Palm Beach Daily

Investing in Dividend Stocks Over the Years Can Build a Retirement Nest Egg

Ronald Read was a janitor and gas station attendant who lived in Vermont.

A World War II vet, he was the first in his family to graduate from high school. He drove a used Toyota Yaris and lived a frugal lifestyle.

But when he died in 2014, he left $6 million to charity and $2 million to his family.

Anne Scheiber was an IRS auditor. She never made more than $4,000 per year. Upon her death in 1995, she donated a $22 million fortune to her two favorite colleges.

These aren’t the millionaires who have become household names. But these “secret millionaires” were able to grow their humble earnings into sizable wealth… and live on their own terms until their last days.

At Intelligent Income Daily, we don’t believe in the messaging Wall Street sells you: that you have to already be rich to get rich.

There are ways anyone can secure financial independence – and then some.

And today, I’ll show you how a secret to immense riches can help you retire in safety and splendor.

Retiring Rich Doesn’t Require Luck

Ronald Read and Anne Scheiber didn’t get lucky by buying Amazon or Apple early… They didn’t master speculative options or day trading… Nor did they inherit a lot of money.

So how did they get richer than 98.5% of Americans?

According to the Wall Street Journal, Read died owning 95 stocks. But they weren’t rock-star growth and tech stocks like Amazon.

Just look at some of the companies he owned:

Procter & Gamble.

JPMorgan Chase.

General Electric.

Dow Chemical.

His biggest holdings were Smucker’s, CVS Health, and Johnson & Johnson.

These large, steady companies are hardly the kind you’d imagine can make you rich… But they can.

As for Scheiber, when she retired in 1947, she started earning a $3,100 annual pension. And having worked for the IRS, she knew how much money could be preserved when you don’t have to pay capital gains taxes.

That’s why she bought and held blue-chip stocks, just like Read did, for nearly 50 years. Starting with $5,000 in her portfolio, she grew that to $22 million.

You might think these stories of the past only applied to that time. But you can still replicate that level of success today…

Let’s consider three investors.

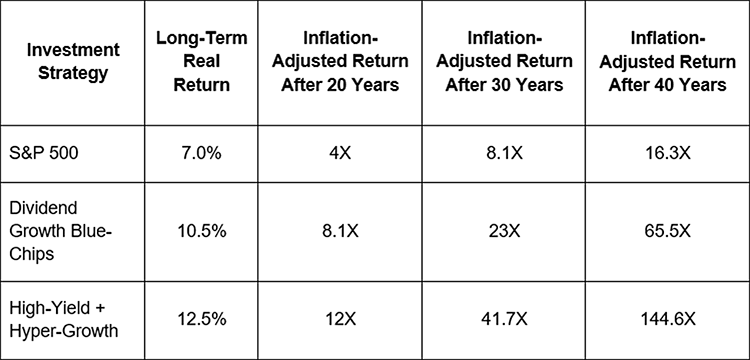

The first buys the S&P 500, which historically earns 7% inflation-adjusted returns.

The second buys dividend growth blue-chips, like what we at Wide Moat Research recommend to our subscribers, and earns 10.5% annual returns after inflation.

And the third combines high-yield dividend growth blue-chips with the best hyper-growth world-beaters and earns a 12.5% annual return. (This is the strategy we recommend to our younger subscribers.)

Take a look at how their finances would have fared over the long term based on their chosen strategies…

(Source: FactSet, Dave Ramsey Investment Calculator.)

Over 40 years, starting at age 30 and retiring at 70, even the S&P 500’s historical inflation-adjusted returns get you 16X your money.

Dividend growth blue-chips get you 66X, about four times more.

Meanwhile, combining yield and hyper-growth hands you 145X your money.

With those kinds of returns, you don’t have to invest a lot of money today for it to compound into massive returns.

And here’s the best part…

We’ve just put together a portfolio that can help you do just that.

Build Your Own Dividend Portfolio

It’s diversified across various assets to withstand market crashes. That makes it much less likely to experience a bear market than the S&P 500.

We ran the calculations, and here’s how much it’s expected to return based on a monthly investment.

(Source: FactSet, Dave Ramsey Investment Calculator.)

And you don’t need to have 50 years ahead of you to reach your retirement goals.

Based on our calculations, even if you start investing at 40 or even 50, you too can retire a “secret millionaire” just like Ronald Read or Anne Scheiber.

You don’t have to live like a monk and save every penny to retire rich. You just need the world’s best companies working hard for you so that one day, you won’t have to work hard yourself.

Even if you’ve made financial mistakes that torpedoed your retirement portfolio, the right investments can help you make it all back – and then some.

Safe Investing,

Adam Galas

Analyst, Intelligent Income Daily

P.S. While focusing on the best-in-breed dividend players is a great investment strategy in any market, we know that most Americans are concerned about a potential recession.

But at Wide Moat Research, we’re not worried about the market volatility this could trigger.

That’s because longtime PBRG friend and Intelligent Income Daily editor Brad Thomas has constructed a multilayered strategy to help you protect your money and earn high yields… all outside the stock market.

The secret to this strategy is something we call “contractually obligated money,” or COMs. As implied, this financial vehicle ensures – by law – that you make money.

And thanks to Brad’s unparalleled research, you can snatch up bargains for pennies on the dollar. And cash in, regardless of whether stocks go up or crash to zero.

This strategy is so simple, you can do it in just a handful of clicks right from your brokerage account. Yet most investors don’t know anything about it.

Brad and our team recently held a special event to explain this strategy. For a limited time, you can watch the replay right here. It’s free for Palm Beach Daily readers.