Warren Buffett is an investing legend.

Even if you don’t know much about him, you probably know he’s one of the richest men in the world. (He currently ranks fifth on Forbes’ Real-Time Billionaires List, with a net worth of about $69 billion.)

So when he speaks, the press listens…

And he made major headlines at his Berkshire Hathaway Annual Shareholders Meeting on Saturday. He announced Berkshire had exited all its airline stock holdings late last month.

Predictably, airline stocks tanked…

American Airlines, Delta, and United all dropped more than 12% when the market opened on Monday. Southwest fell more than 8%, too. And since then, they’re down an additional average of 4%.

Now, if you’re an investor in one of these companies… wouldn’t it have been nice of Buffett to give you a heads up that he was selling before he made his announcement?

It would’ve saved you quite a bit of money.

But Warren Buffett and the likes of him will never, ever tell you they’re selling ahead of time. That’s not how they make their money.

You see, most people have no clue what the big boys are doing until it shows up on CNBC. By then, it’s too late. The major moves have already been made.

The real trick to making money in the markets is spotting big boys before they make their moves.

Fortunately for you, I’ve spent nearly a decade and hundreds of thousands of dollars to build a system to do just that.

And today, I’ll tell you what it’s saying about airline stocks…

Airlines Are Flashing Red

To follow the big money, I created an “unbeatable” stock-picking system that can get you as close as legally possible to frontrunning these massive orders.

I used my experience from nearly two decades at prestigious Wall Street firms – regularly trading more than $1 billion worth of stock for major clients – to make sure it’s highly accurate, comprehensive, and effective.

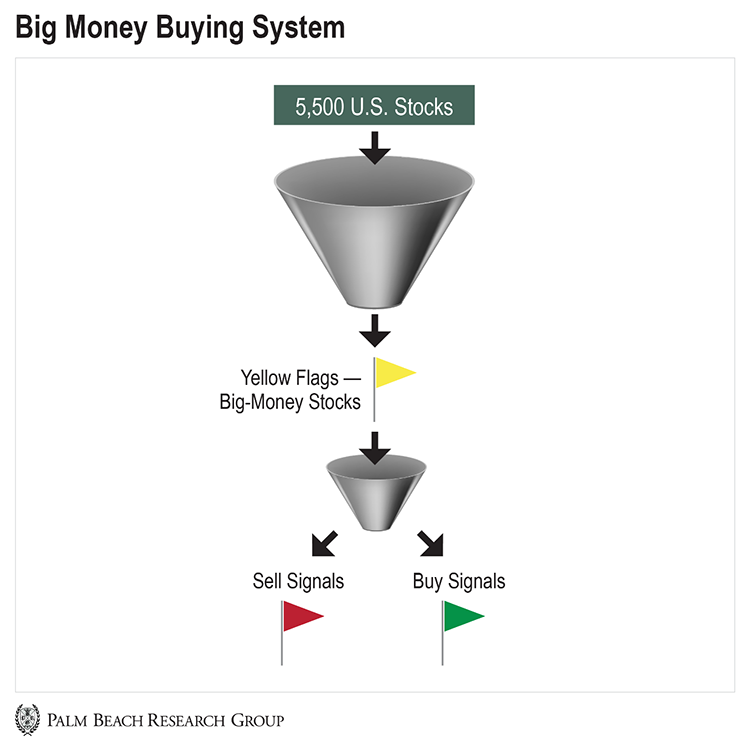

Now, my system scans nearly 5,500 stocks every day, using algorithms to rank each one for strength. It also looks for the movements of big-money investors.

And when it sees them piling into or getting out of a stock, it raises a yellow flag.

I put these yellow flags through another filter. If the flag turns red, it means the big money is selling. If it turns green, it means the big money is buying…

It’s that simple: When I see green, the big money is buying. And when I see red, it’s selling.

And we saw plenty of red in airline stocks even before Buffett made his announcement. Just look at the charts below…

As you can see, institutions were selling airline stocks since the beginning of the year.

And it’s no surprise that the airline industry is one of the hardest hit during the coronavirus pandemic.

But if you look closely at the charts, you’ll see selling started in January and February, even as airline stocks rallied. That’s well before Buffett made his announcement.

It was a telltale sign big money was fleeing the sector en masse. And anyone caught with airline stocks was left holding the bag.

Usually, it’s someone like you…

Don’t Touch These Stocks

You can see that if you really want to know what’s going on, you need to follow the big money.

It moves markets. In fact, huge institutions account for roughly 70% of all stock trading volume – every single day.

They manage trillions of dollars… and can afford an army of analysts to uncover hidden gems. So when they start betting big on a stock, they can lift prices higher and higher.

The good news is, you don’t need to pay elite hedge funds to find the next winning stock. If you know what to look for, you can just track their moves and ride along for big profits.

And my system does just that. For instance:

-

It allowed me to find Grubhub in June 2018… two months before hedge fund JANA Partners announced it’d bought a stake. Less than two months after the signal in June, the stock rocketed 31%.

-

It nailed Applied Optoelectronics (AAOI) in January 2017… a month before Trafelet Brokaw Capital Management announced its stake. About six months after the initial January signal, AAOI peaked over 227%.

-

It happened with Mallinckrodt Pharmaceuticals in November 2013. Three months later, billionaire hedge fund manager John Paulson disclosed a stake in the company. Nearly a year later, the stock peaked over 176%.

Now, as I showed you, my system indicated the big money was betting against airlines even before the pandemic-related sell-off. And it continues to signal that investors should avoid them – along with energy stocks.

Instead, it says we should be looking into infotech and health care stocks to profit during this period of volatility.

Just think about it: Wouldn’t it be great to get a legitimate “heads up” when the big money steps in to buy stocks it loves… or dump stocks it doesn’t?

I’m sure investors in airline stocks would have appreciated it. And you should, too.

Patience and process!

|

Jason Bodner

Editor, Palm Beach Insider

P.S. Remember, my system follows the big money’s lead in all market conditions.

So it’ll continue to identify winners, no matter which direction stocks are headed in next. And you can learn how to access my system’s data right here.

It’ll help you unlock massive profits during this huge money-making market reset.