Friends, we’re witnessing a seismic shift in what people consider a safe asset in the global economy.

The guaranteed return from traditional safe havens isn’t enough to appease global investors… Especially when the purchasing power of money is getting destroyed by inflation.

The asset class at greatest risk of this seismic shift is bonds – in particular, U.S. Treasury bonds.

Treasurys are considered the safest and most secure investments in the world because they’re backed by the full faith and credit of the U.S. government.

However, that hasn’t always been true. Bonds purchased in 1970 saw their purchasing power get cut in half by 1980.

In 1970, you could’ve retired with $500,000 in bonds that would’ve paid you about $35,000 per year.

That was a very comfortable living in 1970… equivalent to about $117,000 in today’s money.

But by 1980, the buying power of your dollars was cut in half. That meant your $500,000 in bonds had the buying power of only $250,000.

You lost 50% of your nest egg in just 10 years.

On top of that, your standard of living would’ve also dropped 50%. Your $35,000 per year in bond income would only buy you $17,500 worth of “stuff.”

In the span of a decade, you went from having a safe and secure lifestyle full of all the little luxuries that make life fun… to a life of clipping coupons and watching every dollar like a hawk.

Twenty years later in 1990, your $500,000 nest egg would only be worth the equivalent of $147,000. And your $35,000 income would only buy $10,000 worth of goods and services.

You went from well off to ruinously poor during the most vulnerable part of your life.

What’s coming for all of us could be far worse than that…

If this decade mirrors the ’70s, by my calculations bonds won’t offer a compelling real return… unless they average over 9% for the decade.

Of course, the Federal Reserve would never raise rates to 9%. If it did, the government would go bankrupt.

Right now, total U.S. debt stands at a record $33 trillion. At 9% interest, the net annual interest payment to service that debt alone would be $2.8 trillion.

These are insane numbers. So let me put them in context.

The U.S. government generated $4.9 trillion in tax revenues last year. Its biggest annual expenses were Medicare and Medicaid ($1.4 trillion), Social Security ($1.2 trillion), and defense ($800 billion).

So at a 9% interest rate, the payments on the national debt would be nearly as much as the outlays for Medicare and Medicaid, Social Security, and defense combined.

This level of debt is the endgame I’ve been warning you about…

A “doom loop” that tips America over the edge from dollar superpower to the collapse of the dollar’s purchasing power.

In this doom loop, the usual safe stores of money – real estate, gold, bonds – won’t be able to keep pace with the erosion of the dollar’s buying power.

But one asset will…

The Asset That Will Flourish

If you’re a longtime reader, you know I’m talking about bitcoin.

I know you’ve heard me pound the drum on bitcoin for years. And many of you are thankful I’ve done so.

Since I recommended BTC in April 2016, it’s up 9,328%. That’s enough to turn every $1,000 into $94,280.

I believe bitcoin will eventually hit $500,000. That means at least 14x more upside from here.

So if I have to drag you kicking and screaming across the finish line – well, you’ll thank me when your bitcoin is 1,300% higher than it is today.

Meanwhile, those who didn’t listen to me will see the purchasing power of their dollars at least cut in half – and probably far worse than that – because our debt burden as a percentage of gross domestic product (GDP) is far larger.

Here’s some sobering perspective…

In 1970 our debt-to-GDP ratio was 35%. Today it’s pushing 130%.

If we lost 50% of our purchasing power in the ‘70s when debt-to-GDP was three times less than it is now, how much purchasing power will we lose this decade?

It’ll be more than you can bear, and far more than your stocks, bonds, gold, and real estate can make up for.

The advantage of bitcoin is that you don’t need to own much of it to protect your net worth.

Let’s say you have $1 million worth of investable capital. And in 10 years, inflation erodes the buying power of that capital to $500,000.

In other words – all else remaining equal – prices would’ve doubled.

How do you protect against that?

Let’s say you take 5% of your $1 million in investable capital and buy $50,000 worth of BTC.

If bitcoin goes up 14x from here, you’d be sitting on $700,000.

So just a 5% allocation to bitcoin alone could maintain most of your purchasing power even if you left the rest of your money in cash.

I know that seems outrageous. But I’ve seen this play out before…

The United States experiences an economic crisis. (The cause could be war, a pandemic, or rising inflation.)

To rescue the economy, the Fed loses its mind and floods cash into the system. When that happens, bitcoin explodes in price – outpacing every other asset class.

We saw this happen in 2020 during the height of the pandemic.

In its infinite wisdom, the Fed unleashed a flood of money supply at a speed unrivaled in history.

On March 15, 2020, the Fed cut rates to near zero. It instantly increased the Treasury’s securities holdings by $700 billion. And that was just the start.

