Palm Beach Daily

The Ethereum Upgrade Will Ignite a Rally in Certain Cryptos

I’m one of the biggest advocates for Ethereum. So I hate to admit this…

The network is holding our money hostage.

Ethereum is paying out $1 billion in staking rewards each year… But no one can access this money.

That’s about to change, though. In April, all that capital will be set free. And when it is, we’ll see a massive opportunity.

If you don’t know me, my name is Houston Molnar. I’m Daily editor Teeka Tiwari’s chief analyst on his flagship crypto advisory, Palm Beach Confidential.

For years, I’ve watched Ethereum grow to become the most successful blockchain network for applications. Today, it’s second only to bitcoin in terms of market cap.

The biggest trends in blockchain – including decentralized finance (DeFi) and non-fungible tokens (NFTs) – first gained traction on Ethereum. And it remains home to most of the activity.

Today, 60% of assets held in DeFi applications live on Ethereum. And roughly 80% of NFT trades by volume take place on the network.

Ethereum also has 3x more developers working on it than its closest competitor. And it generates roughly 10x more revenue from transaction fees than its closest competitor.

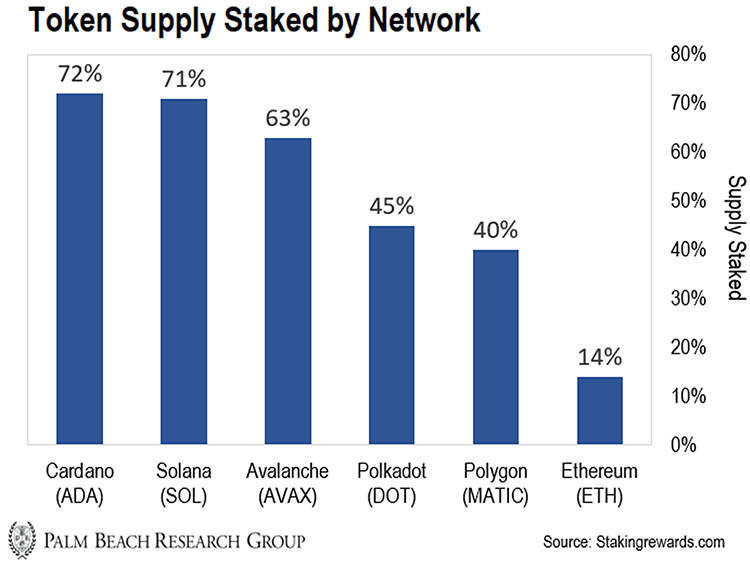

But while Ethereum is the second-largest blockchain network in the world, it’s the least-staked token compared to other major networks.

[When you stake crypto assets, you help secure the crypto’s underlying network. In return, you receive more crypto as a reward. It’s similar to earning a stock dividend or a bond yield.]

You can see that in the chart below…

Ethereum is the least-staked token because it has the highest risk.

But that’s about to change. And it will be incredibly bullish for Ethereum going into the second half of 2023.

Here’s the problem…

If you stake Ethereum to earn income today, you can’t withdraw your tokens.

That’s because the network hasn’t developed a feature to withdraw (or “unstake”) your tokens yet.

Meanwhile, you can stake and unstake the other tokens in the chart above whenever you want.

The inability to access capital indefinitely isn’t a risk that big institutions are willing to accept.

But that’s about to change…

This Upgrade Will Free Billions Worth of ETH

Ethereum will roll out its next network upgrade early – the Shanghai upgrade.

After the upgrade, ETH stakers can access their tokens as they please.

Now, many Ethereum investors are dreading this upgrade.

They believe droves of stakeholders will withdraw their tokens and sell them – putting downward pressure on prices.

And while we’ll likely see some selling pressure in the days following the upgrade… Over the long term, it’ll be incredibly bullish for Ethereum.

That’s because the Shanghai upgrade will lower the risks of staking Ethereum.

Here’s what I mean…

Capital flees from investments that hold it hostage. So the ability to withdraw staking funds whenever you want will be an overall positive… And opening the doors for capital to come and go will attract more investors.

While we’ll likely see some selling pressure shortly after the upgrade… Our research suggests the outflow of Ethereum will reverse quickly.

That’s because the staking rewards on Ethereum are very attractive.

Currently, Ethereum generates roughly $1 billion in staking rewards each year. And that’s during a bear market.

During the next bull market, we believe staking rewards could swell to $40 billion annually.

Unleashing Potentially $40 Billion in Income

Today, there’s roughly 16 million ETH staked… And they’re earning roughly 4–6%.

But during periods of high network activity – like we saw in the days surrounding the FTX exchange collapse – this yield climbed above 10%.

That’s because users are willing to tip network validators more to give them priority and execute their transactions faster.

When the bull market resumes, we can expect network activity to explode higher – like it did from 2020-2021.

That would translate to roughly 1.6 million in ETH paid to stakers annually. Or $2.8 billion in income if Ethereum remains at $1,750.

However, we believe Ethereum could soar to $25,000 during the next bull market.

That’s more than a 5x increase from its previous all-time high.

If so, we could see roughly $40 billion annually paid to Ethereum stakers.

If $40 billion in yearly income sounds crazy, just remember we’re currently sitting at $1 billion in the middle of a brutal bear market – when network activity is extremely low.

So $40 billion isn’t some pie-in-the-sky number. Especially when some of the biggest names on Wall Street and major global corporations are getting involved in this space.

And major crypto exchanges are already positioning themselves to benefit from this flood of income we’re about to see.

Many of the largest exchanges already provide ETH staking services to their users. And in doing so, they charge a fee.

Coinbase, Binance, and Kraken alone are staking billion worth of ETH for their users.

You see, everyone knows that this change is about to happen. And the biggest industry players are positioning themselves to benefit from it today.

Over the past three months, Ethereum developers have been hard at work running tests on this new code to ensure it’s ready next month. And when it rolls out, a flood of income will be unlocked for ETH token holders.

The Shanghai Upgrade Will Unleash a Buying Panic

If you’ve been following Daily editor Teeka Tiwari the past two weeks, you know he believes there’s a “buying panic” coming to crypto.

And the Shanghai upgrade is the trigger. It’s similar to the bitcoin halving.

The halving is when the new supply of bitcoin is cut in half. It’s hardwired into bitcoin’s programming code. So it’s 100% guaranteed to happen.

The halving happens every four years. And each halving reduces supply coming to the market. The first halving occurred in 2012, the second in 2016, and the third in 2020.

After the first halving in 2012, bitcoin’s price rallied 9,200%.

After the second halving in 2016, it soared 2,900%.

And since the third halving in 2020, it’s soared as high as 681%.

But Teeka believes the Shanghai upgrade will bring even larger gains than the past bitcoin halvings.

While bitcoin halvings happen every four years… The Shanghai upgrade will happen only once.

Of course, Ethereum will a major beneficiary of the upgrade. So you should own some.

We recommend you start with no more than $500 if you’re a small investor and no more than $1,000 if you’re a larger investor.

But the upgrade will also provide a slingshot effect for a small subsector of cryptos attached to Ethereum.

Unlike most cryptocurrencies, these tokens are programmed to pay you monthly income on top of capital gains. And they’re set to benefit from the surge of activity coming to Ethereum.

Earlier this week, Teeka held a special briefing called The Crypto Panic of 2023.

During the briefing, he explained how the ETH buying panic could potentially turn $1,000 into an entire nest egg… All while you get paid each month.

For a limited time, you can watch the replay right here.

Regards,

Houston Molnar

Analyst, Palm Beach Daily