Palm Beach Daily

Asset “Location” Can Lower Your Taxes and Boost Your Retirement

Asset allocation is the most important concept in investing…

Numerous studies confirm it. They show asset allocation accounts for 90%-plus of investment returns.

In short, asset allocation seeks to balance risk versus reward through portfolio diversification.

It’s done by adjusting the percentage of different asset classes (stocks, bonds, cash, etc.). Adjustments are made based on your risk tolerance, goals, and investment time horizon.

The classic “60/40 model” is a real-life example. “60/40” refers to 60% in equities and 40% in bonds. This ratio is widely used by many financial advisers and institutions.

However, at Palm Beach Research Group, we use a more diversified portfolio.

It consists of nine asset classes: Equities, Fixed Income, Real Estate, Private Markets, Bitcoin, Altcoins, Precious Metals, Collectibles, and Cash.

This broad diversification is one reason our flagship Palm Beach Letter portfolio has crushed the market over the long term.

In fact, since Daily editor Teeka Tiwari took over in June 2016, the portfolio has recorded an average annual return of 34.7%. Over the same time, the S&P 500 has returned an average annual return of 16.1%.

That’s correct… over the past five and half years, the PBL portfolio has beaten the stock market by more than 2.2 times.

You see, asset allocation is our secret sauce…

By diversifying your assets, you can generate multiple income streams from safe assets like bonds and dividend-paying stocks… and then take a portion of that safe income to speculate on “asymmetric” plays like cryptos and private markets.

These asymmetric plays allow you to swing for the fences without risking your current lifestyle.

Now, asset allocation is a strategy all serious investors must use. But there is a complementary strategy you may not be aware of.

And it could help you lower your taxes on all the gains you make from your asset diversification.

So while it may be difficult to make any serious adjustments to your 2021 tax liabilities before Tax Day 2022 (Monday, April 18)… you can use that tax info and this strategy to shift things in your favor before 2023.

Fair warning… The strategy I’m going to tell you about today is simple… but it does involve some math to show its potential power.

It’s worth a look because a few minutes of math could potentially generate millions in extra savings when you retire…

“Where” You Invest Matters, Too

The complementary strategy I’m referring to is called asset location. It’s the practice of locating assets in the most tax-efficient account types.

This often-overlooked strategy centers on tax minimization. With asset location, you can take advantage of the tax code and owe less when you eventually cash out.

You see, different types of investments and accounts receive different tax treatments.

Generally, placing less tax-efficient assets (such as bonds) in retirement accounts makes sense. And it makes sense to place more tax-efficient assets (such as stocks) in taxable accounts.

So if you take special care of asset placement between your taxable and retirement accounts, it can be financially rewarding.

Here’s an example of how asset location strategy works from financial planning educator Michael Kitces.

Let’s say an investor has $500,000 in a taxable brokerage account and $500,000 in an Individual Retirement Account (IRA), which allows you to defer taxes until you retire.

The investor plans to hold stocks in one account and bonds in the other… a 50/50 asset allocation model. The investor also plans to hold these assets for 30 years.

We’re also going to assume the bonds will return about 5% and be taxed at 25%, while the stocks will return about 10% and be taxed at 15%.

With this information in mind, here’s how each allocation scenario would play out:

Bonds held in the taxable account and stocks in the IRA

Based on the numbers above, the future after-tax value of $500,000 in bonds held for 30 years in a taxable account would be $1,508,736.

During that same 30-year period, the stocks in the IRA would grow untaxed until withdrawn by the investor. When that happens, the after-tax value of the stocks will be $6,543,526.

So, at the end of 30 years, the investor in this scenario would see a total after-tax return of $8,052,262 – a 705% gain.

Now let’s see how that compares to our second allocation scenario…

Stocks held in the taxable account and bonds in the IRA

Based on the same numbers above, the future after-tax value of $500,000 in stocks held for 30 years in a taxable account would be $7,490,996.

During that same 30-year period, the bonds in the IRA would grow untaxed, and their after-tax withdrawal value would be $1,620,728.

At the end of 30 years, the total after-tax return on these investments would be $9,111,724 – an 811% gain.

The result is a difference of over $1 million!

This extra after-tax wealth came solely from strategically allocating investments between accounts with different tax consequences.

A Simple Way to Minimize Taxes on Your Assets

If you really want to move the needle on your net worth, you must follow an asset allocation strategy.

As I mentioned, our asset allocation strategy in PBL has given us average annual returns of 34.7% since June 2016.

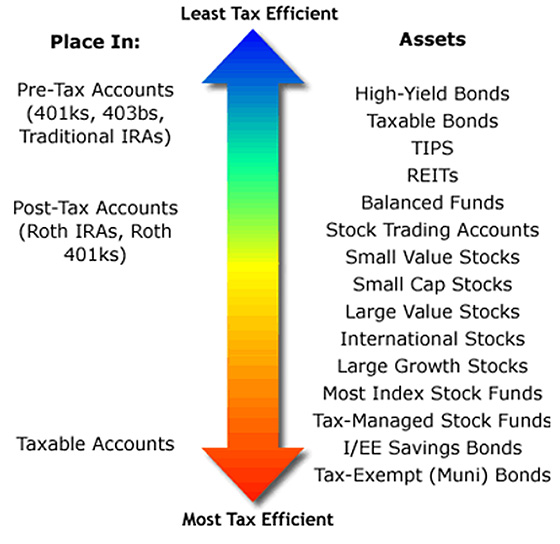

But savvy investors can do even better if they add “asset location” to their asset allocation strategy. If you want to use asset location, this simple graphic shows you where you should generally locate your assets.

Source: Forbes

Remember, asset allocation and asset location are not one-size-fits-all strategies. You must know your situation.

If you’re unsure where to place specific investments, consult your broker, adviser, or tax professional.

So before you make your next investment purchase, consider your recent tax bill and don’t just think about what to buy (asset allocation)… remember to think about where to buy it (asset location).

Regards,

Grant Wasylik

Analyst, Palm Beach Daily

P.S. Thanks in part to diverse asset allocation, our paid-up subscribers consistently beat the market year after year… with our crypto recommendations posting the highest gains across the board.

And while Teeka expects we’ll see bitcoin rise 10x from here to $500,000 in just four years… a coming crypto catalyst could unleash extraordinary gains – bigger and faster than anything we’ve seen this year.

He calls it the “Final Countdown,” and it’ll send mainstream investors rushing into crypto when it triggers. But once everyone is on board, the biggest profits will have already passed.

To learn more about the Final Countdown and receive the name of Teeka’s No. 1 crypto to play it, click here.