Palm Beach Daily

The Best Thing You Can Do Right Now Is Nothing

In life, timing can be everything.

But it’s not always easy to identify the “right” time.

Was it the right time? That was the question analyst Greg Wilson and I were asking ourselves in December 2018…

Just five days before launching our Palm Beach Crypto Income service.

It’s not that we lacked confidence in crypto’s future… but at that moment, we were in the doldrums of the 2018 Crypto Winter.

The crypto markets were terrible… Interest in crypto was at an all-time low.

A month earlier, crypto had fallen 74% from its peak 11 months prior… but that wasn’t the end of it.

Over the next month, the crypto markets fell another 51%. And it wasn’t just crypto…

By December 2018, all three major stock market indices had fallen over 20%… straight into a bear market.

On top of that, there were fears of rising interest rates… the Federal Reserve tightening policy… tense trade talks with China… a potential government shutdown…

It was a scary time for investors.

And in the middle of it all, we wanted to launch Crypto Income.

It wasn’t easy.

I spent time in closed-door meetings with my publishers. I had to convince them crypto wasn’t dead.

Greg and I knew the market would eventually come back… it was an opportunity to take advantage of the lows.

Fast forward to today, and history is repeating again.

Crypto prices are under major selling pressure from investors who trade them like high-risk tech stocks…

Inflation is at its highest level since 1981… the Fed is planning more rate hikes to curb it… which means no more “easy money.”

And then of course, there’s COVID-19, the war in Ukraine, a broken global supply chain, and fear of a looming recession.

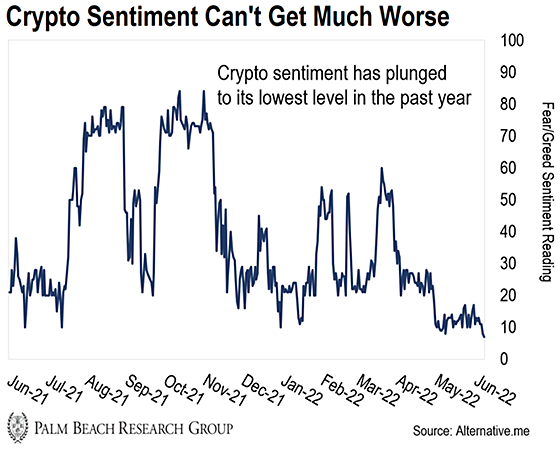

At the same time, crypto sentiment can’t get much worse…

Below is a chart of the Crypto Fear and Greed Index.

It measures crypto sentiment based on things like volatility, market momentum, surveys, social media, and Google trends.

A reading of 0 means extreme fear, while a reading of 100 represents extreme greed.

At the current level of 7, we’re seeing the highest levels of fear in crypto in the past 12 months.

Listen, I know that yet again, it seems like crypto is going to die.

We read reports from respected analysts saying bitcoin is going to drop to $8,000.

Maybe bitcoin does go to $8,000… Or maybe the bottom is already behind us.

Regardless, today’s prices make it one of the best times to invest in crypto… Just like it was in 2018 when we started Crypto Income.

And we have the track record to back that up… but winning big in crypto doesn’t happen overnight. Here’s what I mean…

-

One year after we launched our Crypto Income service, the original portfolio was down 8% with a yield of 6.0%.

Two years after launch, we were up 7% with a yield of 9.1%.

And three years after launch, we were up 652% with a yield of 34.6%.

That demonstrates the importance of investing when overall sentiment is low…

We know we’re investing in cutting-edge crypto projects… And that means we’ll see massive volatility as these projects grow.

But we also know that some of these projects won’t make it… so we improve our odds by uniformly investing small amounts over several projects.

Because just one winner can make up for all the projects that fail.

Stay the Course

Like I’ve written to you many times in the last few months…

The best thing you can do right now is hold high-quality assets… and that includes top-tier cryptos.

There’s a huge opportunity before us right now. But it’s an opportunity that will play out over years… not overnight.

So that means holding your high-quality positions and not panic-selling when things get rough.

The worst thing you can do is sell everything and expect to get in at a better price… Maybe you’ll get lucky and actually pull it off… But it almost never works out that way.

Another step you can take is to incrementally add to your bitcoin and Ethereum positions on big down days if it makes financial sense for you.

If you’re nervous or afraid, that’s okay… You don’t need to put any new cash to work. Just stay the course.

Because just like the 2018 Crypto Winter, the best projects will continue to build…

And eventually, bitcoin and the overall crypto market will recover and rally to new all-time highs… just like they rallied thousands of percent from their bottoms in 2016 and then again in 2020.

The key to making life-changing wealth in emerging assets such as crypto is to have small, uniform positions spread across the space. From there you ignore the daily price action… ignore the volatility and negative headlines… and stay the course.

The trend of crypto adoption and time will do the rest of the heavy lifting for you.

From the very beginning of our crypto journey, I have always told you that we will go through times together when the whole market is down 80%.

I’ve been consistent in this messaging to you because I’ve seen this adoption cycle play out before in the 90’s and 00’s. Over the last 30 years I’ve watched great companies like Apple, Amazon, Netflix, Oracle and to a lesser extent Microsoft weather horrific volatility.

Many people owned those names in the 90’s and 00’s but very few had the vision, the guts and correct position sizing to stay in those names long enough to see life-changing money.

Just like I told my money management clients after the dot com bust, tech was not dead. It was reinventing itself. It was making itself better. The same is true with crypto.

Crypto isn’t dead and the best projects aren’t going anywhere… Just like we have seen many times before, crypto will overcome this bear market and will once again rise to all-time new highs.

It won’t happen overnight… but it will happen. And a few years from now when bitcoin is trading at $500,000 a coin, you will be overjoyed at the life-changing fortune your courage, foresight, and tenacity built for you.

Let the Game Come to You!

Big T

P.S. In Monday’s Daily, Greg will give you four reasons why we’re still bullish on crypto…

Greg’s my top Crypto Income specialist and (like I mentioned above) has been with me since those dark days in 2018… so you don’t want to miss it.