Palm Beach Daily

The Reshoring Trend Will Unleash $1.6 Trillion into the U.S. Economy

Imagine you’re the CEO of a U.S. company that manufactures dental products.

You’ve been at the helm for 20 years… And over your tenure, you’ve managed to expand your business.

You’ve secured new dental-practice customers taking advantage of your low prices while keeping costs minimal.

The secret to your success? Your visionary push to go global. You opened facilities overseas, negotiated new supply lines for raw materials, and outsourced administrative roles.

Things were going really well… until five years ago when the headaches began.

First, there was the trade war with China, making it more expensive to import drills from your factory there…

Then the world was hit by the COVID pandemic, and shipments slowed dramatically. What used to take a week became a months-long waiting game.

To make matters worse, Russia invaded Ukraine. That kicked off a war that shot up palladium prices… a critical component of your dental casting alloys.

So now you find yourself in an uncomfortable position.

Your profit margins are shrinking, reversing your past progress… Your customers are frustrated… And the pressure is on to get things back to normal.

You must reduce the vulnerability of your supply chain… but how do you do that?

If you’re like tens of thousands of American companies today, you bring your manufacturing back to the U.S., where you sell the majority of your products…

This trend is known as “reshoring.” But we call it “Made in America Again.” And it’ll unleash trillions of dollars into the U.S. economy.

Today, I’ll show you how to position yourself to profit from it…

“Made in America Again” Is a $1.6 Trillion Trend

You don’t have to look far to see that reshoring is picking up…

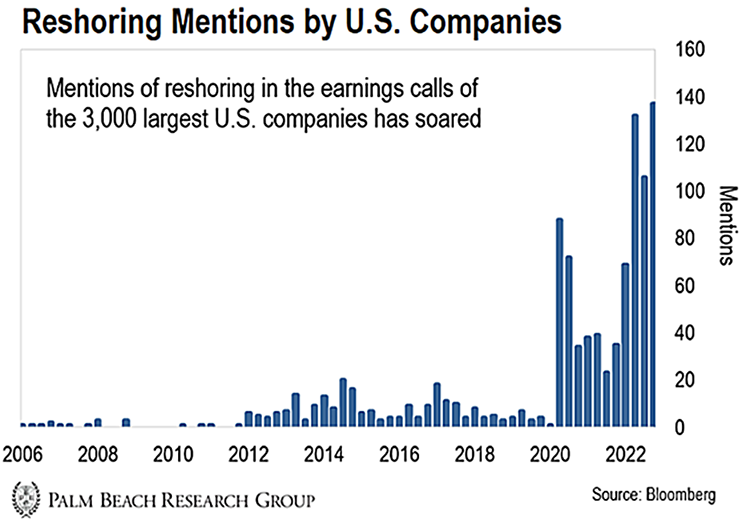

We can see the “Made in America Again” movement is growing in popularity in the earnings calls of the 3,000 largest U.S. companies…

A report from the consulting firm Deloitte further corroborates the trend…

It found that 62% of manufacturers with revenues between $500 million and $50 billion are reshoring their production facilities. That’s about 200 of the biggest U.S. industrial players.

And it’s not just American companies… Foreign companies are also making reshoring plans to produce goods closer to the U.S. end consumer.

