Palm Beach Daily

Rising Inflation Means It’s Time to Adjust Our Playbook

Everything about the economy right now comes back to one thing: Inflation.

It’s on everyone’s mind. It enters every conversation.

It’s an economic problem. It’s a political problem. And it’s also a huge problem for your personal wealth.

At its core, inflation is simply an ongoing and general rise in prices.

It’s not a temporary rise due to supply chain issues (although that’s certainly keeping goods scarce)… Or the demand for popular goods like a PlayStation 5 video game console.

We’re seeing the inflation impact of trillions of dollars in fiscal stimulus created during the pandemic.

At the time, faced with the uncertainty of the deadliness of Covid-19 and with the rise of stay-at-home orders, printing money to “tide over” the economy made great political sense.

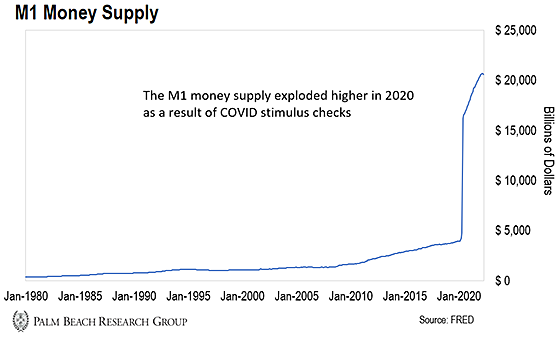

Just take a look at the M1 money supply.

It’s the widest measure of money as calculated by the government. It includes physical cash as well as cash equivalents like bank account balances.

You don’t have to be a Ph.D. economist to notice anything out of the ordinary.

This explosion reflects the impact of the stimulus checks the government handed out like party favors during the pandemic.

It also includes extended unemployment benefits… forgivable loans to businesses to avoid layoffs… and the trillions of dollars that went to shore up the banking system over the past 30 months.

So it’s no surprise that inflation hasn’t just ticked up. It’s skyrocketed…

Inflation is at its highest level in 40 years.

The fact is… times are changing.

So we need to change our investing and wealth-building strategies along with them. That will put us ahead of the curve, giving us the best returns.

For several months, I’ve worked closely with my team to revise our asset allocation models. We’ve focused on ideas to help you navigate today’s high-inflation world.

These are the same strategies many of the ultra-wealthy are using right now to protect and grow their capital.

Behind the scenes, I’m working on some special projects that will begin rolling out later this year. Like the strategies used by the ultra-wealthy, they’ll ensure you come out of a challenging market with even more wealth.

And as loyal Daily readers, I want to give you a preview…

When Inflation Rises, the Wealthy Turn Here

Since the pandemic outbreak, I’ve been concerned about massive deficit spending and the inflationary spiral it would create.

In February 2020, I gave a private talk to a room full of entrepreneurs… warning them that crippling inflation was coming. I told them to go out and buy rare hard assets like trophy real estate, collectible watches, and blue-chip art.

(Even before then, I recommended Palm Beach Daily readers diversify into alternative assets. You can click here to read it.)

I told these entrepreneurs to buy things wealthy people would want to own in the future.

Two back-to-back signs from the Federal Reserve told me my reassessment was correct.

The first was March 15, 2020. That’s when the Fed said it would restart quantitative easing and committed to buying $500 billion in Treasurys and $200 billion in mortgage-backed securities.

The second was on March 23. That’s when the Fed said it would start buying securities.

At this point, I knew the Fed was in a full-flight panic about the economy. And I predicted it would print stadium-sized stacks of money to paper over the effects of the pandemic.

That would spark massive and prolonged inflation. And a concurrent rise in the prices of hard assets.

For instance, money zoomed into art, cars, and real estate during the dot-com bubble…

Why does this happen?

When the stock market gets crushed, the wealthy say to themselves…

Well, I could put another $4–10 million in equities. And maybe watch my position go down 20–30%. Or I can buy a $10 million Ferrari. The Ferrari may depreciate, too. But in the worst case, I still own a Ferrari.

So as inflation ramps up, I expect the ultra-wealthy to run to hard assets.

That’s because these assets are scarce and retain value. Let me give you an example from my own…

Where to Put Your Capital Now

Since the outbreak of COVID, I’ve moved millions of dollars of my own money into hard assets… including watches, luxury real estate, bitcoin, and Ethereum.

I’ve even bought a couple of boats. But one of the boats I bought is now worth 25% more than I paid. That’s with almost 3 years of use on it.

The other, a sailing catamaran, has gone up 20% just through manufacturer price hikes. They have a 2-year waiting list.

My boat will be ready in September. And if I wanted, I could flip it for at least a 20% profit the day I take possession of it.

Since the waitlist is so long, I’m confident I could get an even bigger premium.

Let me be clear: This is not normal. The dollar’s buying power has dropped so much you can now make money on items that normally go straight down in value.

Just look at the used car market. Over the last two years, used car prices have been on fire rising 50% since the start of the pandemic…

Given what we see in the markets and the economy, I’m readjusting my asset allocation model to better navigate our current inflationary policies.

We are in the process of putting all our research into a new report for my Palm Beach Letter subscribers.

I believe this will put us in position to outpace inflation while continuing to outperform the market.

Act Now and Let Time Do the Rest

In the past, as an individual investor, there was little you could do when the markets crashed.

You just had to sit there and watch as the rich protected their wealth while you got ravaged. And that’s just not true anymore.

There’s a lot that you can do.

These days, you don’t need to be rich to invest in some of the world’s most coveted trophy assets.

For example, platforms like “Rally” allow just about anyone to purchase fractional ownership interests in Rolexes, Lamborghinis, and even CryptoPunk NFTs for $10 or less.

With a fractional investment, the owner of an asset can list it on a platform… and offer shares (or fractions of the asset’s worth) to investors.

For example, you could list a rare baseball card worth $100,000 and offer investors $100 fractions. If the baseball card’s value rises to $1 million, that $100 investment rises to $1,000.

Friends, I understand if you aren’t familiar with these types of investing. And it’s not your fault.

You didn’t have the right playbook. Nobody sat down to tell you how the rules have changed. It’s a new world.

In 20 years, everybody will know this. But by then, the opportunity will be over, and it’ll be too late to preserve your money’s purchasing power. You must take action now.

So while the market is down, take a closer look at your investments and see what’s working and what’s not…

If things look off-balance, you can use this essay as a general guide to identify corners of the market you haven’t considered… and put yourself in a better position to beat inflation and profit when the markets recover.

Let the Game Come to You!

Big T