Palm Beach Daily

Rising Inflation Will Erode Americans’ Purchasing Power

On October 10, 2018, I delivered my most public prediction ever on the Glenn Beck show.

During the interview, I told Glenn’s 5 million listeners that bitcoin would hit $40,000.

At the time bitcoin was trading a hair above $6,400.

Glenn thought my prediction was crazy. During the broadcast he asked me, “Tiwari, are you sure you want to say that?”

That was during the brutal 2018 Crypto Winter. Bitcoin dropped from a high of $20,089 to a low of $3,191 between December 2017 and December 2018.

People just savaged my prediction. I had to look in the mirror and question whether I was wrong.

I re-examined my research, and I stood firm in my commitment that bitcoin would reach $40,000.

Fast-forward to 2021, and bitcoin blew past my prediction of $40,000… climbing as high as $69,000 in November 2021.

And guess what?

Glenn eventually invited me back on his show. Do you know what he told me? He “bought more” bitcoin and was “thrilled” he did.

Right now, bitcoin’s trading around $34,500.

Even with its current pullback, you would’ve made five times your money if you bought BTC when I recommended it on Glenn’s show in October 2018.

And with a spot bitcoin exchange-traded fund and the 2024 halving on the horizon… I have no doubt bitcoin will surpass its old all-time highs again.

In fact, I expect bitcoin to hit $500,000 over the coming years.

Here’s why I’m telling you this…

Earlier that same year – just a few months before Glenn interviewed me on his show – I made another bold prediction.

It received much less fanfare than my bitcoin prediction on Glenn’s show… But today, it’s even more imperative.

In fact, that earlier prediction I made back then is why I moved millions of dollars of my own money into bitcoin.

That’s because I believed back then – as I still do now – that we’re heading toward the Final Collapse of the dollar.

This Asset Is Getting Devastated

In March 2018, while many market commentators were calling bonds a “safe investment,” I was warning everyone within earshot to get out of them.

I knew massive government printing would erode the purchasing power of the dollar, and anyone holding bonds would get annihilated. Especially those holding long-term bonds.

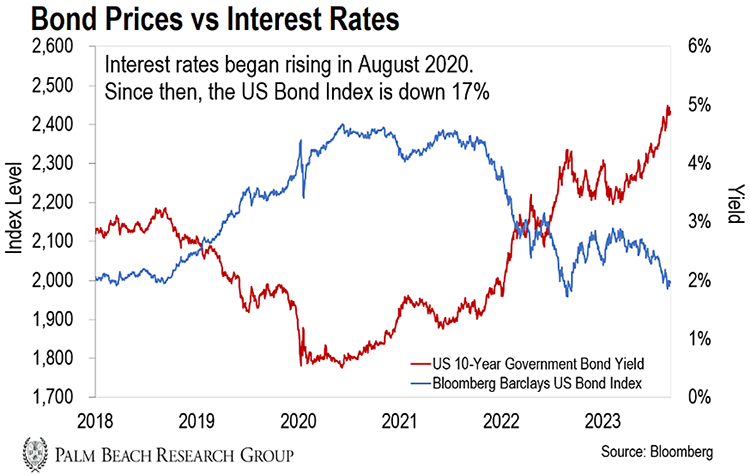

I predicted interest rates would eventually need to hit 7% just to keep pace with inflation. And when interest rates rise, the price of bonds plunges.

Here’s what I said in a March 5, 2018, Daily interview:

For the past 35 years, bond yields have generally gone down, and bond prices went up. And when something happens for that long, people start to call it a “safe investment.”

But bonds are anything but safe. Already since September [of 2017], we’ve seen some long-term bond funds lose nearly 9%.

And this is far from over… Right now, we have rising interest rates and rising inflation. The last time we saw this happen was in 1981. The bond market fell 19% that year.

That was the tail end of a brutal 30-year bear market in bonds. During the last bond bear market, investors saw the value of their “safe” investments collapse 60%.

As with my bitcoin prediction, I was a bit early on my bond call.

To rescue the economy during the COVID-19 pandemic, the Federal Reserve lowered interest rates to near zero. And that temporarily sent bond prices soaring.

But those lower rates caused runaway inflation. And just as I expected, the long-term trend of rising rates and falling bond prices has resumed.

The Fed had no choice but to start raising rates at an unprecedented rate – 11 rate hikes over 16 months.

As you can see in the chart above, since the Fed started its current rate-hike cycle in August 2020 (red line), bonds (the blue line) are down 17%.

Friends, I believe we’re at the beginning of another long-term bond bear market. And things are about to get worse…

Right now, interest rates stand at 5%. Similar to my 2018 prediction, JPMorgan Chase CEO Jamie Dimon believes they can go as high as 7%.

At 7%, the net interest payments on $33 trillion would be in the vicinity of $2.1 trillion per year. That’s nearly three times bigger than the U.S. defense budget.

To cover these debt payments, the Fed will be forced to “print” money to buy its own government’s bonds.

When the Fed cranks up the money printer, it’s diluting the value of all the other dollars in the system. Just like when a company issues too many shares, it dilutes the value of the shares you own.

The result? The value of the dollars you own will shrink – a lot.

This level of debt is the endgame I’ve been warning you about… a “doom loop” that tips America over the edge from dollar superpower into dollar collapse.

Don’t Ignore This Prediction

Friends, out-of-control government money printing will lead to persistent inflation. But it’s a silent killer. And many people don’t know it’s happening.

It’s like a termite infestation in the foundation of your home. On the surface, everything looks fine. But crack open the foundation, and you see it rotted away.

That’s how inflation works. It eats away at your savings like termites eating wood.

And as I mentioned above, it’s about to get worse…

There’s an unprecedented event scheduled for this month that I believe will trigger the Final Collapse of the U.S. dollar.

It’s one of the reasons I moved millions of dollars of my own money into bitcoin to protect my purchasing power.

So you should absolutely buy some bitcoin. It’s a terrific asset. But the biggest gains during this Final Collapse won’t come from bitcoin.

To help you prepare for this event, I’m holding a special briefing called The Final Collapse on Wednesday at 8 p.m. ET.

During this event, I’ll tell you what this event is… and reveal the one asset that will skyrocket.

The last time the dollar had a similar crisis, my readers had a chance to make 27 times…. 56 times… and even 850 times their money – in less than two years.

And if you attend my special briefing on Wednesday, you’ll get the name of a recommendation absolutely free. (My past free picks have an average gain of more than 1,100%.)

Friends, those who ignored my bitcoin prediction in 2018 missed out on the chance to make peak gains of nearly 1,000%.

Those who ignored my warning about the bond market likely saw their bond portfolios go up in flames.

I don’t want that to happen to you.

Inflation is already destroying the retirement plans of millions of Americans. But if you follow my plan for this panic, you’ll put yourself in position to potentially build a six-figure retirement starting with just $1,000.

Click here to reserve your seat today.

Let the Game Come to You!

Big T