Palm Beach Daily

Bitcoin Is an Escape Hatch From an Unstable Banking System

The traditional financial system is like a closed loop…

Bitcoin is an escape hatch from this loop. And that’s why you’re seeing the government step up attacks against it.

Last week, the Securities and Exchange Commission (SEC) warned crypto offerings in the U.S. may be illegal because they’re not registered with the regulator.

The next day, Treasury Secretary Janet Yellen said the U.S. should implement a strong regulatory framework for cryptocurrencies.

And Democratic Sen. Elizabeth Warren of Massachusetts – a notorious crypto hater – wants federal regulators to act against “sham audits” of crypto companies.

She even had the gall to suggest that crypto contributed to the recent banking crisis. (I explained the real reason behind the crisis right here.)

Meanwhile, the same feds who were asleep at the wheel while the banking crisis spread unchecked now plan to spend billions of taxpayer money to bail them out again.

Yellen said the Treasury Department is ready to take “additional actions if warranted” to stabilize banks. That includes insuring deposits above the FDIC limit of $250,000.

That means your tax dollars (and mine) could go to bail out millionaire and billionaire depositors at failed banks like Silicon Valley and Silvergate.

So why the double standard? Why do the banks get treated with kid gloves while bitcoin gets the iron fist?

Because bitcoin allows you to escape their matrix…

How the Closed Loop Works

The closed loop system I’m referring to is the U.S. banking system.

Outside of owning physical gold, virtually every traditional investment you make goes through a bank account or brokerage house.

Whether it’s stocks, options, futures, bonds, or commodities… Trillions of dollars flow through this loop every year. The money has no way to leave the traditional financial matrix.

It’s no surprise why…

Banks and brokerages manage an estimated $370 trillion in wealth. According to estimates, they rake in about $503 billion per year from fund management fees alone.

And they’ll do whatever it takes to keep that honey pot to themselves.

Combined, the securities/investment and banking industries spent over $202 million lobbying Congress in 2022. Only Big Pharma and the electronics manufacturing industry spent more, according to the website OpenSecrets.

Nearly 73% of securities/investment lobbyists are former federal officials. They lobby on behalf of companies like Charles Schwab, Fidelity, Morgan Stanley, and Goldman Sachs.

It’s like a revolving door between the government and these industries. And it’s another way to keep the loop closed.

Look, I’m not saying there’s anything wrong with lobbying. Everyone does it.

But you can clearly see the big banks and brokerage houses are in bed with Congress. They’ll do anything to protect their closed loop.

Bitcoin threatens all of this…

Bitcoin Is an Escape Hatch From the Matrix

We’ve seen the worst banking crisis this year since the 2008 Great Financial Crisis.

Three major U.S. banks have collapsed…

Switzerland’s Credit Suisse needed a lifeline from its central bank to keep from buckling under…

And shares of Germany’s Deutsche Bank tumbled 14% last week amid fears that the banking crisis could spread there.

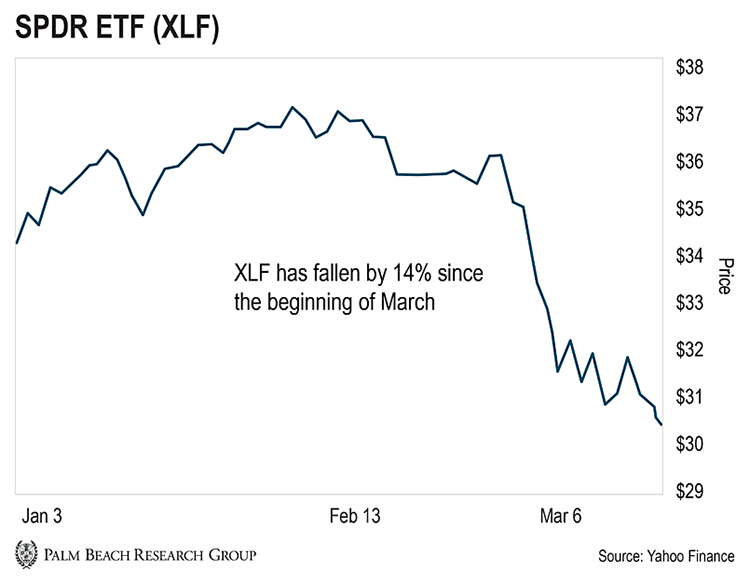

The panic has hammered U.S. banking stocks.

The Financial Select Sector SPDR ETF (XLF) – a proxy for the U.S. banking industry – was down 14% since the beginning of the month.

I believe the banking panic is behind this flight to bitcoin, not the other way around.

Bitcoin’s 64% rise this year has been fueled by people fleeing the closed loop traditional banking system.

The beauty of bitcoin is you hold it. Nobody can take it from you.

Plus, if you self-custody your own bitcoin, no one can charge you any fees on it. So you’re essentially your own bank.

This is the real reason bitcoin threatens the banks. If you custody your own bitcoin, they can’t make any money off of you.

It’s completely outside their closed loop.

Now, the people who run the banks and brokerage houses aren’t dumb. Regardless of what the feds say, these Wall Street titans know crypto is the future.

That’s why financial firms like Fidelity and BlackRock are creating crypto custody solutions for their clients.

Mark my words: They’ll eventually get a large slice of the pie. And it will be a very big pie.

Right now, bitcoin’s market cap is $523 billion. That’s a spit in the ocean compared to the total estimated global wealth of $463 TRILLION.

If just 5% of that flows into bitcoin, it’ll go up 45 times higher.

The financial firms will be like ravenous wolves outside a butcher’s shop. They’ll find a way in.

The difference with bitcoin is that you don’t have to let them in your shop… Because you can custody your own coins.

No matter how many centralized custodial solutions come to market… Bitcoin is by its very nature decentralized. It’s encoded that way.

Bitcoin is no one else’s liability. As long as you custody your own bitcoin, it’s free of counterparty risk. And no central authority can tamper with it.

The developers of bitcoin created it after the 2008 Financial Crisis for this very reason. And the current financial crisis is proving them remarkably prescient.

Prepare for the Coming “Buying Panic”

Friends, over the coming weeks and months, you’ll see attacks on bitcoin ramp up. And they’ll likely play the patriotic card.

You’ll have people say it’s unpatriotic to buy bitcoin. They’ll urge you to keep your money in their closed-loop system.

I don’t want you to buy into that nonsense for a second.

There’s nothing more patriotic than owning your own assets. That’s the basis of American capitalism.

As this banking crisis worsens, more people will come to this realization…

Now, bitcoin is a world-class asset – and I recommend everyone own at least a small amount of it – but I don’t believe buying it is the most profitable move you can make right now.

Last week, I shared details about a tiny subsector of the crypto market that will benefit from the coming “buying panic.”

If you don’t own these tokens, you’ll get wiped out as the broad crypto market (excluding bitcoin) gets crushed. But if you do, you’ll have the potential to make a killing from this buying panic.

Unlike most cryptocurrencies, these tokens are programmed to pay you monthly income on top of capital gains. And they’re set to benefit from a surge of activity coming to one of crypto’s largest networks as early as next month.

During his special event, I explained what this catalyst is and what types of tokens will benefit from it. For a limited time, you can stream it right here.

Let the Game Come to You!

Big T