Last month, I reached out to legendary commodities expert Frank Holmes.

Frank is CEO and CIO of natural resources firm U.S. Global Investors. He’s a sought-after speaker at precious metals conferences all over the world.

He runs several commodity funds, including mutual funds and exchange-traded funds (ETFs). And he and his team have visited hundreds of mines over their careers.

As you know, at PBRG we recommend you allocate 5% of your portfolio to precious metals (primarily, gold). They’re a good hedge against the kind of financial chaos we’re seeing during the coronavirus pandemic.

And according to some estimates, the governments of the United States, Europe, and China will spend nearly $6 trillion combined in stimulus money to rescue the global economy. This massive infusion of “printed” money will create inflation. And it will send investors looking to protect their money into gold.

So I asked Frank how gold and gold stocks will play out in the wake of the coronavirus pandemic.

Here were some of his key takeaways…

Rising Demand, Falling Supply

General investors haven’t been in the gold space for quite some time. But Frank says they’ll start to swoop in and buy gold.

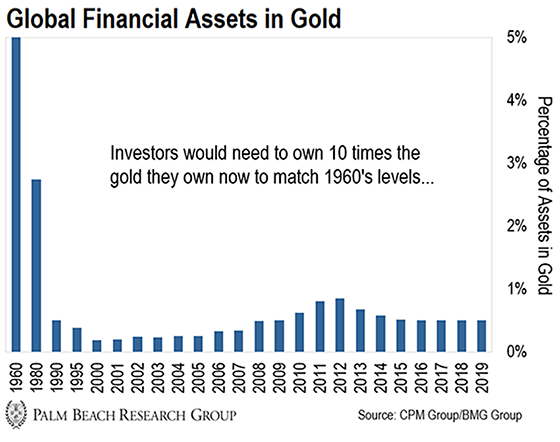

You see, historically it’s been considered a good idea to allocate at least 5% of a portfolio to gold. But other than gold bugs, no one holds that much gold anymore.

According to Credit Suisse’s Global Wealth Report, global investors have an estimated gold allocation of just 0.5%…

So gold could be worth much more if their allocations go up.

Let’s say that allocation goes from 0.5% back to a conservative 0.85% (the most recent high in 2012)…

Over $1.2 trillion would need to flow into gold. And it would take gold’s price to $2,550 – a 50% increase from today’s level of around $1,700.

Here are the prices gold could reach if we hit other allocation levels:

-

At a 1.37% allocation (just half of the 1980 level), gold’s price would be $4,110 – a 142% gain from today.

-

At a 2.74% allocation (the level in 1980), gold’s price would be $7,170 – a 322% gain from today.

-

At a 5% allocation (as we saw in 1960), gold’s price would be $15,000 – a 782% gain from today.

As you can see, just a small increase in the percentage of gold holdings could send gold’s price skyrocketing.

Another reason Frank says we’ll see gold rise is… peak supply.

According to Barrick Gold – the world’s second-largest gold mining company – the number of mega-gold deposits yielding 30–50 million ounces has plummeted since the 1970s.

Meanwhile, legendary goldfields like South Africa’s Witwatersrand Basin, Nevada’s Carlin Trend, and Australia’s Super Pit are nearing the end of their life cycles.

A lot of mid-cap miners will be bought out. And bullion will perform like it has during previous cycles.

When you combine declining supply with increasing demand, gold will ignite.

But certain gold stocks could soar even higher because they’re levered to the price of gold.

Gold Stocks Will Outperform the Market

Over the coming year, Frank expects the mining industry’s three-year numbers to outperform the S&P 500’s due to higher gold prices.

On a relative basis, gold stocks will outshine on revenue growth rates, cash flow, and free cash flow per share – something we haven’t seen since 2003.

And while companies like Carnival, Estée Lauder, Hilton, Kohl’s, and Las Vegas Sands recently suspended their dividends due to the economic fallout of COVID-19… Frank expects gold companies will have plenty of market beats.

Now, so far, few miners have reported earnings. But one that has is Australia-based Evolution Mining. It announced a 10% increase quarter-over-quarter in mine operating cash flow, as well as record net mine cash flow at two of its projects.

As Frank told me, Evolution Mining is just one example of what’s to come…

There’s a lag on gold to gold stocks. Metal prices rise. And then all of a sudden, everyone falls in love with gold stocks. Six months out, bullion prices should be higher. And gold stocks should follow, because confidence in stocks, in general, has returned.

One way to gain exposure to the mining sector is the U.S. Global GO GOLD and Precious Metal Miners ETF (GOAU). It has a rules-based system that focuses on producers with strong balance sheets, talented management teams, and an attractive portfolio of active mines.

What I also like about GOAU is that it overweights royalty and streaming companies, such as Franco-Nevada, Royal Gold, and Wheaton Precious Metals. These companies are often called the “smart money” of the industry. They avoid costly mining expenses and overhead as they benefit from higher gold prices.

But always remember: Do your homework before making any investment.

Regards,

Grant Wasylik

Analyst, Palm Beach Daily

P.S. Gold isn’t the only thing we’re bullish on at PBRG. There’s another industry that is about to explode, too. In fact, Daily editor Teeka Tiwari calls it his No. 1 investment of the decade.