As of mid-2021, total money printing tallied $13 trillion.

All that money printing caused record-high inflation… And higher inflation equals the start of an across-the-board bull market in assets.

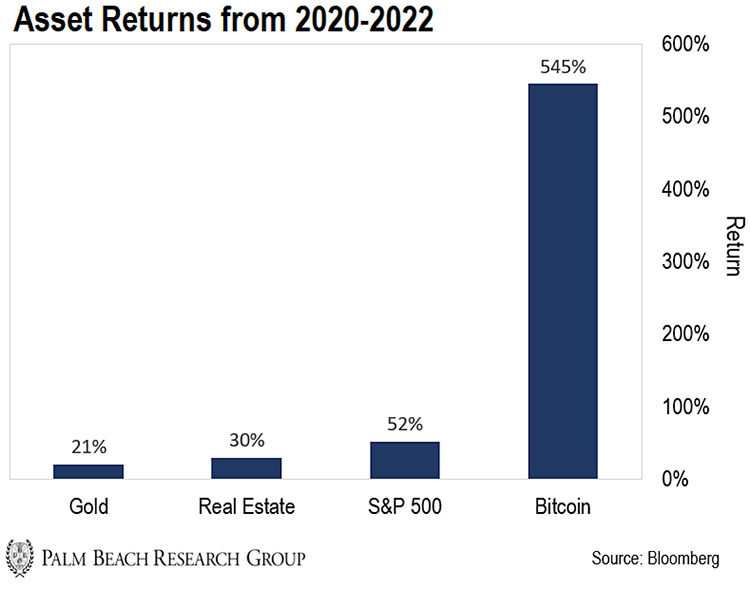

From 2020 to 2022, the median house price in the U.S. grew from $300,000 to $400,000. That’s a rise of around 30%.

Around that same period, stocks climbed 52%.

But bitcoin would do even better…

On March 17, 2020, bitcoin traded as low as $5,032.50.

Just two days later, Fed Chair Jerome Powell and his team went about the greatest monetary expansion America has ever seen.

By the second half of 2021, bitcoin would reach an all-time high of $69,044 – a 1,271% rise.

Here’s why bitcoin outperformed every other asset during this extreme money printing…

The Fed can print as many dollars as it likes. But the number of bitcoin will never exceed 21 million.

This preset scarcity (along with bitcoin’s security features) is why the crypto has wildly outpaced other investments over the past decade.

Smart people realize it’s one of the best ways to protect – and actually increase – their purchasing power in the face of rampant money printing and rising inflation.

You Need to Position Yourself Now

If you’ve been following me this month, you know I’ve been warning about an event that could trigger the final collapse of the dollar.

Later this month, to fund the government’s ongoing operations – and the trillions in debt it continues to stack up – the U.S. Treasury will auction off a host of Treasury bills and bonds to the market.

But there’s a gigantic elephant in the room: What if there’s not enough buyers to soak up all the new supply?

The Treasury needs to sell hundreds of billions in its auction to fund the government.

But if it can’t… All hell could break loose.

The inability to sell bonds to service the absurd debt spiral means Powell and his minions at the Fed will have no other choice but to wind up that money printer again and dramatically increase the money supply so they can buy U.S. bonds.

If the money supply ramps up again, then I expect bitcoin could see $500,000 far faster than you think.

And just like 2020, bitcoin’s bull run will act as a slingshot for a handful of smaller “altcoins.”

These tokens won’t just follow hot on bitcoin’s heels… but streak past the possible gains up for grabs.

I even went on camera on March 12, 2020 – at the beginning of the global pandemic – and said that:

In terms of crypto, this is actually a tremendous opportunity… And while this is definitely very difficult to live through and to sit through, I need you to view it as an opportunity.

Seven days later, I published advice on five cryptos I believed were poised to seize that opportunity.

Those cryptos – from the time I recommended them in 2020 to their peaks – went up 9,227%, 2,639%, 1,965%, 1,557%, and 969%, respectively.

Friends, these are prime conditions for bitcoin and crypto to enter another gigantic bull run if the Fed goes bonkers again and winds up the printing press.

So you should absolutely buy some bitcoin. It’s a terrific asset. But the biggest gains during this Final Collapse won’t come from bitcoin.

Last week, I held a special briefing to discuss five altcoins I believe could potentially help you build a six-figure retirement starting with just $1,000.

You can replay the stream right here…

Friends, these altcoins are still actionable. (Some are trading for less than $1.)

So buy some bitcoin today… Set aside a portion of your capital to allocate to some altcoins… Then watch my briefing for more details.

Let the Game Come to You!

Big T