Work hard, save money, and hope to grow your wealth through investing.

It’s a mindset many people have.

After all, who wants to stress about investing when you could focus on spending time with family or working on your golf game instead?

That’s why most investors choose a passive investing strategy. They put their money in an index fund… and let the market do all the work as it rises massively higher over decades.

It’s set and forget. But there are also downsides…

Along with the gains, you have to be able to stomach any sharp drawdowns. Even though history shows that the market always recovers, it’s hard for many to sit still during heavy volatility.

Plus, only a handful of stocks really carry the market higher. In fact, over the past 100 years, just 4% of stocks have accounted for nearly all the market’s profits each year.

For instance, just 1% of stocks have accounted for 30% of the S&P 500’s 60% rally since its March 23 lows. Tech companies like Amazon, Google, and Microsoft have been doing all the heavy lifting.

Now, I call these stocks outliers. And if you’re not targeting these companies, you’re basically wasting your time as an investor.

So today, I’ll show you my process for identifying them – and how you can ride them to profits…

The Power of Outliers

You see, I’ve devoted my life to finding these outliers. They’re the stocks where the big money hides out. And to follow the big money’s trail, I created an “unbeatable” stock-picking system.

I used my experience from nearly two decades at prestigious Wall Street firms – regularly trading more than $1 billion worth of stock for major clients – to make sure it’s highly accurate, comprehensive, and effective.

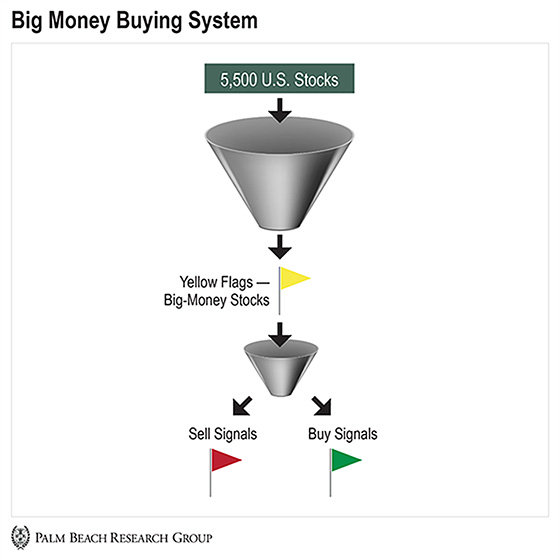

Now, my system scans nearly 5,500 stocks every day, using algorithms to rank each one for strength. It also looks for the movements of big-money investors.

When it sees them piling into or getting out of a stock, it raises a yellow flag. Then, I put these yellow flags through another filter.

If the flag turns red, it means the big money is selling. If it turns green, it means the big money is buying…

It’s that simple: When I see red, the big money is selling. And when I see green, it’s buying. It takes all the emotions out of investing.

Now, these green flags are the market’s next outliers. And my system has already found several of them for my Palm Beach Trader subscribers.

Even through the pandemic, we have five doubles out of 20 open trades, including The Trade Desk, which is up 824%. Another, Veeva Systems, has already doubled since we added it in March.

(The Trade Desk and Veeva are now above their buy-up-to prices, so I don’t recommend initiating a position in either one now.)

Overall, we’re sitting on a portfolio win rate of 69%. And our average closed gain is 29%! That’s the power of outliers…

Following the Market’s Leaders

The bottom line is to stay patient and look at the big picture. And I know that’s hard to do, especially when you’re waiting for a big payoff.

But if you persistently follow the big money, you can ride its coattails to big profits in all sorts of market conditions.

There will always be market leaders to focus on: high-quality, adaptable companies with proven business strategies and little debt.

Meanwhile, I’ll continue to monitor my system’s market data and keep you updated on any changes.

Patience and process!

|

Jason Bodner

Editor, Palm Beach Insider

P.S. Market leaders aren’t easy to identify…

That’s why I built my own unbeatable stock-picking system to find the outlier stocks that can’t be beat. Of the 5,500 stocks my system scans, they rise to the top. And my subscribers have booked large gains thanks to them.

With a current win rate of 80% on our open trades in Palm Beach Trader… and an average 100% open gain… “unbeatable” is fitting. Your portfolio can do the same. Just click here to learn more.