Palm Beach Daily

Boost Your Portfolio with Wall Street’s Favorite “All-Weather” Strategy

There’s a simple strategy Wall Street doesn’t want you to know about. And yet, it’s behind some of their biggest profits.

Christopher Wolfe, equity strategist at J. P. Morgan Chase, called it “an all-weather strategy.”

And I can tell you from personal experience it’s a game-changer in choppy markets.

If you don’t know my story, I started on Wall Street when I was 19. And over the next 15 years, I helped clients through a lot of market turmoil.

For example, I was a Senior Managing Director at Bear Stearns in London when the Asian crisis hit in 1997. Then the Long-Term Capital Management crisis hit a year later.

I led a team of analysts and our institutional clients through both crises.

At that time, our clients included some of the biggest hedge funds in Europe, pension funds, and even central banks.

So we’re talking about billions of dollars on the line.

Do you think these institutional investors do nothing and just wait for the storm to pass when the market tanks?

Of course not. They can’t afford to. Even a small down move could mean hundreds of millions in losses when you have billions on the line.

That’s why they use all forms of advanced strategies to hedge the losses.

And that’s where my team and I came in. We developed several strategies following this “all-weather” approach.

The idea is simple: You invest in the winners, but you also bet against the losers at the same time.

We were so successful that, later, Goldman Sachs hired me to do something similar for their clients. That’s how I became a managing director at Goldman.

When Enron (the infamous energy giant) collapsed, I led my team with a similar approach. We helped Goldman clients protect their money against positions exposed to the Enron fraud.

Now, we were using very complicated financial instruments and techniques only available to institutional investors, like credit default swaps.

But there’s a much simpler version of this strategy that anyone can do from home.

And that’s what Wall Street will never tell you. They’ll never tell you that you can do this, too.

But you can. And that’s why I’m sharing this with you all today.

A Strategy That Works in Any Market

See, we may be at the beginning of a stock market “winter.”

The combination of inflation and higher interest rates is slowing down the economy. Consumers and businesses can now afford less than a year ago. That means it’s fair to say we can expect lower profits.

But that’s not all. Higher interest rates mean shrinking earnings and lower stock prices. That’s bad news for companies and investors alike.

What to do? What hedge funds have been doing for decades. That is, playing a relative game.

If you can find a company that you expect will do well and a company that will do horribly, you can pair them. This means betting on the winner and against the loser at the same time.

Once you pair the two trades, it doesn’t matter what the market does. All that matters is how your winner does relative to the loser.

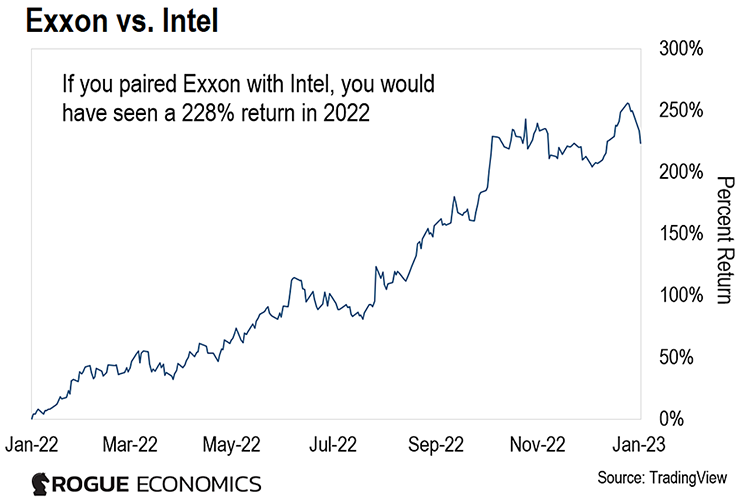

Let’s take an example from 2022. In the chart below, you can see last year’s best and worst performers…

Source: Finviz.com

You might have guessed that oil companies would do well due to the war in Ukraine. Then you could have chosen ExxonMobil (XOM) as a winner.

On the other side of the trade, you could have chosen Intel (INTC). That’s because computer chips are a very cyclical business. When the economy slows, chip companies tend to do worse.

If you combined a bet on Exxon with a bet against Intel, this would have been the performance of the trade over 2022…

As you can see, this pair trade returned 228%.

But let’s say you didn’t have the best insight and thought that Pfizer’s stock (PFE) would do well (it didn’t).

So you paired a bet on Pfizer with a bet against Intel (INTC). You would have gotten the following performance…

As you can see, the return on this trade was 94%. So even betting on a loser against a bigger loser works beautifully.

Of course, hindsight is 20/20. And not every pair trade will be a winner. But there’s a reason hedge funds love this strategy…

Because in volatile times like today, it can really help tip the scales in your favor.

As I mentioned, this is a very popular strategy on Wall Street.

In fact, research firm BarclayHedge looked at the best-performing hedge funds over the last five years.

The No. 1 was a fund called Skye Global. It had annualized returns of nearly 50%. Guess what strategy they follow?

They follow a similar approach of not only betting on the winners but also betting against the losers.

Or look at legendary investor Bill Ackman. He once turned $27 million into $2.6 billion in what The New York Times called the “single best trade of all time.”

His hedge fund, Pershing Square, also follows this approach.

And when I was on Wall Street, we used this all the time. Especially when markets were volatile like they are now.

Get on the Right Side of This $46 Trillion Shift

Over the past few months, I’ve been working behind the scenes to find a way to bring it to you, too.

See, a law went into effect just a few days ago that will help the government trigger a historic $46 trillion shift in the market.

And I want to help put you on the right side of that shift.

I believe that in the coming weeks, some stocks will crash and maybe even go bankrupt… while others will skyrocket.

And if you don’t know what’s really going on in Washington, by the end of the year, you could be the one holding the bag.

Fortune even warned its readers to “buckle up for more carnage.”

If you end up getting stuck with the losers, 2023 could end up being even worse than 2022.

That’s why I hosted a special strategy session earlier this week called 2023 Government Winners & Losers…

During the session I uncovered some of the biggest government winners and losers of this market shift… And I even shared the name of one stock to buy and one to avoid – for free.

For limited time, you can watch a free replay right here.

Regards,

|

Nomi Prins

Editor, Inside Wall Street with Nomi Prins