For the first time ever, the telephone offered instant communication between people on different sides of the world.

Phones started out as novelty items shown just to kings and queens.

By 1914, at the start of World War I, there were 10 people for every working telephone in the U.S.

By the end of World War II in 1945, that number doubled to five people for every working phone.

And in 1998 the phone passed a key milestone: one for every man, woman, and child in the U.S.

It looks like a story of rapid adoption. But here’s the thing: The first practical phone was invented in 1876.

Yet by the turn of the century, nearly 25 years later, only 10% of the population had a phone.

So what changed from there so that every man, woman, and child would eventually have a phone?

Simply put, the technology improved. And as it did, adoption grew.

For example, 1889 saw the installation of the first coin-operated pay phone.

In 1896 came the invention of the first rotary dial phone.

Then in 1899 new loading coils were created that allowed for the use of thinner copper.

In 1915, Alexander Graham Bell made the first official transcontinental phone call. And 10 years later, the first transcontinental phone service launched.

And, of course, we’ve had advances since then such as cordless phones, fiber optics, and copper with gigabit speeds.

I bring this up because we’re at a similar place today in crypto as we were with the phone at the turn of the 19th century.

The groundwork has been laid. No longer is there just bitcoin. We also have smart contracts, stablecoins, DeFi, and DAOs.

And with those building blocks in place, crypto is ripe to take off in adoption and usage.

But like the phone, some work needs to be done to make this happen.

And the good news is, it’s already happening.

Ethereum’s Major Achievement Paves the Way

On April 12 Ethereum successfully completed the Shanghai upgrade.

The upgrade enables withdrawals of staked ETH for the first time since Ethereum launched the Beacon Chain in December 2020.

And it follows the Merge in September 2022, which transitioned Ethereum from proof-of-work to proof-of-stake.

Compared to the Merge, Shanghai was a minor technical upgrade. But the economic impact could be massive.

Going into the Shanghai upgrade, just over 18.1 million ETH was staked, about 15% of the circulating supply.

At today’s prices that’s worth over $34 billion.

So the worry was Shanghai would be a sell-off event. But we didn’t think that would happen for a few reasons:

-

Out of the 15% of staked ETH, 14% are deposits and 1% are rewards. There’s a low probability that ETH stakers will stop staking.

-

While there’s a high probability of users withdrawing ETH rewards, it equates to about $2 billion in value – which is just 25% of ETH’s daily trading volume.

-

Roughly half of ETH stakers are in loss. It’s more likely they’ll keep on staking than take a loss.

-

Over a third of staked ETH is in liquid staking solutions, where you can easily exchange your token if you want to exit.

-

Ethereum uses a dynamic exit-queue system and churn limits for withdrawing staked ETH. Without getting into the weeds, it prevents a mass exodus and keeps ETH staking withdrawals orderly. For example, if one-third of the entire validator set tried to exit in one day, it would take at least 97 days to complete.

We predicted that once the dust settles, it’s more likely the Shanghai upgrade will be a boon to Ethereum and its ecosystem.

The Verdict So Far

The sell-off some predicted never materialized. In fact, quite the opposite.

A record-breaking amount of ether deposits, 572,000 ETH, flowed into staking last week.

It’s the largest inflow in Ethereum’s staking history.

And it’s being driven by institutional staking services and the reinvestment of staking rewards.

Here’s why…

The first obvious reason is the major de-risking that has taken place.

Recall that Ethereum started the transition to proof-of-stake with the launch of the Beacon Chain in December 2020.

Then it completed the Merge in September 2022, a feat described as like changing a jet engine mid-flight.

And it finally completed the process with the recent Shanghai upgrade.

Accounting for the planning, this has been over three years in the making.

And those who staked early took on a lot of risk. If Ethereum wasn’t successful, there could have been over $30 billion worth of ETH stuck.

For early adopters, that’s an acceptable risk. But for more conservative investors and those who manage money for others… It was simply too risky.

But now that the risk is gone, we expect investment dollars to flow into Ethereum.

And that brings us to the second reason the Shanghai upgrade will be a boon to Ethereum.

