Since its $2.9 trillion all-time high in November, the global crypto market has fallen as much as 48% and is now worth about $1.69 trillion.

We’ve seen bitcoin fall 48% to a low of $35,180… While Ethereum fell as much as 51% to $2,407.

At first glance, it looks like the worst possible time to be – or get – in crypto.

But that’s a mistake.

As I’ll show you today, these negative moves aren’t unusual… and while skittish investors are selling, investment banks, VCs, and the rest of Wall Street are pouring money in.

But first, let’s do a quick refresh on crypto volatility…

We’ve Been Here Before

Volatility, including bitcoin’s most recent 22% drop, is the norm in crypto land.

Over the last decade, we’ve seen bitcoin fall 40% or more about 10 times.

Both the 2013 and 2017 bitcoin bull runs had at least five separate 20–50% drops, according to crypto education platform Onramp Academy.

But when those cycles peaked, investors that held on saw over 8,000% and 4,000% returns, respectively.

Or look at March 2020… bitcoin fell 50% to under $4,000 in just two days. But if you persevered through that drop, you’d have seen bitcoin soar 1,894% to $68,789.

In all three examples, nervous investors panicked and sold out of crypto on negative short-term news. Mainstream finance declared crypto dead or dying. And investors who held on saw life-changing returns.

So, while some crypto newbies are panicking… our longtime readers have been here before. They know how this story plays out over the longer term.

Especially now that Wall Street has made a U-turn on bitcoin.

In the past, Wall Street was rooting for bitcoin to fail. They had no skin in the game. When investors bailed, Wall Street cheered.

Today, it’s quite the opposite…

Wall Street’s Crypto 180

Crypto and bitcoin may be down on the year… but institutional interest and investment are higher than ever.

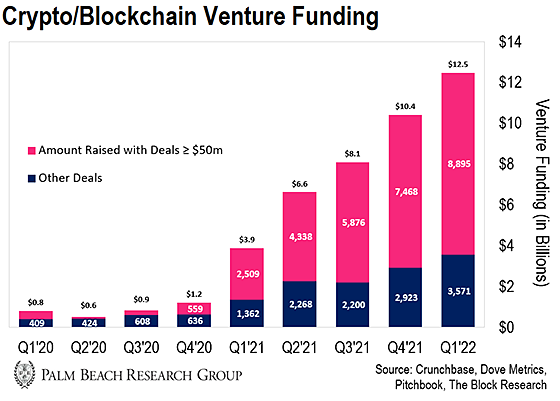

As you can see in the chart, venture funding in private crypto/blockchain companies hit another record in Q1 2022. The number of funding deals, 624, also broke a quarterly record for the sector.

Funding has continued to increase for seven straight quarters.

And there’s no sign of a slowdown.

Check out some of the biggest fundraising announcements in April thus far…

-

“Fortnite” developer Epic Games secured $2 billion in additional funding to further its metaverse ambitions.

-

Pantera Capital announced it raised $1.3 billion for its Blockchain Fund.

-

Stillmark is targeting a $500 million raise for a new credit fund to lend capital to companies building in the Bitcoin Lightning space.

-

Circle, half of the Centre Consortium behind the second-largest stablecoin USDC, announced a $400 million fundraise.

-

Metaverse platform The Sandbox is looking to raise $400 million.

Each of these funding deals was for a quarter of a billion dollars or more.

And I cut the list short. There have been another 50-plus announcements related to crypto/blockchain funding just within the first three weeks of April.

Many of these investment dollars come from major VCs like Andreessen Horowitz, Animoca Brands, Sequoia, Softbank, and Tiger Global.

And traditional finance firms are forking up investment dollars, too – names like BlackRock, BNY Mellon, Fidelity, Goldman Sachs, and T. Rowe Price.

Plus, celebrities like Snoop Dogg, Paris Hilton, Joe Montana, Tony Robbins, and Bruce Willis participated.

The “big money” is backing crypto like never before.

Follow Wall Street… Buy on Fear

Here at PBRG, we believe in crypto just as much as we did in 2016, 2018, and 2020… but this month’s pullback is different.

It feels like the world is burning around us. Markets are crashing. A global recession appears imminent. Fear and panic are running rampant…

But it’s only a matter of time before investors realize the opportunity in front of them and crypto makes its next move higher.

If you don’t already own some crypto, consider buying some bitcoin and Ethereum today.

Over the next few years, we expect ETH to grow 10x – or more – from today’s prices… and we think bitcoin will do just as well… especially following the recent dip in crypto.

So a small $200 position is a good entry point for most investors.

But if you’re looking to take your crypto investments a step further, consider this…

Daily editor Teeka Tiwari believes you’ll see some of the fastest gains in history if you invest in the foundational cryptos and companies leading NFT and metaverse development…

As I showed you above, metaverse projects have major Wall Street backing despite the plunge in crypto… and a coming catalyst is about to accelerate their adoption and send prices through the roof.

Click here for more details on how to position yourself… you’ll even get a free pick (no strings attached) that could potentially 10x your money when this trend takes off.

(Once you’ve subscribed, you’ll also get immediate access to a portfolio of over 20 diverse, actionable investments you can make right now.)

And remember… this pullback is a short-term blip in a long-term crypto trend that’s made millionaires out of patient investors.

As crypto continues to go mainstream… more of Wall Street comes aboard… and the buying panic ensues… there will be fewer opportunities for life-changing returns.

Regards,

Grant Wasylik

Analyst, Palm Beach Daily