Palm Beach Daily

More Countries Are Reducing Their Dollar Reserves

Most countries use U.S. dollars to transact in global trade because it’s the world’s reserve currency.

For that reason, the world’s central banks must hold U.S. dollars in reserve.

This has been the case since the Bretton Woods Agreement of 1944, which established the dollar as the world’s reserve currency.

That agreement was a game-changer because it created guaranteed demand for the U.S. dollar.

The problem is that the U.S. government has been abusing that privilege for decades by issuing mountains of unfunded liabilities in the form of government bonds.

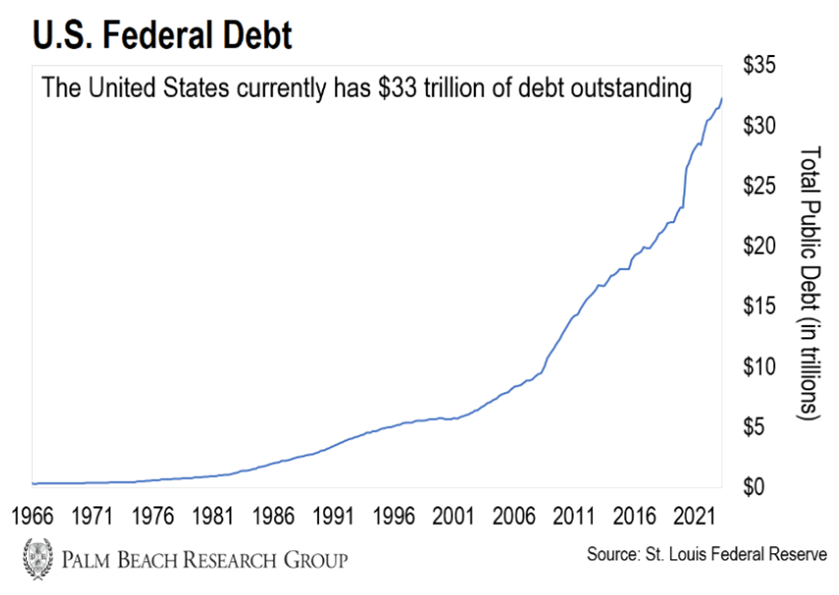

U.S. debt has exploded, especially in the last two decades.

As you can see in the chart above, U.S. debt is at $33 trillion. To put that in perspective, that’s about $100,000 per citizen.

It’s the burden that you, your children, and your children’s children currently face.

That burden is about to get even worse because of a new phenomenon called de-dollarization.

De-dollarization is when nations around the world start dumping the U.S. dollar in unison.

And the trend is accelerating…

The U.S. dollar’s share of world reserve currencies has decreased from 73% in 2001 to 47% this year – the lowest level ever.

Most Americans don’t realize why this is a huge deal. Thanks to its status as the world’s No. 1 reserve currency, there’s always been a lot of demand for the U.S. dollar.

That’s the only reason why our government has been able to print billions of new dollars without having to worry about any consequences…

There was always someone there to buy them.

It’s a huge advantage that literally gave us our standard of living.

So the fact that nations around the world are now dumping the U.S. dollar at a pace faster than the previous two decades is a huge crisis because who will be there to buy our debt?

I believe this trend will contribute to what I call the Final Collapse of the dollar’s purchasing power.

The Weaponization of the Dollar

In 1971, the U.S. government moved off the gold standard. That turned the U.S. dollar into a fiat currency.

By moving off the gold standard, the Federal Reserve was free to print money willy-nilly, without worrying about any gold reserves.

The result?

Inflation crushed U.S. consumers in the 1970s. By the end of the decade their purchasing power collapsed by 50%. And since 1970, the dollar has lost 87% of its value.

Here’s another way of looking at it…

It takes about $7.82 in today’s money to purchase the same amount of goods and services a single dollar would have bought you back in 1970.

In other words, most Americans became poorer under the new U.S. dollar regime.

But the U.S. could continue to print money as it saw fit because there were always willing buyers of U.S. debt abroad.

That started to change in February 2022.

That’s when the U.S. government took things to a whole new level by aggressively weaponizing the U.S. dollar.

To punish Russia for its invasion of Ukraine, the U.S. froze all the dollar reserves of Russia’s central bank. That was $630 billion.

The rest of the world watched that unprecedented move and started thinking, “Wait a second. If the U.S. can do that to a nuclear power like Russia, it can do that to anyone.”

That’s why an increasing number of nations in Asia, Europe, and Latin America have recently announced plans to dump the U.S. dollar as their sole reserve currency… and instead trade in their own local currencies.

Over the past year or so, China has slashed $191 billion of U.S. Treasury bills from its reserves… Japan has sold off $116 billion… Ireland $44 billion…Brazil $8.6 billion… Singapore cut almost $5 billion.

The finance ministers of the Association of Southeast Asian Nations – including Indonesia, Thailand, the Philippines, Singapore, and Vietnam – recently met behind closed doors, and they also decided to start reducing their dollar reserves.

And look at Saudi Arabia. For the past 48 years, it’s only accepted U.S. dollars in exchange for the oil it sells to nations. But now, Saudi Arabia says it’s considering trading in currencies besides the U.S. dollar.

Friends, these aren’t tiny, obscure countries that nobody can even find on a map. They account for 60% of the global economy.

The bottom line is this: Everyone is losing trust in the greenback. And that will contribute to the Final Collapse of the dollar’s purchasing power.

“We’re In Deep Trouble”

The de-dollarization trend is spreading wider and it’s not slowing down. But there’s something more troubling happening behind the scenes.

I’m talking about an unprecedented government event scheduled for this month that will trigger the Final Collapse of the dollar’s purchasing power.

One of the few people who understand what’s happening is the legendary investor Stanley Druckenmiller. In 30 years managing money he’s never had a down year.

During a recent CNBC interview, he said of this event, “We’re in deep trouble.”

That’s why tomorrow at 8 p.m. ET, I’m hosting a special briefing called the Final Collapse.

During this briefing, I’ll tell you what this event is… why it’ll put America in “deep trouble”… and the one asset that will skyrocket from it.

The last time the dollar had a similar crisis, my readers had a chance to make 27 times, 56 times, and even 850 times their money…. in less than two years.

As a bonus to those who attend, I’ll also give away a free pick – no strings attached. You should know my past free picks have an average gain of more than 1,100%.

Friends, when this event occurs this month, most people will watch their purchasing power evaporate.

But tomorrow at 8 p.m. ET, I’ll show you how a handful of tiny investments could potentially help you come out of this collapse with a massive six-figure nest egg that could set you up for life.

Click here to reserve your seat today.

Let the Game Come to You!

Big T