It’s the single most important financial institution in the world. And the biggest threat to your financial freedom.

And you’ve probably never heard of it.

Over $400 billion flows through it every day. By comparison, that’s more than the annual gross domestic product (GDP) of Iran, Denmark, and South Africa.

It connects over 11,000 banks and financial institutions in over 200 countries… including global central banks like the U.S. Federal Reserve.

The institution I’m talking about is the Society for Worldwide Interbank Financial Telecommunication (SWIFT). It’s the backbone of the global financial system.

This organization impacts everyone. If you’ve ever sent a wire, it was routed through the SWIFT network. And even if you haven’t directly done this, your bank uses the system to handle your payments on the backend.

Here’s why I’m telling you about SWIFT…

On August 31, this institution announced it successfully completed a pilot program to transact central bank digital currency (CBDC) transactions. (More on that in a moment.)

This is a sure sign that the current global financial establishment is preparing for the release of CBDCs.

A CBDC is a digital version of fiat money. It’s issued by a central bank using blockchain technology.

And according to the Atlantic Council, 130 countries are working on or adopting a CBDC – including the United States, Canada, and China. That’s 98% of the global economy.

Look, if you value your financial freedom, you need to know what’s going on with SWIFT. Because CBDCs will be a threat to your financial privacy.

If SWIFT’s plans come to fruition, there may be no place to hide your wealth.

Not only will U.S. bureaucrats be able to snoop into your most intimate bank transactions – as they’ve done ever since the 9/11 attacks 22 years ago – so will these unelected foreign officials.

Today, I’ll show you how to get some of your wealth out of their system – and potentially profit from it in the process.

Swiftly Going Digital

The first message sent through the SWIFT network was in 1977. And despite all the technological improvements in the past 46 years, the process remains nearly unchanged today.

This is why it still can cost over $100 to send a wire. And if you’re sending an international wire, it can take up to five days to clear.

To keep up with the modern era, SWIFT must adopt blockchain technology. That’s why it conducted a trial using Chainlink’s Cross-Chain Interoperability Protocol for real-time settlement, 24/7.

Meaning no more waiting days for your wire to arrive.

The trial showed that SWIFT can provide an easy way for countries and businesses to interact with each other in a CBDC-based financial system.

Tom Zschach, SWIFT’s chief innovation officer, hailed the successful trial, saying:

For tokenization to reach its potential, institutions will need to be able to seamlessly connect with the whole financial ecosystem. Our experiments have demonstrated clearly that existing secure and trusted Swift infrastructure can provide that central point of connectivity.

Longtime readers know we’ve been fans of blockchain since Daily editor Teeka Tiwari recommended bitcoin and Ethereum in 2016. They’re up 7,028% and 18,103%, respectively, since then.

We can send vast sums of value on crypto networks. And it takes a fraction of a second for the transaction to finalize and can cost just pennies to complete.

For instance, the Polygon Network can process up to 65,000 transactions per second, and each transaction costs less than $0.02 on average.

The people working at SWIFT know this too. And that’s why they’re looking at CBDCs – they don’t want to lose the control they have over the financial markets.

And as I’ll show you next, an international network that has centralized control over the global financial system is a threat to your financial privacy.

How SWIFT Could End Your Financial Privacy

SWIFT is the hub of the global financial network. If you want to transact internationally, you have to go through it.

It didn’t take long for governments to figure out how to use this to their advantage.

