When I bring a new idea to you, I always ask you to keep an open mind.

Because when people hear about new ideas outside their comfort zone, they often dismiss them. But once it’s explained to them properly… it blows their mind.

So with that in mind, let’s talk about trading options.

When most people hear about options on stocks, two words usually jump into their heads: “Risky” and “run.”

And it’s understandable…

Wall Street has spent an obscene amount of money promoting the riskiest way to use options.

It’s why people get blown up in options all the time.

So, why would Wall Street do that?

In a word: Money.

The primary strategy it promotes has customers losing 95% of the time. Options are a zero-sum game. That means for every loser, there’s an equal winner.

So, if Main Street is losing 95% of the time… who do you think is on the other side of that trade winning 95% of the time?

You don’t need to be a math whiz to figure it out.

A quick look at the profit sheets of the top options market-making firms tells you all you need to know. Last year, they raked in billions in trading fees.

And who put that money in Wall Street’s pocket?

You did… And it makes me sick.

That’s why I want to set the record straight and tell you what Wall Street won’t…

I want to show you the most proven, consistent, profitable options strategies I’ve ever encountered.

I have to warn you…

This strategy may take you out of your comfort zone… But once you see the power of it, you’ll never again trade options the way Wall Street wants you to.

The Strategy Wall Street Doesn’t Want You to Use

Since launching in 2012, my team has achieved a 97% win rate across 421 options trades. Since 2018 we’ve only had four losing trades.

How do we do it? I call it the “Instant Cash Payout” method.

It’s a type of options trade you can use to quickly and safely generate hundreds or even thousands of dollars without buying a single stock.

With this strategy, shareholders receive a form of “insurance” on their shares.

Using a unique aspect of the options market, we agree to buy those shares for a certain price and length of time in exchange for an upfront cash payout.

Now, we only make offers on the best companies in the market – blue chips like Walmart, Home Depot, and Coca-Cola. These are companies that dominate vital industries. They gush free cash flow and profits and look after shareholders.

But just simply earning outsized income from this strategy isn’t enough for us. We don’t just want to outperform the market, we want to crush it in the blink of an eye.

That’s why we use a portion of the income we earned from our Instant Cash Payouts to make bets on a sharp rise in the price of those same blue chips.

We call this boosted strategy No-Money-Down Alpha trades, as we can make those bets with money the market initially paid us.

My team has used this strategy to bank triple-digit gains in weeks on boring, blue-chip companies like eBay, Target, and Morgan Stanley.

I want to be clear here: These are not backtested gains. They’re the actual gains my subscribers had a chance to make.

Here’s the thing…

Our Instant Cash Payouts increase during what I call “Anomaly Windows.”

And when you operate inside an Anomaly Window, the gains you can see from ordinary, boring, safe blue-chip stocks become extraordinary.

Election Volatility: When Blue-Chip Stocks Act Like Cryptos

An Anomaly Window is when we believe an event or catalyst will massively increase activity in the market.

This increased activity spikes volatility. And when volatility increases, so do the premiums people pay for our Instant Cash Payouts.

Think of it as a form of market insurance. When fear or uncertainty (volatility) is high, people pay more for insurance.

Right now, the U.S. midterm elections are creating the kind of Anomaly Window that only comes around every few years… when the uncertainty of who will control Congress amps up volatility.

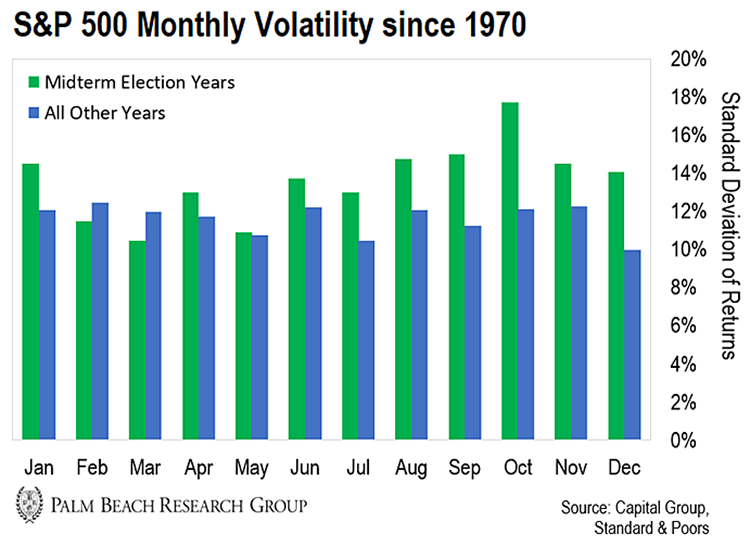

You can see this going all the way back to 1970…

Midterm election years have had a median standard deviation of returns of nearly 16%…

This means stocks can seesaw up to 16% in either direction. That’s compared with 13% in non-election years.

And most of that volatility occurs between September and November… just like it did during the 2020 U.S. presidential election.

Back then, the uncertainty surrounding the outcome created volatility in the market.

From October 23 to the day before election day on November 2, the S&P 500 fell 5% − a huge drop in such a short period.

And while most investors fretted, my subscribers and I took this as our signal to strike…

We sold options (market insurance) on some of our favorite blue chips across a handful of trade alerts. Then we turned around and made bets that our favorite blue chips would rise amidst this market turmoil. And the returns were crypto-like:

-

612% in 42 days on Jefferies Group

-

168% in 14 days on Morgan Stanley

-

128% in four months on eBay

-

92% in 28 days on Pfizer

That’s enough to turn a starting stake of $10,000 each into $140,000.

Let’s put that in perspective…

To amass that kind of windfall using the S&P 500’s average annual return of 10% would’ve taken 14 years or more. We did it in an average of 51 days.

So, if you’re a subscriber who took the leap into those options trades, congratulations. You’ve experienced this strategy – and its rewards – firsthand.

If you missed those trades, you’re about to get a second chance…

And this time, we have the opportunity to do even better… this year’s midterms are giving us a shot at collecting 30 Years of Wealth in the Next 30 Days.

The Next Anomaly Window Is Open

Over the next few weeks, worried investors will panic. They’ll look at the runup to the election and its results… and fear will lead them to sell into volatility.

It won’t matter who comes out on top… because this fear isn’t dependent on one political party or another taking control.

But there’s a smarter way to manage the inevitable short-term chaos ahead of us.

Instead of selling into chaos, you can take a handful of “boring” blue chips and watch them potentially return 30 years’ worth of S&P 500 gains in the next 30 days…

That’s why I hosted a live Anomaly Window event earlier this week.

Thousands of online viewers learned about the midterms Anomaly… and how to use it to capture three decades of market returns in 30 days.

I even gave the names of my top 3 stocks to play it. No strings attached.

This strategy has produced a Wall-Street busting 97% win rate for my subscribers since 2012.

Friends, I know options trades can feel intimidating or risky. But my Anomaly Window track record proves that it’s not as hard as you think.

You can make crypto-like gains on stocks with a fraction of the risk. You just need the right strategy and the expertise to back it up.

That’s why I’m here to guide you.

To get started, click here to watch a free replay of my live event… and do it as soon as possible.

Once the midterms are over, the volatility will gradually cool… The longer you wait to take advantage, the less chance you’ll have to see the returns I mentioned above.

Let the Game Come to You!

Big T