Palm Beach Daily

How to Earn up to 136 Times More Interest on Your Idle Cash

In 2009, Gary Zimmerman believed his bank was on the brink of bankruptcy.

While he was an investment banker at Citigroup, the bank’s stock went from $55 to 97 cents during the financial crisis.

That’s no typo. Citi stock fell below a buck – in a 98% freefall.

At the time, there was legitimate concern Citi would go under.

Safety was top priority for Gary.

He determined that any cash balances above the FDIC insurance limits in his Citi Private Bank accounts were at risk.

So Gary swiftly opened multiple online bank accounts and linked them to his Citi account. Then, he strategically spread his cash around and kept each new account balance under the $250,000 FDIC insurance limit.

For a few years post-crisis, Gary shuffled monies around various online banks.

His goal: To ensure his cash was always getting the highest yield and keeping it all FDIC-insured.

Gary was racking up close to $40,000 in extra annual income with his cash arbitrage approach. (At the time, online banks paid 10x the yields of traditional banks.)

His method of cash management was tedious. He’d spend hours upon hours manually checking yields/balances and shifting his funds every month.

Gary considered throwing in the towel. But that’s when he had a “light bulb” moment.

Gary decided to scale his process through technology. And with this strategy, millions of people, including you, can benefit from it today…

Get Super Alpha on Your Cash

Longtime Daily readers know we view things differently from ordinary investors. So we use portfolio diversification and asset allocation to outperform the traditional 60/40 model (60% stocks, 40% bonds).

And one of our assets is cash. Which brings me back to Gary’s strategy…

After leveraging high tech to scale his process, Gary founded MaxMyInterest – or “Max” for short – in 2013. Max is an intelligent cash management system.

It’s not a bank, so it doesn’t custody any funds. It’s a hub-and-spoke model. The “hub” is the client’s checking/brokerage account. The “spokes” are the client’s online bank accounts.

When I spoke to Gary, here’s how he summed up the opportunity…

Everyone holds cash. But most of that cash is sitting in the wrong place, underinsured, and earning next to nothing. Since FDIC-insured bank accounts are pretty undifferentiated, it makes sense to shop around for the best rates, much like you might search online to find the best price for a book.

Max enables you to keep your existing bank, while supplementing that relationship with higher-yielding online savings accounts. And Max automatically seeks the best rates each month. So your cash always earns as much as it can without the need to switch banks.

Essentially, it does exactly what Gary did before. But now, it’s automated by a computer algorithm.

Here’s a little more on Max’s two primary benefits…

First, cash yields are at historic lows.

The national rates banks pay are 0.06% for checking accounts… 0.09% for savings accounts… and 0.16% for money market accounts.

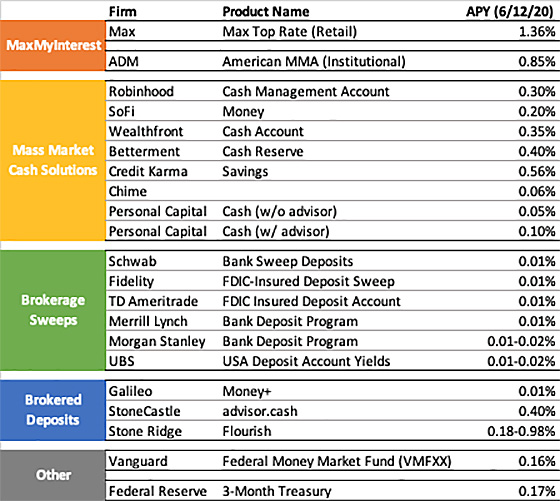

As you can see below, Max delivers the highest rates in the nation. Its top annual percentage yield (APY) of 1.36% is 1.4–136x higher than its competitors.

Source: MaxMyInterest

Gary calls it “super alpha,” because the incremental interest income comes with less risk.

That brings me to the second benefit: Broader FDIC insurance.

Typically, the FDIC offers up to $250,000 of coverage for most bank accounts.

But with Max, individuals can get FDIC insurance of up to $2 million. And couples can get FDIC insurance of up to $8 million through a combination of individual and joint accounts. Naming additional beneficiaries can get you even more FDIC insurance coverage.

Max’s other bells and whistles include:

Transferring funds with one click

-

Automatically moving cash to the highest-yielding online bank accounts

Consolidating tax reporting at year-end

-

Offering an optional no-fee, high-yield checking account

[Note: In addition to higher yields, Max charges 0.02% in fees per quarter – 0.08% per year. This is roughly half the typical money market fund rates.]

A Simple Solution for All

Cash is the universal asset class, because everyone has some. As Daily editor Teeka Tiwari says, everyone needs cash…

You never know what life can throw at you. Stocks could fall 50% and give you a rare shot to buy dirt-cheap stocks. You could discover a lucrative business opportunity. Or you might get blindsided with a huge medical bill.

Whatever it is, cash typically “meets the need” better than anything else. Therefore, it’s crucial to hold some.

And that’s why we recommend you always have some on hand. (We generally recommend holding up to 10% of your portfolio in cash.)

So if you’re an everyday investor, consider using MaxMyInterest.

Max has a patented approach to opening multiple bank accounts in less than five minutes, through a single online form. And its network includes eight online banks. (It’s adding more, too.)

Max’s one-two punch can automatically earn you the highest yield on your cash across multiple bank accounts – and keep it all FDIC-insured.

If you want to learn more about MaxMyInterest, click here. But remember, always do your homework before making any investment-related decision.

Regards,

Grant Wasylik

Analyst, Palm Beach Daily

P.S. As I mentioned, at PBRG, we view things differently from the average investor. And we look for ways to put you on the road to financial security and independence.

And on Thursday, June 25, at 8 p.m. ET, Teeka’s holding a special briefing on a strategy he believes will level the playing field between Wall Street and Main Street. Now, I can’t reveal all the details, but this simple strategy can give you the opportunity to make life-changing gains.

Teeka will share all the details next Thursday, so click here to reserve your free spot…