Palm Beach Daily

Corporate Treasuries Will Be Next Wave of Bitcoin Buyers

Historically, when new asset classes evolve, institutions come first, and retail investors come second.

Think commodities, emerging markets, real estate, etc. Generally, institutions get in early and make massive gains… while Main Street gets the leftovers.

But when crypto came along, it turned that order upside down. For once, Main Street came first, and Wall Street came second…

Today, an estimated 40−60 million Americans own crypto. And crypto exchange Coinbase has more users than traditional brokerages Charles Schwab, E-Trade, Interactive Brokers, and TD Ameritrade combined.

At the same time, Fidelity, Guggenheim, and JPMorgan have recently changed their tune on bitcoin. They either offer bitcoin services or plan to invest in bitcoin.

And top hedge fund managers like Bill Miller, Paul Tudor Jones, and Stanley Druckenmiller have added bitcoin to their portfolios as well.

But now, a new layer of Wall Street is entering the crypto market: publicly traded companies. And as institutional demand for bitcoin increases, the price of bitcoin and other cryptos will follow.

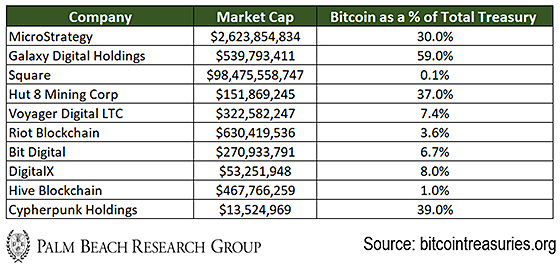

Here’s a list of the top 10 public companies that have added bitcoin to their balance sheets since 2019:

Why are these companies suddenly placing bitcoin on their balance sheets like never before? It all comes down to the dollar…

A “Superstar” Currency

Since the outbreak of the pandemic in March 2020, it’s estimated the Federal Reserve and Congress have spent a combined $6 trillion to rescue the U.S. economy.

And we expect that number to grow next year, with even more stimulus likely.

As more and more currency units are added, they make the rest of the dollars we hold worth less and less.

To protect the value of their money, these companies have been turning to bitcoin.

One example is MicroStrategy CEO Michael Saylor.

Last month, I attended a two-day virtual conference titled “Bitcoin for Advisors.” It was put on by Coinbase and Onramp Invest. Over 400 financial professionals participated, and Saylor was a keynote speaker.

During his presentation, Saylor said MicroStrategy’s treasury had $500 million in cash. But with the U.S. printing so many dollars, the treasury’s purchasing power was debasing rapidly.

So MicroStrategy decided to convert $475 million into bitcoin to preserve the value of its treasury. And it chose bitcoin over bonds, gold, real estate, and equities.

Saylor said the company liked bitcoin because it’s not tied to a fiat currency. And it’s programmed to reduce the supply coming to market. In essence, it will hold its value or rise in value, as the U.S. monetary supply expands.

Plus, studies show adding bitcoin to your portfolio reduces downside risk while increasing its overall value over time.

As Saylor attests, the fact that so many companies are now adding bitcoin to their treasuries indicates the asset class is maturing rapidly.

He compared bitcoin’s growth to that of NBA superstar LeBron James…

The knock on bitcoin is it’s this highly-volatile, exotic thing that is hard to understand. That was true for the last 10 years.

Look at Lebron James. He played basketball from age 8 to 18. And he was this interesting, enigmatic, talented guy. The second decade he played basketball was a different story.

It takes a little bit of time to go from something that’s going to be great… to adolescent great… to matured greatly. Bitcoin is similar. It’s a different story for the next decade than it was the last decade.

The LeBron James comparison might be new. But if you’re a regular Daily reader, the bigger picture shouldn’t be a surprise…

For years, Daily editor and world-renowned crypto expert Teeka Tiwari has been predicting that multilayers of institutions would flood into this space.

Here’s Teeka:

Here’s the key to why more and more financial pros will adopt bitcoin… Bitcoin is uncorrelated to the markets. So its price movements aren’t tied to stocks, bonds, real estate, or the business cycle. And just a tiny allocation can boost a portfolio’s returns – while also lowering its risk.

The bottom line: The institutional world can no longer ignore bitcoin. And this is just the tip of the iceberg.

How to Play the New Wave

Despite the significance of these publicly traded companies adding bitcoin to their balance sheets, we don’t suggest buying them for their bitcoin exposure.

Instead, the better option is owning bitcoin yourself. Since the beginning of the year, it’s up 166%. And we believe it’ll go even higher in 2021 as more companies, financial professionals, and individuals buy it as a hedge against money-printing.

Opportunities like we’re seeing in crypto are rare… Maybe once every 25 years you’ll get a chance to make a fortune by being early on a massive trend… if you’re lucky.

This is one of those times. This is the stage where you can make 200x, 300x, even 1,000x your money.

To get ahead of the next major move in crypto adoption… Start with a small stake in bitcoin, keep a long-term mindset, and let it ride.

Remember, bitcoin has a fixed supply. And as more retail investors, money managers, and publicly traded companies pour into the crypto, prices have nowhere to go but up.

Regards,

Grant Wasylik

Analyst, Palm Beach Daily

P.S. Bitcoin won’t be the only winner coming out of crypto’s mass adoption… Companies like Amazon, Google, and Facebook have already placed their bets on another crypto breakthrough.

It’s a tech that’s poised to transform manufacturing, data storage, and security forever. And as crypto’s mass adoption gains momentum, Teeka believes it’ll become the No. 1 investment of the decade… but you need to act now.