Palm Beach Daily

“I Would Never Put My Money Into a Bank Stock Ever Again”

“I would never put my money into a bank stock ever again…”

That’s the advice from Kevin O’Leary.

After recent bank runs, no one could blame him for such a strong stance.

If his name doesn’t ring a bell, you may know O’Leary as “Mr. Wonderful.” He’s the royalty-seeking lead “shark” from ABC’s Shark Tank.

(The show invites aspiring entrepreneurs to pitch their product ideas to successful entrepreneurs in hopes of receiving funding from the “sharks.”)

Last week, CNN interviewed O’Leary after global banking giant Credit Suisse nearly buckled under. Over the weekend, Swiss rival UBS bank announced a $3.2 billion takeover of Credit Suisse.

The failure of Credit Suisse followed the collapse of three major U.S. banks.

To stem the panic, U.S. regulators said they would make sure account holders at those banks could access all their deposits… even if those accounts have more than the $250,000 insured by the FDIC.

Given the systemic risk in the banking system, O’Leary told CNN:

What effectively happened over the weekend is that he [President Joe Biden] nationalized the American banking system. It’s no longer a risk. It’s no longer private in any sense. It is now backstopped by the government, ultimately the taxpayer…

There’s no such thing as a free lunch, and this is going to be very expensive for shareholders of banks long term. I would never put my money into a bank stock ever again. (Emphasis added.)

Whether you agree with O’Leary about the feds bailing out bank depositors is up to you…

But he’s right about one thing: Bank stocks have been hemorrhaging value…

Below is a chart of the Financial Select Sector SPDR Fund (XLF).

The exchange-traded fund holds 75 financial firms, including Bank of America, Wells Fargo, JPMorgan Chase, and Goldman Sachs. So it’s a good proxy for the U.S. banking system.

Bank stocks rallied Tuesday when the federal government pledged additional support. But before that, it looked like XLF had fallen off a cliff…

Smaller regional banks have fared even worse. Western Alliance, PacWest, and First Republic Bank were down 65%, 67%, and 90%, respectively, since the start of the month.

Given all the carnage going on in the banks, it’s no surprise O’Leary is swearing off bank stocks.

Right now, he recommends investors find safety in blue-chip dividend stocks – which is one of our core strategies at Palm Beach Research Group.

While you usually can’t go wrong with blue-chip stocks – Daily editor Teeka Tiwari believes the biggest long-term beneficiary of the current banking panic will be bitcoin.

An Alternative to the Traditional Bank System

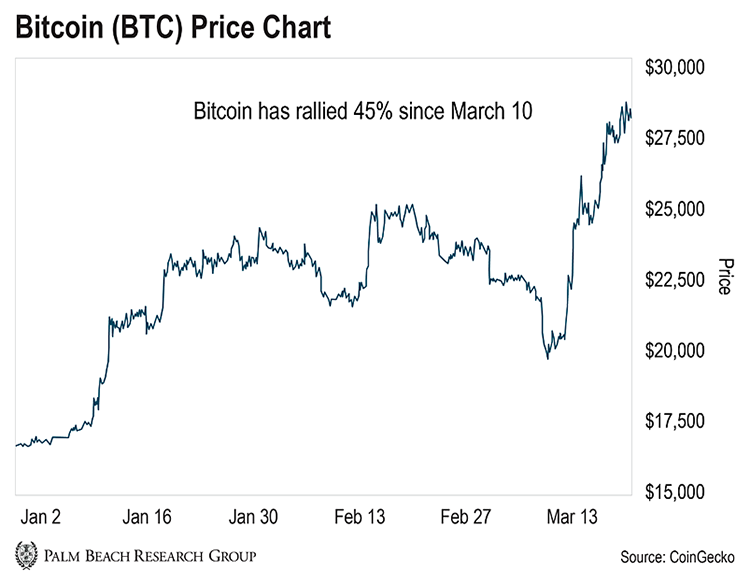

Just look at the chart below. It shows how much bitcoin is up this year…

As you can see, bitcoin really began soaring after we started seeing a run on banks.

Teeka says that’s because people are starting to see bitcoin as an alternative to the traditional banking system.

Here’s Teeka from Tuesday’s Daily:

The beauty of bitcoin is you hold it. Nobody can take it from you.

Bitcoin is no one else’s liability. As long as you custody your own bitcoin, it’s free of counter party risk. In addition to that, it’s impossible to dilute bitcoins value beyond its preprogrammed creation schedule.

Sure, bitcoin is volatile. And yes, you might wake up one morning and see it down 30%, 40%, or even 50%. But bitcoin always comes roaring back (like we’re seeing now). After every bone-crushing crash, it always powers back to new all-time highs.

People are realizing its better to deal with volatility than the risk of 100% loss that currently exists in the fiat-based banking system. That is why I believe bitcoin will continue rising from here.

According to Teeka, only about 2 million BTC actively trades every day. That’s just $56 billion. By comparison, more than $183 trillion is held in global banking deposits.

During this banking panic, billions of dollars have fled from banks to bitcoin.

If wealthy depositors allocate just 1–2% of their net worth to BTC… It could send over $1 trillion heading into bitcoin.

While bitcoin is set to be a huge beneficiary of this turmoil… And Teeka expects it to go much higher from here…

It’s not yet the right time to buy into the broad crypto market…

You Need to Invest the Right Cryptos

There’s a panic coming to crypto like we’ve never seen before.

Teeka believes it’ll catch millions of Americans by surprise. By the time they realize what’s happening, it’s going to be too late.

Many Americans are using this rally to speculate in meme coins and a bunch of other fraudulent projects. This coming panic will wipe them out…

But not in a way you’ve ever seen before.

According to Teeka, the big mistake everyone is making is they think the entire crypto space will have an explosive rally… “and they’re horribly wrong.”

To prepare you for this coming panic, Teeka has put together a special briefing tonight at 8 p.m. ET. It’s called The Crypto Panic of 2023.

During this briefing, he’ll explain exactly what will cause this panic – and how you could potentially turn $1,000 into an entire nest egg… All while getting paid each month.

And as a special bonus for those who attend, he’ll even give away his top pick to play the coming panic.

You should know Teeka’s past free picks have an average peak gain of more than 1,300%.

Just click here to register, and your email address will automatically be added to his RSVP list.

According to Kevin O’Leary, the contagion spreading through the financial system should change how investors look at bank stocks.

One way to diversify your savings is to put a small portion of your capital into bitcoin.

And then tune in to Teeka’s briefing tonight at 8 p.m. ET to learn which other sector of cryptos is set to benefit from the coming panic.

Click here to automatically add your email address to his RSVP list right now.

Regards,

Chaka Ferguson

Editorial Director, Palm Beach Daily