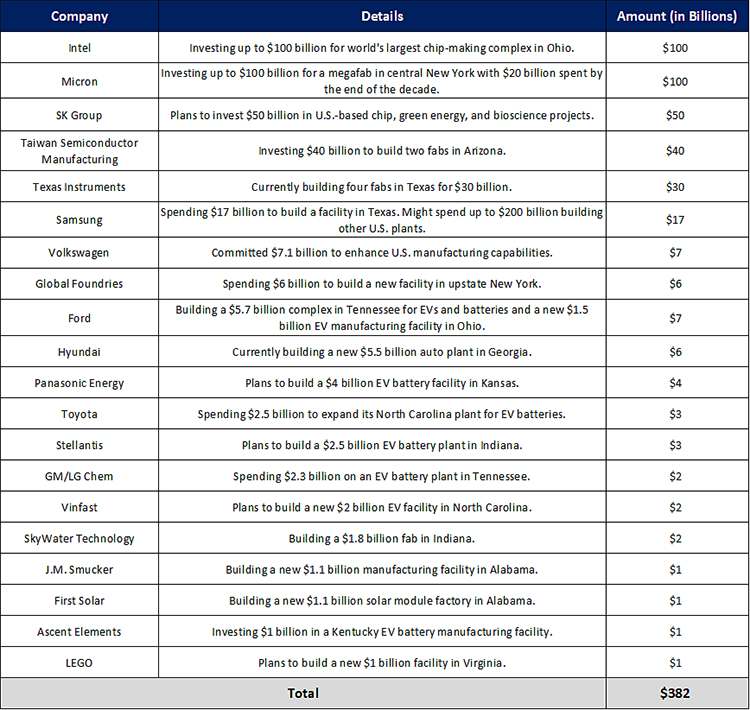

The following is a list of companies that have announced plans to spend over $1 billion on new U.S. manufacturing facilities…

Source: Company Press Releases

In total, these companies plan to spend over $382 billion on reshoring.

This is by no means an exhaustive list… There have been many announcements made by smaller companies as well.

And those announcements are just the beginning… much of the Made in America Again trend can be attributed to $1.6 trillion in federal spending recently signed into law:

-

The Investments and Infrastructure Act (IIJA): The biggest piece of the pie, with $1.2 trillion allocated over the next several years. The act aims to build out U.S. infrastructure, supporting a new generation of industrial facilities moving stateside.

-

CHIPS and Science Act: This $52.7 billion bill is hyper-focused on ensuring America reclaims its lead in semiconductor chip design. It includes funds for artificial intelligence, nanotechnology, and quantum computing investments.

-

Inflation Reduction Act (IRA): This bill provides $250 billion for clean energy technologies. That includes solar panel production, lithium-ion batteries, and electric vehicles. All of them will require new, state-of-the-art factories.

COMPETEs/United States Innovation and Competition Act (USICA): This $51.5 billion grab bag of government spending includes funds for increasing U.S. production and reducing supply chain vulnerabilities.

Again, that’s $1.6 trillion in federal spending to boost domestic manufacturing capabilities.

The infrastructure to support these facilities is being built… Plus, subsidies and tax credits are in place to incentivize companies to make the move.

While building these facilities will only take years, the benefits will play out in decades to come across many industries.

In the near term, I believe this trend will be incredibly bullish for a specific sector of the market…

How to Profit from “Made in America Again”

U.S. construction and engineering companies are seeing a surge in business due to the Made in America Again trend.

In fact, the industry’s five largest publicly traded companies averaged 18% growth in their backlog over the past year.

A “backlog” is the number of projects a company is contracted to complete but has yet to record as revenue… And the historical growth rate for the backlogs of these companies tends to hover around 7–8%.

It makes sense that this sector is the first to see the benefits of reshoring…

As companies plan to build domestic facilities, they need to hire engineering firms to guide what’s feasible. They need to rent the equipment to use on the projects. And they’ll need to employ contractors to lay the rebar, pour the concrete, and patch up the roofing.

Various companies are involved in putting together a manufacturing facility… and right now, the best way to get broad exposure to them is through an exchange-traded fund (ETF) like the Global X U.S. Infrastructure Development ETF (PAVE).

PAVE provides exposure primarily to engineering firms and construction equipment companies… However, the ETF also includes exposure to domestic steel and concrete manufacturers.

And as the $1.6 trillion in infrastructure spending makes its way into the U.S. economy, these companies will be some of the first beneficiaries… but in the end, it won’t just be investors that reap the rewards.

Because whether you’re a dental manufacturing CEO or a dental patient, “Made in America Again” will go a long way toward strengthening our supply chain and easing the financial burdens of trade wars, political conflicts, and rising inflation.

Regards,

Michael Gross

Analyst, Palm Beach Daily