My 34 years in traditional finance – along with seven years in crypto – have taught me that if you want to get really rich through investing…

You’d better be able to handle a bear market.

Few people have experienced the level of volatility present in crypto. They’re the wildest assets I’ve ever owned.

And that’s why I’ve spent so much time giving you a mental framework to handle the volatility that comes along with this asset class.

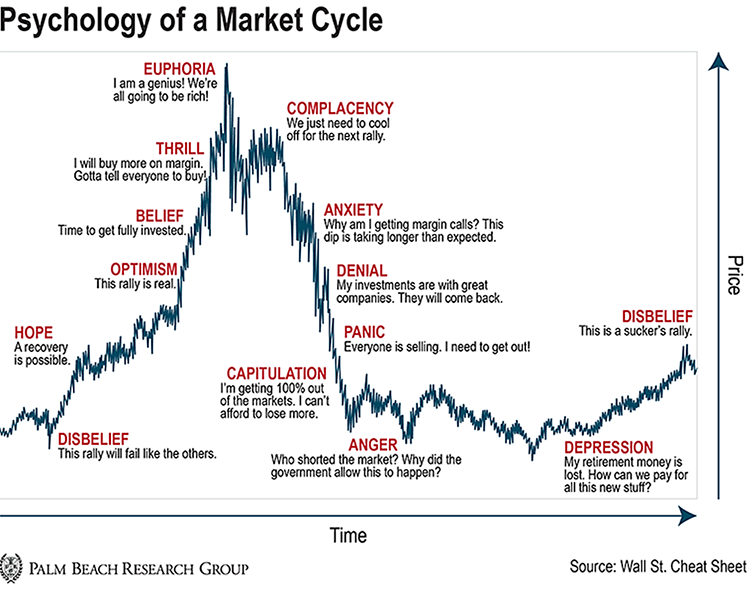

The chart below gives you an idea of how psychology shows itself through a market cycle.

According to this chart, there are 13 emotions investors go through during a complete market cycle.

If you’ve been with me since we started recommending crypto in 2016, you’ve probably experienced all of them.

I won’t go over the entire chart, but there are some clear patterns.

In 2021, we hit “euphoria” when bitcoin peaked at an all-time high near $70,000.

Right now, many people believe we’re in the “capitulation” stage. That’s when investors give up and start running for the hills, signaling to savvier investors that the bottom is just about in.

I disagree with those people. In my opinion, we’ve yet to hit full capitulation.

I know it may feel like it… But we’re not there yet.

Many folks will point to the collapse of Terra and its stablecoin, UST, which led to investors dumping $3 billion worth of BTC into the market, which triggered a wave of margin calls in bitcoin.

Companies such as Celsius, BlockFi, Three Arrows Capital, and Voyager Digital engaged in rampant leveraged lending against their crypto holdings. And when they had to meet massive margin calls, it led them to forcibly sell over half a million more bitcoin.

Now we’re seeing millions of people – from everyday users to hedge funds – lose access to their assets as lending platforms and exchanges implode. That puts even more pressure on bitcoin.

This forced selling has triggered a 56% drop in the price of bitcoin in less than two months. And as bitcoin goes, so does the entire crypto market.

As bad as this all is, it’s important to remember that in a bear market, capitulation happens in waves.

Last summer, I warned that we hadn’t seen the lows in bitcoin and that there was another shoe to drop. For several months, I was accused of being too bearish as bitcoin recovered to as high as $25,000.

Of course, since then we’ve seen bitcoin drop to as low as $15,500. I wouldn’t be shocked to see it go lower.

So what’s next?

Well, during the bear market process, we inevitably hit the “anger” stage. That’s when people call for more regulation of the market.

We’re seeing that start to happen now…

The “Anger” Stage

NYSE President Lynn Martin expressed deep skepticism about the future growth of the crypto industry, stating in the aftermath of the FTX implosion that:

There was no regulatory framework, and an institutional investor isn’t going to really dip their toe in a meaningful way in a market unless they understand what the regulatory framework is.

For example, at the G20 Summit in Indonesia in November, U.S. Treasury Secretary Janet Yellen said the implosion of FTX chaos “demonstrates the need for more effective supervision of the cryptocurrency markets.”

She also added that it was “a wake-up call, rather than just a bump in the road, or even the end of the road.”

It bears repeating that the implosions we see in centralized crypto lending platforms and exchanges have nothing to do with crypto or blockchain technology.

It all comes down to greed.

In a recent CNBC article, CME Group CEO Terry Duffy said he suspected corruption at FTX when he first interviewed former FTX CEO Sam Bankman-Fried. CME Group is the world’s largest financial derivatives exchange.

I told my team this had nothing to do with crypto. [Bankman-Fried] wanted to list all asset classes – mine, the Intercontinental, the CME, and everybody else’s – under his model, which would’ve been a biblical disaster.

And analysts at JPMorgan Chase put it even more bluntly when they wrote:

While the news of the collapse of FTX is empowering crypto skeptics, we would point out that all of the recent collapses in the crypto ecosystem have been from centralized players, and not from decentralized protocols [emphasis added].

So, again, I think the people who really get it understand this isn’t a crypto problem. It’s a fraud problem localized around centralized exchanges.

It would be similar to saying the entire energy industry was uninvestable because former Enron CEO Jeffrey Skilling cooked the books.

At its peak, Enron’s market cap exceeded $60 billion. In 2001, the company filed for bankruptcy – the largest in U.S. history at the time. More than 20,000 employees lost their jobs, and investors lost billions.

