Palm Beach Daily

The Fed Is Signaling Interest Rates Will Remain Higher for Longer

The Empire is striking back…

The Federal Reserve is the most powerful economic institution in the world. It’s responsible for managing the $21 trillion global supply of U.S. dollars.

No other central bank comes close to managing that much money…

The Federal Open Market Committee is a body within the Fed made up of 12 voting members. The chairman is Jerome Powell.

If Powell were Emperor Palpatine, the voting members would be his Sith Council.

These are the men and women who directly influence the interest rates you pay on everything from car loans to mortgages.

In fact, it was predicting the Fed would cut rates by a full point by the end of the year.

Generally, when interest rates fall, stock prices rise. In fact, in the last five instances when the Fed cut rates, the S&P 500 ended up gaining an average of 5% over the subsequent 12 months.

However, over the past week, at least five governors have publicly and aggressively pushed back against the market’s narrative.

I believe the market will begin to digest the real possibility that its expectations of a Fed pivot are way off. If that happens, we’ll likely see downward pressure on stocks.

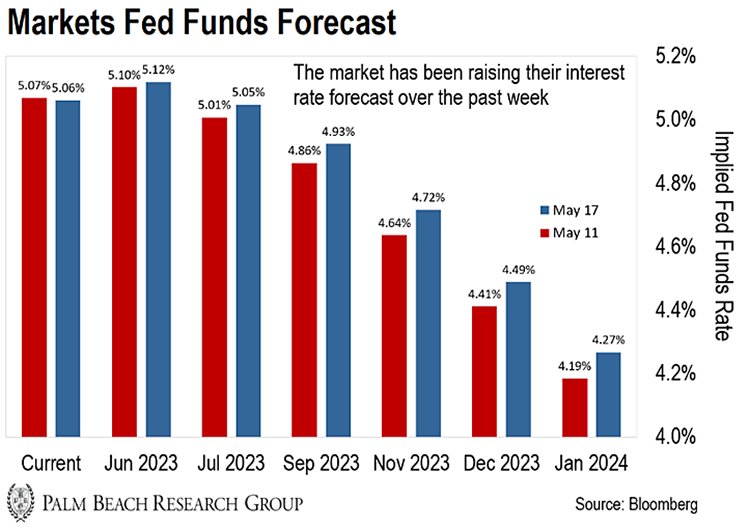

That’s what the chart below suggests…

The blue bars show the current projections for interest rates by year’s end. Most of them have ticked up since last week.

If this trend continues – and I believe it will, at least for the next few weeks – we’ll likely see prices dip further.

Today, I’ll show you what you can do to protect your money.

The Fed Strikes Back

Richmond Fed President Tom Barkin is a member of the board of governors.

In an interview on Monday, he said a hot job market and enduring inflation would make it difficult for the Fed to lower rates anytime soon:

I continue to believe that inflation will last longer than perhaps market measures of inflation would suggest. And so I’m still looking to ask myself the question whether we need to do more.

Barkin is looking at the same data that we highlighted last week.

The Core Consumer Price Index rose by 5.5% in April relative to a year ago. It has barely budged this year… even as the Fed has continued to hike interest rates.

This is due to the stickiness of categories known as core services. They include medical and personal care, insurance rates, and education.

Powell made a point to highlight this category as the most pressing sign that inflation remains a problem.

Another governor, Atlanta Fed President Raphael Bostic, also echoed this sentiment on Monday. He even suggested the Fed may not be done with raising rates:

If I had a bias between going up and going down as our next action, I would say we might have to go up. What we’ve seen is that inflation has been persistently high. Consumers have been really resilient in terms of their spending, and labor markets remain extremely tight. All of those suggest that there’s still going to be upward pressure on prices.

Bostic’s views were soon validated.

When stripping out volatile categories like cars sales and gasoline prices, consumer spending rose by 0.6% in April relative to the previous month. This roundly beat the 0.2% growth that economists had penciled in.

The April jobs report also exceeded economists’ forecasts. The U.S. added 253,000 jobs in April, 37% more than the forecast of 185,000.

The unemployment rate now sits at 3.5%, the lowest in 54 years.

That’s important because the Fed has never cut rates with U.S. unemployment this low.

Said Bostic: “My baseline case is we won’t really be thinking about cutting until well into 2024.”

Don’t Fight the Fed

The market has begun to pare back its expectation of rate cuts this year.

That has put downward pressure on the broad stock market.

We expect this walk back by investors on rate cut forecasts to continue pressuring stock prices lower.

That’s because the higher interest rates are for longer, the lower the fair value of stocks.

If you’re looking to take advantage of this current pullback, you’ll do better if you wait.

You’ll likely see better entry points over the coming weeks and months as the market absorbs the increasing possibility that higher interest rates are here for longer.

In the short term, we anticipate the S&P 500 to dip to its 200-day moving average of 3,974, which would be a 4% pullback. That’s represented a meaningful level of resistance over the past year.

When the S&P 500 dropped below that level in March 2023, it snapped back by 8%. So it offers a good risk-reward setup.

There’s an old Wall Street saying that goes, “Don’t fight the Fed.” The market is quickly relearning that lesson.

Regards,

Michael Gross

Analyst, Palm Beach Daily

P.S. Many investors will start to panic once stock prices fall… Meanwhile, Teeka recommends a tiny subsector of crypto that will benefit from a coming “buying panic.”

Unlike most cryptocurrencies, these tokens are programmed to pay you monthly income on top of capital gains. And they’re set to benefit from a surge of activity coming to one of crypto’s largest networks.

During his special event, he explained what this catalyst is and what types of tokens will benefit from it. For a limited time, you can stream it right here.