Supercycle

It’s easy to track how many ships are under construction in the shipyards of China, Japan, and South Korea. And it’s easy to track the ages of existing ships.

(Oil tankers have a life span of about 20 years. Then they get demolished.)

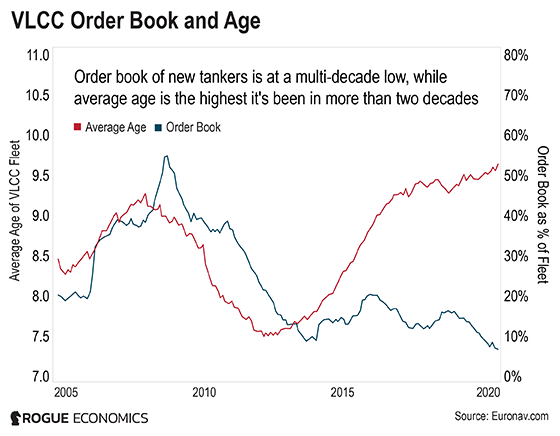

This chart shows the order book for new VLCC oil tankers. (VLCC stands for very large crude oil carriers). And it shows the average age of the oil tanker fleet.

You can see that the order book is at the lowest it’s been in more than two decades (the blue line). There won’t be many new ships entering the fleet over the next couple of years.

Meanwhile, the average age of the oil tanker fleet is the highest it’s been in more than two decades (the red line). Many oil tankers will be retiring over the next couple of years.

In other words, the period of too few ships will continue for at least two more years. (Probably even longer… As I’ll show you in a second, it’s unlikely that ship owners will suddenly start ordering lots of new ships.)

Meanwhile, in the stock market, investors haven’t noticed the tanker industry just entered its next “supercycle.”

Why am I so sure?

The best way to judge how investors feel about the oil tanker business is to sum up the value of the oil tankers in a company’s fleet. (Its net asset value, or NAV.)

This is easy. There’s an active market for used oil tankers.

Then, you compare NAV to what the stock market says the business is worth. (Its market capitalization.)

Normally, these two numbers should be more or less equal. But sometimes, investors get either greedy or fearful, and the numbers diverge.

Like now, for example.

Some of the best oil tanker companies in the business have fleets worth, say, $1 billion, but the stock market says the businesses are only worth $750 million. Three of the tanker companies I recently recommended have Price/NAVs in this range.

In other words, they’re trading at a 25% discount to NAV.

Said another way, you can buy oil tankers at a 25% discount by buying them through the stock market instead of in the real world.

Worst of the Selling Is Over

Soon, investors will notice how much money oil tankers are making, and how the fleet is about to shrink, and they’ll close the gap between NAV and market caps. They may even send it to a premium.

There could even be some consolidation between companies. Why pay full price for a new oil tanker from a shipyard when you can buy an entire fleet from a competitor at a 25% discount?

And finally, companies are starting to buy back their own stock. Why spend money on new oil tankers when you can buy your own tankers at a 25% discount by buying back your own stock?

And of course, the oil tankers will continue earning big profits, as there won’t be enough ships in the fleet for the next few years.

Over the last month, there’s been a bloodbath in oil tanker stocks. Some of the tanker stocks fell nearly 50% in the last four weeks. It’s been brutal.

My feeling is, that was the climax of the 12-year bear market, and the worst of the selling is over. We’ll see…

Regards,

|

Tom Dyson

Editor, Postcards From the Fringe

P.S. As I mentioned, Kate and I have put our entire retirement savings into gold…

We’re using a long-term compounding strategy that involves rotating between gold and stocks every generation or so, according to the stock market’s valuation.

I’ve shared all the details right here.