Who are you going to believe, Janet Yellen or your own eyes?

Last week, Treasury Secretary Yellen brushed aside concerns that a credit crunch is beginning to emerge.

“I’ve not really seen evidence at this stage suggesting a contraction in credit, although that is a possibility” she said.

This would be a laughable statement if it weren’t so concerning.

Anyone paying attention to economic data over the past week can clearly see lending standards tightening and a credit crunch forming.

Last Thursday, we showed you how banks and credit unions across the Southwest are holding back on making as many loans.

Now we have fresh data from businesses and consumers highlighting the same distressing development.

This is set to have a huge effect on slowing down the U.S. economy and will hurtle it into a recession.

Even the Federal Reserve is growing concerned. The central bank spent the majority of its March meeting discussing the fallout we’ll likely see as this year plays out.

Ultimately, the minutes of that meeting showed it has come to the same conclusion we have:

Given their assessment of the potential economic effects of the recent banking sector developments, the staff’s projection at the time of the March meeting included a mild recession starting later this year, with a recovery over the subsequent two years.

Today, we’ll go over those new developments, and what you can do to prepare for the fallout.

Slowing the Flow of Money

A credit crunch is when banks significantly tighten their lending standards.

That means they’re much more conservative as to who they lend money to. Additionally, they’ll raise borrowing costs to account for the perceived riskiness of that lending.

As a result, consumers and businesses that need loans find that they’re much tougher to get.

That’s exactly what we’re seeing play out today.

Last week, the New York Federal Reserve released its monthly survey of consumer expectations. This survey highlights the effects inflation, labor market strength, and credit availability are having on consumers.

Per the survey, nearly 60% of consumers are finding it harder to obtain loans compared to a year ago.

That’s the highest percentage recorded in the survey’s 10-year history.

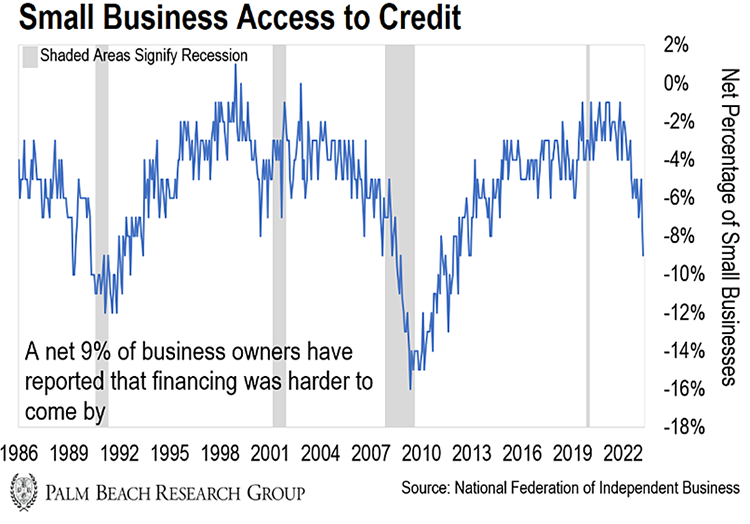

When we turn our focus to small businesses, we see the same effects.

Last week, we got the results from the National Federation of Independent Business (NFIB) survey of small-business optimism.

At the end of March, a net 9% of small-business owners said that financing was harder to get than three months earlier.

That’s around 55% of small businesses surveyed, the highest share of businesses reporting that since the end of 2012.

Low Fuel Warning

It’s difficult to overstate just how critical purchases by both consumers and businesses are to the U.S. economy. As of the end of 2022, those two categories made up over 85% of the U.S. gross domestic product (GDP).

Consumption can be thought of as the fuel that runs the economic engine.

Credit availability plays a critical role in stimulating that spending. We can see that reflected when we look back at small businesses.

The same survey by the NFIB showed that the share of owners who feel the next three months will be a good time to expand fell to the lowest since 2009.

Additionally, only 1 in 5 owners expect to invest in new equipment or facilities within the next six months. Any further deterioration in that figure would put it at levels not seen since the 2008 Great Financial Crisis.

Small businesses tend to operate on thin profit margins when compared with their large counterparts. That makes them much more reliant on bank loans to finance hiring and expanding.

So when that spigot of funding slows, small businesses must make difficult decisions to cut expenses to survive. That means no expansion, less equipment purchases, and likely letting go of workers.

That’s exactly what we’re seeing now per the NFIB survey.

Ultimately, this pullback in spending is closely associated with an oncoming recession.

As you can see in the chart above, recessions are typically preceded by a pullback in lending to small businesses.

And now we’re seeing a similar setup today.

I know this is an uncomfortable position to be in as an investor. No one wants to face a potential recession, especially as stocks have yet to really digest this information.

But rest assured, there are ways you can safely preserve your wealth during this uncomfortable period.

Prepare in Advance

In these uncertain times, one strategy that can help protect your wealth is buying U.S. Treasuries.

Treasuries are the debt obligations of the U.S. government, issued by the U.S. Treasury Department.

The full faith and credit of the U.S. government secure the payments of that debt. (In other words, the government’s power to tax.)

This quality is why we call Treasuries a “risk-free” investment.

Unless the U.S. government goes bankrupt (a highly unlikely event), you’ll receive your entire principal back, provided you hold these securities to maturity.

Like Daily editor Teeka Tiwari, I’m personally buying short-term Treasuries. These are T-bills issued for periods as short as 30 days and for as long as two years.

In the April issue of our flagship Palm Beach Letter newsletter, we showed you step-by-step how to buy T-bills for maximum yield. Subscribers can read the issue right here.

Right now, you can earn yields around 4% on these types of Treasuries.

For more info or to buy T-bills, you can visit TreasuryDirect.gov.

Regards,

Michael Gross

Analyst, Palm Beach Daily

P.S. If you’re looking for an outside-the-box way to earn income, Teeka says there’s a “buying panic” coming to a subsector of crypto that pays yield…

If you don’t own these tokens, you’ll get wiped out as the broad crypto market (excluding bitcoin) gets crushed. But if you do, you’ll have the potential to make a killing from this buying panic.