Right now, we’re dealing with after-effects similar to the accounting scandals of the early 2000s. So we’re going to see a lot of anger… a lot of rhetoric… and a lot of doom-and-gloom prophecies.

Now, let’s talk about what happens after the anger phase: Depression.

The Crypto Depression Cycle

This last emotional stage of the bear market is “depression.”

This final phase can drag on for months. We’re not there yet, though.

During this phase, you’ll feel like crypto will never, ever come back. You’ll lament ever getting into the asset. And all you’ll see ahead is an endless expanse of darkness.

That’s what market cycle depression looks like.

You’ll beat yourself up for buying crypto and probably question your own sanity… You’ll think: This will be the final wipeout…

Because that’s exactly how I felt in March 2020, when bitcoin dropped 50% overnight. It was brutal.

They talk of “the long dark night of the soul”… I can tell you I did some deep soul-searching that day in March.

Fortunately for my subscribers, I’ve learned to divorce my actions from my emotions.

You see, it’s not that I don’t feel emotions. I do. I feel them deeply. It’s that I’ve learned how to separate my actions from my feelings.

And that’s why in April 2020, I ignored my feelings, refocused on my research, and got in front of a camera and told hundreds of thousands of my readers and subscribers to buy bitcoin.

For those who listened to me… They multiplied their money by as much as 12 times over the following 19 months.

While fortunes are made during bull markets, the seeds of those fortunes are planted during bear markets. If you can etch this idea into your brain, it will transform your investing results.

Just like in the previous bear markets, where we uncovered gems like Monero, Ether, and NEO that went on to go up as much as 6,023%, 36,655%, and 156,753%, respectively.

Just $500 into each of those names would have made you as much as $30,600, $270,389, and $784,263.

As you can see, buying quality projects during the depression stage gives you an opportunity to generate life-changing money when the bull market resumes.

What’s Next?

At some point over the next 12 months, we’ll be fully immersed in the depression stage of the market. It’ll be ugly. Even uglier than what we’ve seen so far.

You may curse the day our paths crossed. Your spouse will likely be shooting daggers from their eyes at you over your morning coffee.

In short, it’ll be brutal.

That’s the nature of this game. To expect it to be any different would be as absurd as swimming fully clothed and getting mad about your clothes being soaking wet.

I don’t know how long the depression phase will last… But it will eventually end.

You’ll see a sustained rally in prices once again. But you won’t believe it’ll last. That’s the “disbelief” stage.

And it’ll set up the next bull run.

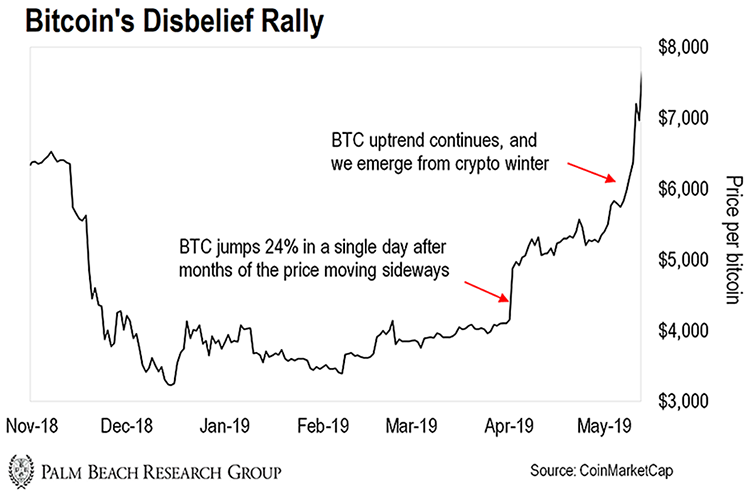

We saw this at the end of the 2018–19 Crypto Winter. This “disbelief” rally happened after several months of the price moving sideways and sellers becoming exhausted.

At this point, no one wanted to talk about bitcoin or crypto. It was completely hated. Weak hands sold and moved on. And the strong hands accumulated.

Then out of nowhere, on April 2, 2019, we got a massive one-day rally when BTC gunned up as much as 24%. At the time, the world at large dismissed it.

Despite bitcoin more than doubling off its lows in 2019, pundits called it a “fool’s game,” “garbage,” and “a gambling device.”

They completely wrote it off. That’ll be our cue that we’re just about on the other side of the bear market.

But we’re not there yet.

Right now, every rally is greeted with far too much hope for the bottom to be in. So we must wait for the dissolution of all hope before we may allow ourselves to be hopeful.

For now, we’ll do what we’ve always done: stay focused on finding projects that have the potential to transform your financial life from a modest investment.

So this is a good time for me to stress the absolute need for you to be rational in your position sizing.

The game plan is simple: Use rational, uniform position sizing and HODL – hold on for dear life.

That’s all that’s needed to put yourself in a position to radically transform your investment returns once the next bull market gets started.

Major institutions are directly aligning themselves with the crypto space. And by building blockchain technology directly into their existing platforms, their customers can gain the benefits of blockchain without knowing they’re using it.

Customers don’t care how it works. They just want to know they’re getting a better product at a cheaper price. And that’s what blockchain can do for them.

Whether it’s Instagram enabling its users to mint and own their own NFTs… JPMorgan tapping into this new technology to improve its operations… or some of the world’s largest asset managers providing you with a safe place to buy and store your assets.

These examples show us that the adoption story I first laid out to you in 2016 is unfolding exactly as I told you it would.

And that means after this bear market is over, the stage is set for you to see significantly higher prices ahead.

Hold the line and always remember…

Let the Game Come to You!

Big T