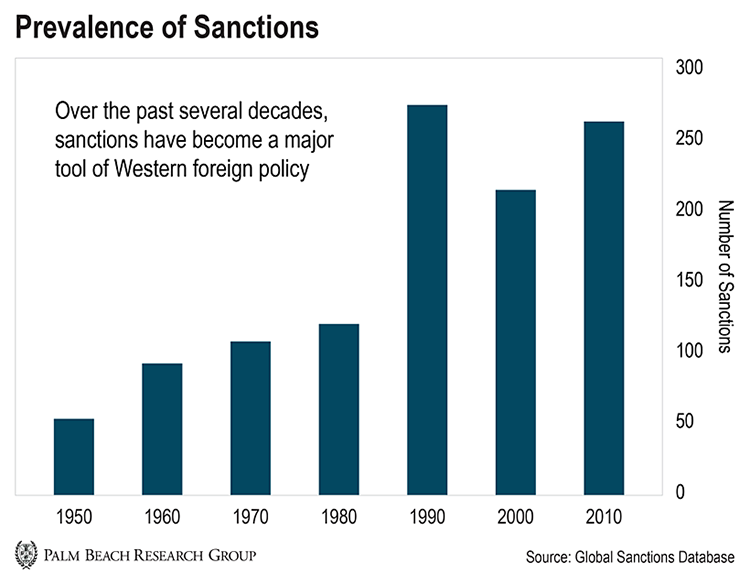

Over the past several decades, sanctions have become a major tool of Western foreign policy.

You can see in the following chart that the number of sanctions grew in the ‘70s… and then exploded in the ‘90s and beyond.

After the 9/11 attacks, SWIFT began sharing information with the U.S. government in an effort to crack down on terrorists.

In 2012, the U.S. passed sanctions on Iran. SWIFT disconnected Iranian financial institutions from the network. This was the first time it ever disconnected a bank.

When Iran got disconnected, it could no longer receive payment for its oil. Its oil exports plunged from 2.5 million barrels a day in 2011 to 1 million barrels per day in 2014.

In 2022, when Russia invaded Ukraine, the Western world demanded SWIFT cut off Russian banks from the network. It quickly complied. And now an estimated $1.1 trillion of Russian assets are frozen in bank accounts across the globe.

My point is this…

If SWIFT can cut off entire countries like Iran and Russia, what do you think a powerful international group of unelected bankers can do to you?

We’ve already seen governments cut off individuals because they’ve done something the government didn’t like.

In February 2022, dozens of truckers shut down several border crossings between the United States and Canada to protest COVID-19 vaccine requirements.

Even without a CBDC, the Canadian government was able to track down citizens who donated to the truckers.

Hundreds of supporters had their bank accounts frozen – all for sending truckers just a few (Canadian) bucks, in most cases less than $50.

And think about how heavy-handed the government could get with gun control.

It could lock your money from legal gun purchases by saying, “No, sorry, you’ve exceeded the federal limit on how many guns we think you should own.”

Or the government could “kill off” political rivals by calling someone un-American and cutting off all their funding.

Look, I don’t care what side of the political aisle you’re on.

Maybe you do support sanctions on Iran and Russia. Maybe you don’t… But either way, SWIFT is a huge potential threat to your financial freedom.

That’s why all Americans need to prepare now – before the U.S. government gets rid of physical cash and replaces it with a digital dollar.

The Best Ways to Prepare

By becoming a centralized hub for CBDCs, SWIFT will become what it calls “a single point of access to multiple networks.”

And governments will love having that single point of access. They will have only one place to look to see who is depositing money. And once the money is on the blockchain, it will be fully traceable.

And once money has gone into CBDCs, the government will put up roadblocks on getting your money out. So you’ll be stuck.

Just think about it… If SWIFT can punish major countries, what do you think it can do to you?

Financial privacy will be a thing of the past.

As Daily editor Teeka Tiwari has told his readers, there are two ways to opt out of the coming digital dollar regime. Those two ways are owning bitcoin and physical gold.

Bitcoin is a digital payments system. But its decentralized and deflationary nature makes it the opposite of a centralized digital currency.

If you self-custody your bitcoin, no one can confiscate it. You don’t need permission to transact with it. There’s no counter-party risk.

No one can inflate it away through excessive money printing. And the bitcoin code doesn’t allow any bail-ins… or bailouts. It’s a tool of financial freedom.

Gold is the analog backup to bitcoin.

Owning physical gold gives you an asset outside the currency system – as well as a long-term inflation hedge against the potential devaluation of a CBDC over time.

Even a small allocation to bitcoin and gold can help you opt some of your wealth out of the CBDC system – and give you some financial privacy.

If you want to learn more, Teeka recently put together a new playbook to show you how to protect yourself – and potentially profit – from this CBDC trend.

Remember, the backbone of an international CBDC framework has already been laid out. This means a future where CBDCs dominate global transactions is drawing nearer.

And the time to protect yourself from this overreach of governmental control is now.

Regards,

Nick Rokke

Analyst, Palm Beach Daily