Going into 2022, the stock market was enjoying a “Santa Claus rally.”

That’s a period of rising prices fueled by an upbeat holiday mood, increased consumer spending activity, and last-minute repositioning from large institutional investors.

In fact, from December 27 to January 4 – commonly considered the peak of the traditional “Santa Claus period” – the S&P 500 enjoyed its best rally since 2012.

And historically, the market’s performance during this trading window is often a good indicator of how the year ahead will unfold.

But recently, all that optimism was quickly dashed. On January 5, the Federal Reserve released the minutes from its December policy meeting.

The notes suggest the central bank is considering unwinding some of its money-printing efforts sooner than previously indicated, including interest rate increases at faster and/or higher rates.

Almost all the meeting’s participants expressed concerns about higher inflation in 2022 and 2023.

And over the next two days, these revelations quickly turned a post-holiday party into a raging hangover. The S&P 500 gave up all the gains it made during the rally and dove into the red.

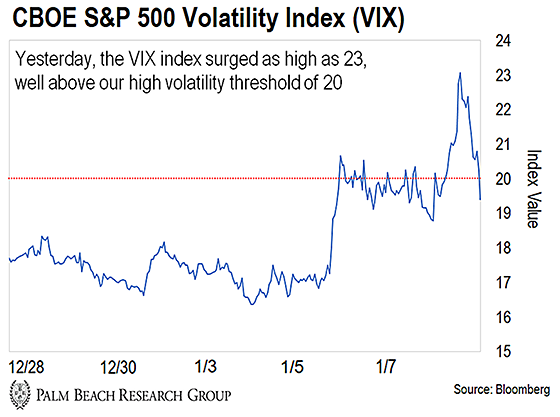

The tech-heavy Nasdaq did even worse – dropping 3.6%. While the CBOE Volatility Index (VIX) – a good indicator of the level of fear in the market – jumped a full 22.2%.

Here’s a snapshot from when we first reported this move on January 11…

Of course, rising fear can be a good thing if you have the right strategy.

Because when investors are worried, they’re willing to pay higher premiums for “insurance” that protects them from future downside.

And our Instant Cash Payout strategy is all about selling them that insurance and collecting bigger checks in the process.

Better yet, since we only use this strategy on companies we’d like to own, we’re getting paid for the opportunity to acquire great investments at discounts.

It’s the ultimate “heads we win, tails they lose” scenario.

How to Earn Instant Cash From the Market

An Instant Cash Payout is when we offer shareholders a form of insurance that amounts to a low-ball offer.

In technical terms, it’s called selling put options.

Using a unique aspect of the options market, we agree to buy investors’ shares for a specific price and over a certain length of time in exchange for an upfront cash payout.

The cash is ours to keep – no matter what happens. And we only have to buy shares if they drop to our agreed-upon price.

The bottom line is that we get paid to buy companies we love at a discount. And we only target the strongest, most dominant companies on the planet. That’s what makes the strategy so powerful.

These are companies that dominate vital industries. They gush free cash flow and profits, and they look after shareholders.

More importantly, they’ll make it through a market crash with relatively minor damage.

Sure, their share prices might fall a bit, but they’ll eventually recover.

And here’s the best thing…

As I mentioned above, our Instant Cash Payouts increase when investors become more fearful… like they are now. Think about it from your own perspective: You’re more likely to pay-up for insurance if you feel an event is almost certain to happen.

It’s no different in the stock market.

I think the very best version of this strategy is selling specific put options on great companies whenever the timing is best.

However, there are other ways to benefit from the approach…

Without worrying about active trading…

Or even having to deal with options at all.

Make Money When Everyone Else Is Scared

One example is the WisdomTree CBOE S&P 500 PutWrite Strategy ETF (PUTW).

This exchange-traded fund basically sells put options on the S&P 500 every month and aims to generate steady returns in the process. It’s a relatively small fund and not without risk, but certainly one to consider.

The important thing to know is that you don’t have to succumb to market fears.

Instead, you can take other investors’ fears and turn them into cold, hard cash.

Better yet, every time you collect another check, you set yourself up to potentially buy another quality stock at a below-market price.

It’s truly a win-win situation.

Best Wishes,

|

Nilus Mattive

Analyst, Palm Beach Daily

P.S. Our Instant Cash Payout Strategy is perfect for generating income from volatility…

But if you want the potential to 10x your money over the next 365 days, Daily editor Teeka Tiwari says you have a limited window of opportunity to get in on what could be the biggest financial trend in all human history.

Click here for full details on how this new financial technology is disrupting the industry and upending traditional financial institutions.