Palm Beach Daily

As Banks Failed, This Strategy Returned 35%

When markets are volatile, buy-and-hold investors feel the pain…

As soon as they get into a trending position, the stock market turns around and bites them hard.

That’s why I’ve been spreading the word on using a mean reversion trading strategy instead.

Stocks tend to revert to their long-term average – or mean – after they make dramatic moves.

So, I look for stocks that have overshot in either direction… and profit when they snap back toward their average.

I know that idea is probably new to a lot of people… especially folks who’ve never traded before.

So today, I’ll show how I used this strategy to profit from the SPDR Euro Stoxx 50 ETF (FEZ). It tracks 50 European blue-chip stocks.

As buy-and-hold investors were getting hosed because of the banking crisis earlier this month, I gave subscribers of my Opportunistic Trader advisory the chance to close out a mean reversion trade on FEZ for a 35% gain.

Diverging Patterns

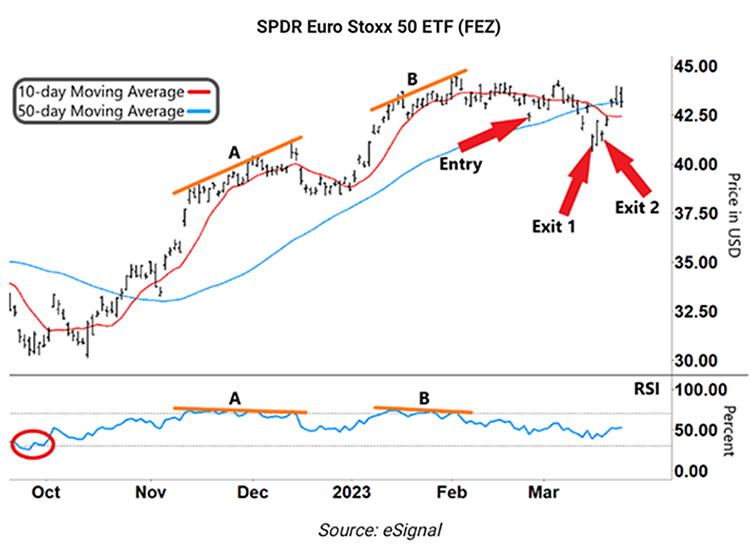

It’s all in the next chart. It’s a bit more complex than the typical chart you’ll see.

But don’t worry. I’ll walk you through the different elements.

As you can see, FEZ started to rally last October.

But it wasn’t one-way traffic…

FEZ made higher highs in November through December (upper orange line at “A”).

But the Relative Strength Indicator (“RSI”) – the lower orange line at “A” – showed that buying momentum had plateaued in overbought territory (upper grey dashed line).

And when buying momentum stalls like this, you can expect the rally to fizzle. Which is exactly what happened.

Then at the start of this year, we saw this pattern repeat. FEZ and the RSI again diverged (orange lines at “B”).

FEZ peaked on February 2 and then gradually drifted lower as the RSI trended down.

FEZ had already rallied nearly 50% from its October low to its February high. And our signals looked bearish.

So, on February 24, I placed a bearish trade using a put option. These are side bets that pay off when stocks fall.

That position initially went against us. FEZ counter-rallied over the following days.

Then, as news broke that Swiss investment banking giant Credit Suisse was in trouble, FEZ gapped down. That sent a wave of fear through the markets.

Credit Suisse bonds were trading at distressed levels, and credit default swaps in the banking sector went through the roof.

This opened the prospect that the European Central Bank (“ECB”) would come in to bail out Credit Suisse… much like the Fed handled the Silicon Valley Bank fallout.

So, I decided to lock in a part of our profits by selling half our position on March 15 for a 42.1% gain.

Although it was the Swiss National Bank, and not the ECB, that handled the bailout, this proved to be the right call…

As you can see above, FEZ rallied higher the following day.

The remaining half of this position was still showing profit. And I didn’t want to hand any more of our remaining profits back at that point.

So, I closed out the remainder of our position on March 17 for a 27.7% gain.

That left readers who’d followed my trade with blended gain of 35% over three weeks.

As I keep saying, by choosing the right stock and strategy, traders can make money… no matter what direction the market takes.

Regards,

Larry Benedict

Editor, Trading With Larry Benedict

P.S. Volatility doesn’t have to hurt your wealth. One of my greatest advantages as a trader is how I can profit from short-term market swings – both up and down. And the wider the swings, the greater the profits.

It makes today’s choppy markets a trader’s paradise. In fact, one of my favorite trading strategies involves something I call “Lightning Trades.”

These trades let you to take advantage of short-term market volatility… in just one day. And my Lightning Trades have seen one-day gains of 100% or more 91 times this year so far.

You can learn more about my Lightning Trades strategy right here%%[ENDIF]%%.