When I was a boy, my mom would often drag me to the local jewelry store…

While she looked at gold necklaces, or took something over to the repair desk, I would always end up at the exact same place…

The small glass case full of Rolex watches.

I can still picture the entire scene like it was yesterday… right down to my favorite one at the time, a gold model with a bright blue dial.

I also vividly remember the armed security guard at the door, watching me as closely as I was studying the watches.

Not that I blame him. Or the salespeople for completely ignoring me. There was no way anyone in my family was buying one back then.

Still, that made it all the sweeter when I came back in my early 20s, a brand-new Rolex GMT-Master shining on my wrist.

It was amazing how everything had reversed. The security guards nodded kindly and the salespeople were all too eager to talk.

The reality is that Rolexes and other luxury watches are an enduring symbol of wealth.

But they’ve become more than that… They’re also a store of wealth.

And in today’s economy, they’ve been generating returns that outpace most traditional investments.

Take my GMT-Master… It’s a 1998 model with a black “Swiss only” dial and the famous two-tone blue and red “Pepsi” bezel, originally designed for Pan-Am pilots.

It was about $2,500 when I bought it new in 1999.

Right now, well-known dealer H.Q. Milton is selling a very similar example for $13,250.

That’s five times my purchase price over the span of 20 years. And consider the fact that I’ve been wearing this watch the entire time.

Funny enough, collectors actually prefer scratches, scrapes, and even the faded bezel over examples that have been polished or altered in other ways.

So I’ve enjoyed using and wearing this tool for 20 years and quintupled my original investment along the way.

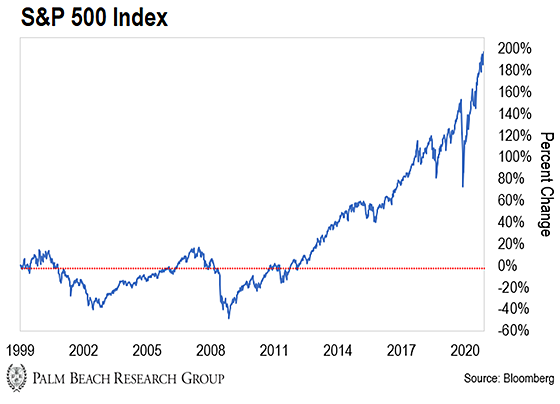

Meanwhile, this chart shows the stock market’s performance since the day I bought my watch…

You might be surprised to see that even after the massive post-2009 rally… the S&P 500 has only risen 197% over the same two decades.

That means my Rolex has beaten the market 2½ times over.

And make no mistake… that outperformance has been fairly proportional over time… especially in the last several years.

To illustrate the point, consider another personal anecdote…

Back in 2015, I tried to buy another Rolex at auction. It was a pristine Daytona Cosmograph model from 1991 – replete with a relatively rare “inverted 6” white dial.

The pre-auction estimate was $8,000 to $10,000. I went as high as $13,500. And then the action just kept going all the way to a final hammer of $17,500.

I thought that was crazy at the time.

Today, six years later, I’m seeing similar examples pushing $50,000.

Now, you may be wondering why I’m telling you a story about expensive Rolex watches – especially if you’re not a collector. But as I’ll show you below, the smart money is piling into what we call “trophy” assets…

Here’s Why Rolex Watches Continue to Soar in Value

Trophy assets are valuable, tangible things like vintage cars, wine, real estate – and even certain cryptos – that’ll skyrocket in price due to the Federal Reserve’s unprecedented money-printing and the inflation that follows.

Trophy assets grow ahead of the inflation curve. So the wealthy buy them to protect their wealth. We like them because they offer the not-yet-wealthy the chance at life-changing gains.

Now, as a category of trophy assets, Rolex watches aren’t necessarily rare.

While production numbers are closely guarded, the company likely produces more than a million watches every year.

However, the market is huge and well established. Demand continues to outpace supply every single year. And certain models – especially stainless-steel sport models – have fanatical fanbases.

So in a world where money is being printed at an unprecedented rate, the smart money is rushing into anything that will stay ahead of the inflation curve – especially trophy assets.

And just like a highly sought-after Rolex, bitcoin brings an element of privacy and portability that can only be found in a handful of other assets.

Just think about it: I regularly walk around with more than $13,000 on my wrist and only watch geeks really take notice. (I often wear mine on a $13 nylon NATO strap, which further tones down the bling factor.)

I could easily hop on an airplane, fly to just about any major foreign city, and pretty quickly exchange my watch for cash in the local currency… precious metal… or crypto.

My point is simple, and it’s one that Daily editor Teeka Tiwari drives home all the time…

For every reason, it pays to have some part of your wealth in alternative assets right now. They can help you stay ahead of the massive money-printing happening around the world. They can move independently of other asset classes like stocks and bonds. They can provide levels of privacy and portability far beyond most traditional vehicles. And even a relatively small amount of money can end up producing outsized gains.

In the case of my watch, my original investment has doubled every four years on average.

But you can find even bigger gains in crypto…

For example, Teeka recommended bitcoin around $400 in 2016. Today, it’s trading around 13,900% gain. That’s enough to turn every $1,000 into $140,000.

That’s the true power of certain trophy assets.

Don’t Have Enough Money to Buy a Rolex? No Sweat!

I know what it’s like to stand at the counter looking at watches worth more than the family car.

Fortunately, there are new ways to invest in luxury items like Rolexes that simply didn’t exist back when I was a kid.

For example, platforms like Rally Road now allow just about anyone to purchase fractional ownership interests in Rolexes, Lamborghinis, and Warhol paintings for as little as $25.

These same platforms offer liquidity and transparency, too. And they give you broad exposure to the tremendous upside in trophy assets.

(Perhaps the only real downside is that you don’t get to enjoy the items on a daily basis the same way I enjoy my trusty, old GMT-Master…)

So if you’re looking for an easy way to protect the value of your wealth from rampant money-printing and inflation, investing in trophy assets like a Rolex or crypto is a great place to start.

Best wishes,

|

Nilus Mattive

Analyst, Palm Beach Daily

P.S. As Fed money-printing continues, the value of trophy assets like bitcoin will skyrocket… and if you’ve read recent headlines, then you know this frenzy – and bitcoin’s price – has already taken off.

Billionaires are piling into it… The world’s largest payment networks are adopting it… And Wall Street’s most respected firms are rushing to add it to their portfolios.

But what nobody sees… what the media isn’t reporting… AND what no member of the financial elite wants you to find out is this…

Behind the scenes, the smart money has begun to go all in on another coin… and it’s one that costs just a fraction of bitcoin’s price.

Teeka – arguably the No. 1 most trusted expert in crypto – says it will be Crypto’s Next Trillion-Dollar Coin. And on Wednesday, March 31 at 8 p.m. ET, he’ll reveal its name for free.

All you have to do is click here to reserve your seat to this free event.