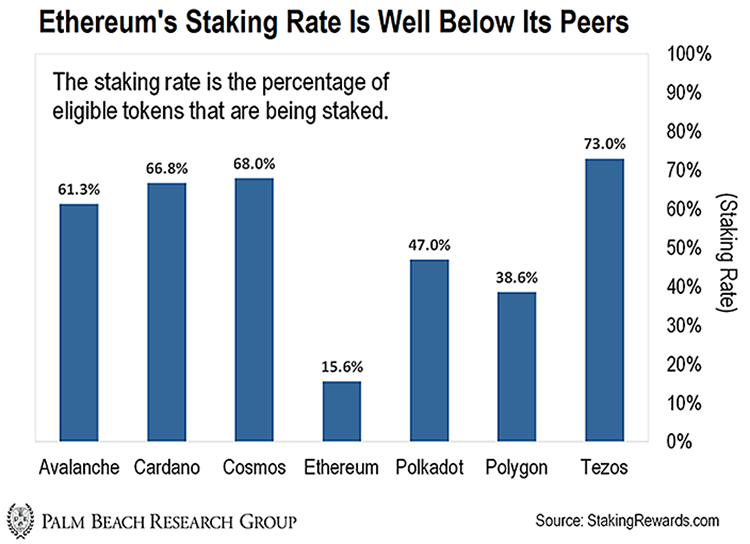

As it stands now, Ethereum’s staking rate is far below its peers.

Check out the chart below. It shows the staking rates of other Layer-1 protocols. And as you can see, it ranges from about 40% to 70%.

Let’s assume that post-Shanghai upgrade, the Ethereum staking rate grows to 50%.

That’s over 42 million ETH worth over $79 billion that needs to be purchased.

It Gets Better

With the transition to proof-of-stake out of the way, Ethereum can now focus on the next stage of the road map, the Surge. And the Surge is all about scaling.

So what’s going to help Ethereum scale?

Right now, what’s helping Ethereum scale the most are Layer-2 solutions, specifically rollups.

Like how the telephone progressed over time, it’s the cumulation of the many technical advances made in the last seven years.

Blockchain is getting its cordless phones, fiber optics, and copper with gigabit speeds.

And it’s already happening.

Today, Layer-2 protocols consume nearly 6% of gas fees. That’s up from less than 1% at the beginning of 2022. And over 20% of Ethereum transactions happen on Layer 2s, up from 1.8% a year ago.

It will only get better. Ethereum’s next upgrade, Cancun, is expected later this year.

It will reduce the cost of transacting on rollups by 10x to 100x.

And that will get us to sub-$0.05 fees, the level Ethereum co-founder Vitalik Buterin believes is “truly acceptable” for billions of users.

An Even Bigger Catalyst Is on the Horizon

Since we first recommended Ethereum in April 2016, it’s up 21,122%. And based on its growing network, we think there’s plenty more upside left.

If you’ve missed past big opportunities in crypto, you don’t want to make the same mistake again.

You see, Daily editor Teeka Tiwari believes a bank run is coming… And it will trigger a huge boom in cryptos. And it could begin as early as June 1.

Thanks to his connections in the crypto space, Teeka’s obtained critical intel that a new banking regime is set to take effect June 1. This date has been set by the financial authorities involved in this new catalyst.

And on Tuesday at 2 p.m. ET, he’ll reveal how this new banking regime will trigger a massive $19.4 trillion bank run.

When Teeka makes a prediction, you better pay attention…Because his timing has been impeccable.

He predicted the rise of bitcoin and Ethereum before anyone that I know.

Just from those two coins alone, anyone who invested $1,000 had a chance to walk away with as much as $147,317 from Bitcoin… and $534,000 from Ethereum.

So during Tuesday’s special briefing, Teeka will discuss three new coins he’s never recommended before.

These are the same type of coins that already gave his readers the chance to turn $1,000 into massive six- and seven-figure payouts… in as little as 11 months.

He’ll also give away his entire crisis-proof model portfolio with four assets that should perform well regardless of what happens with our economy or banking system.

So click here to automatically reserve your seat today.

Regards,

Greg Wilson

Analyst, Palm Beach Daily