It’s a $57 million mistake I hope you never make…

In the early 1990s, I was a 19-year-old money manager… I was living in an analog world that suddenly found itself falling headfirst into a digital future.

We were using paper-filing systems, typewriters, and fax machines. The personal digital assistant (the predecessor to the smartphone) wasn’t invented yet.

People referred to the internet as the information superhighway. I didn’t know anyone who used email… and we still rented movies on VHS.

At the same time, technology experts were making bold predictions. They theorized that one day, we would all be able to…

-

Afford our very own cell phones.

-

Own personal computers.

-

Do all our shopping on the internet.

For most, it seemed like wild speculation. This potential future was so different from the present that most people found it hard to imagine.

But I could see it…

So while my peers were still buying stalwarts like Kodak, Occidental Petroleum, and IBM… I was buying Intel, Microsoft, Oracle, and Qualcomm.

They were “disruptive” tech companies with the potential to dramatically change the world.

For example, Microsoft disrupted the software market and stole huge profits from IBM… Oracle disrupted the database market… and Qualcomm created tech that gave it a piece of just about every cell phone sold worldwide.

Then I made the biggest mistake of my early investing career…

I sold my positions in Microsoft and Oracle when the market fell 10% in the early 1990s.

A $57 Million Mistake

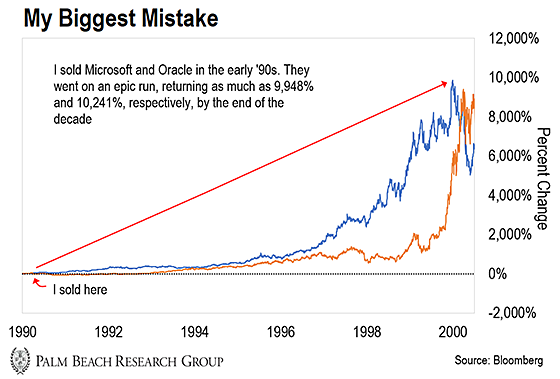

As you can see in the chart below, Microsoft and Oracle returned 9,948% and 10,241%, respectively, from their 1990 bottom to their highs in 2000.

If I had kept just $100,000 in each stock, I’d have an extra $57 million today. Even $5,000 in each stock would be worth $2.8 million today, including the current sell-off.

That’s the cost of selling too early… millions of dollars in potential profits.

Why didn’t I stick around? In one word: Volatility.

In the early days of a high-growth stock, there are always doubts about whether the company will make it. And sometimes, those doubts get magnified by huge bouts of volatility.

For instance, Oracle once dropped over 80% due to doubts about its survival during an accounting scandal. Microsoft would frequently see its stock swing down 30% or more.

In retrospect, I now realize that 1-year period (1994-’95) was the single-best buying opportunity of the entire decade. It was when the risk was lowest, and the reward was highest.

So instead of price, I now look at a technology’s adoption rate as the No. 1 metric to project long-term value.

Think about it…

In the early ‘90s, all you needed to know to make a fortune from Microsoft was that the number of personal computers would explode over the next two decades.

That’s it.

If you got in the adoption story right, time would bail you out.

The same is true with bitcoin…

This Is Not the Time to Sell

I’ve been in the crypto space for years… and I have tens of millions of dollars of my own money allocated to it.

So, I’m losing millions of dollars every day as prices fall…

But it’s not my first rodeo.

I’ve been down this road before: The dot-com crash of the late 1990s… the 2007 Great Recession… and the 2018 Crypto Winter.

Through all that, I learned you couldn’t just look at price as the barometer of long-term value in an asset class. Like early internet stocks, adoption is key.

And that’s the reason I still have so much confidence in bitcoin.

If you believe – as I wholeheartedly do – that digital assets are the future… then you know we’re still early in this adoption cycle.

And if you believe – as I wholeheartedly do – bitcoin will be the backbone of the digital asset space… then you buy it before adoption takes off.

Crypto.com estimates there are 200 million people who use crypto assets. By the end of this decade, I believe at least 4–5 billion people will be using bitcoin.

If that sounds crazy, remember this: In 1990, smartphones didn’t even exist. Today, 6.6 billion people own them.

Now, it wasn’t a straight shot up. There were plenty of crashes and corrections along the way. And that’s true with every technology adoption cycle I’ve participated in.

The mistake I made in the early 1990s was confusing a short-term “cyclical” bear market with a “secular” long-term bear market.

The decade of the 1990s was an amazing bull run. But within that bull market, there were short-term cyclical bear markets.

And during those pullbacks, you could buy disruptive companies on the cheap.

Not understanding the difference between a short-term cyclical bear market and a secular bear market cost me tens of millions of dollars.

It’s a mistake I won’t let you make…

Keep Your Eye on the Prize

Look, I get it. We’re not robots. We’re humans full of emotion.

Watching your portfolio fall is hard to stomach. Even when you know that crypto’s long-term fundamentals are still intact.

So if it makes you feel better, you can take your anger out on me. Pull out a Big T voodoo doll and stick pins in it. I’m a big boy. I can take it.

Right now, my No. 1 mission is to navigate you through this cyclical bear market… without you shooting yourself in the foot by selling at the bottom.

Since February, I’ve warned you that 2022 would be a rough year. And I’ve done everything I could to prepare you for the volatility we’re seeing.

What I need you to do is keep your eyes on the prize. By this time next year, the markets will be running and gunning again. And this sell-off will be a distant memory.

And you’ll be kicking yourself if you didn’t take advantage of the cheap prices we’re seeing now.

Just follow the trend.

It will bring you peace of mind and the ability to hold onto these assets when everything is screaming at you to sell.

Let the Game Come to You!

Big T

P.S. The downturn in stocks and crypto is creating incredible bargains… and “unlocking” previously inaccessible corners of the market to everyday investors.

That’s why I recently put together a presentation highlighting one of these “unlocked” sectors… one estimated to grow nearly 38,000% in the years ahead.

To find out how to take your first steps into this massive, unlocked opportunity, click here… But please do it soon.

When the dust settles on the pullback and prices rebound… the bargains we’re seeing today will be few and far between.