Palm Beach Daily

This Is the “Final Collapse” of the Dollar’s Buying Power

I remember years ago when my daughter – my middle child – got accepted to a private school. She worked hard to pass that entrance exam.

At the time, some things went askew in my business. And I couldn’t spare the capital needed to send her to a private school.

So I had to sit down with my then-preteen daughter and tell her the hard truth. I said, “Honey, I can’t afford these school fees.”

That conversation haunts me to this day.

Friends, you never get over a wound like that. I’m a far wealthier man now than I was back then, but I still carry the guilt of not being able to provide for my daughter.

I couldn’t give her the opportunity she needed at the time she needed it because I didn’t have the money. I don’t think I’ll ever get over it.

If you’re a parent, you know exactly what I’m talking about.

Here’s why I’m telling you about this painful moment in my life…

I know hard times. In the late 1990s, I made some bad investments. I lost everything I’d made and more. I went from wealthy to poor in less than a month.

Ultimately, I was compelled to file for personal bankruptcy.

I was mentally destroyed… My wife and I separated. I ended up renting a room from a friend in Queens and lived on a wafer-thin mattress for nearly a year and a half.

Because I know what hard times look like, I’m issuing this warning to you today…

There’s an unprecedented government event happening this month… And I believe it will lead to what I call the “Final Collapse” of the purchasing power of the dollars in your wallet, bank account, and brokerage accounts.

If you bury your head in the sand and just wait for the storm to pass… You could end up losing everything – just like I did.

Inflation Is Killing the American Dream

You already know the dollar’s buying power is crashing.

You know that the same number of dollars aren’t buying the same amount of goods and services. From houses to cars to food to gas, the dollars in your wallet don’t go as far as they used to.

Just a couple of years ago, if you went to the store with $100, you’d come home with four bags of groceries.

Today, you’ll be lucky if you can fill up one bag.

This is happening because the dollar is losing its purchasing power at a speed we haven’t seen since the 1970s.

According to a survey by Natixis Investment Managers, nearly half of Americans say inflation will kill their chances for a secure retirement. And the U.S. Census says we’re seeing the biggest poverty increase in over 50 years.

So you can see the dollar crash has already begun. And I’m afraid it’s about to get a lot worse.

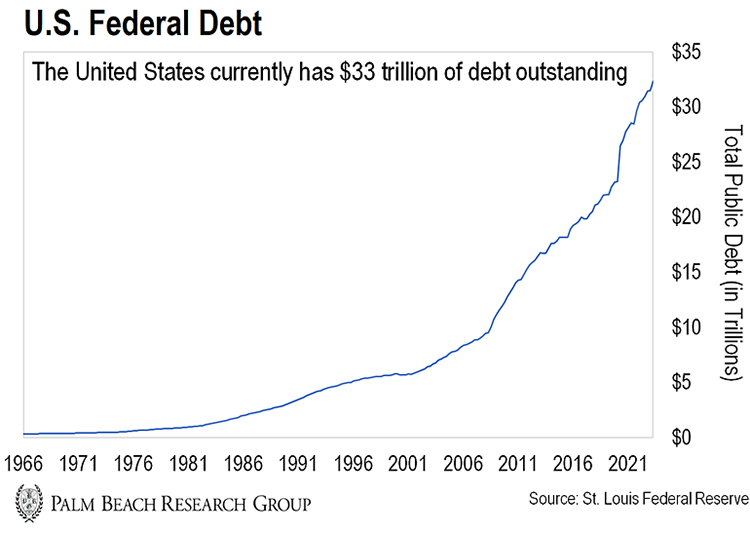

Just look at the chart below. It shows the amount of U.S. public debt.

For the first time ever, we now have more than $33 trillion in debt. That’s bigger than the size of our entire economy.

Now, from 2008–2021, this absurd amount of debt was manageable. That’s because interest rates were close to zero.

So the interest we paid in that mountain of debt wasn’t a big deal.

But since then, rates have skyrocketed to over 5%. That’s the highest level in the last two decades.

Here’s why I believe things will get worse…

The Coming Doom Loop

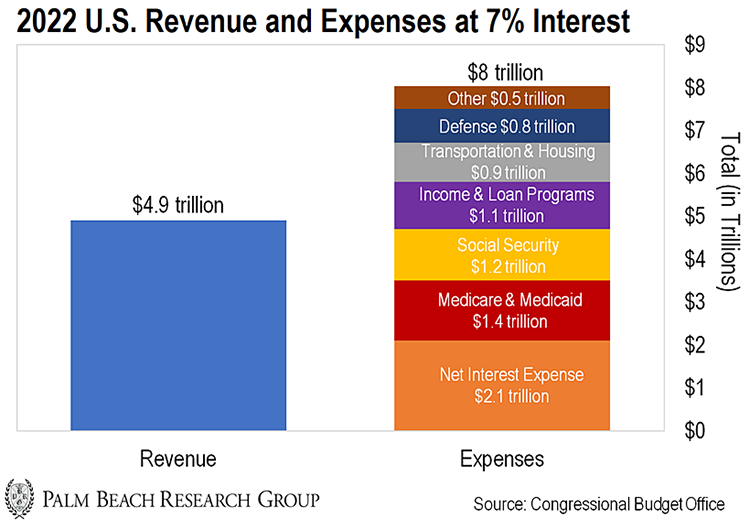

JPMorgan Chase CEO Jamie Dimon recently warned we could see rates as high as 7%.

At 7%, the interest payment on $33 trillion debt would be about $2.1 trillion – every single year.

That’s nearly three times bigger than the U.S. defense budget. And almost twice the amount the government spends on Social Security.

But there’s more…

In 2022, the U.S. government generated $4.9 trillion in tax revenues. If it had spent $2.1 trillion on interest payments, then its expenses would’ve totaled about $8 trillion.

That means the government would’ve spent nearly twice as much as it earned from taxes.

When I faced that type of debt as a young man, I had no choice but to tighten my belt.

I told my family we had to reduce spending. I canceled trips… cut up credit cards… and downsized to cheaper cars. And yes, I even had to make the painful decision to not send my daughter to a private school.

No one in my family wanted to talk to me.

So you can see why no politician will ever run on a platform to cut spending.

They’ll never promise to cut spending on popular programs like Social Security and Medicare… or raise taxes. That’s the only way to fix this mess they got us into.

Instead, they’ll continue to issue trillions of new dollars via government bonds to fund their spending. This will cause the value of the dollars you hold to plummet in value.

That means the cost of everything you need (like food) and want (like a dignified retirement) is going to rise dramatically.

What You Need to Do

Friends, when I declared bankruptcy, I lost my career, my family, my self-respect, and, for a brief moment, I even lost my will to live. It was a dark time in my life.

After my bankruptcy, I started rebuilding my net worth.

I worked like the devil was on my back. I took every available penny and invested it into safe, income-generating assets.

But this time, I believe things will be different.

This time, stocks won’t be able to keep pace… neither will gold or real estate. Nor just working extra hard.

That’s why on Wednesday, November 8, at 8 p.m. ET, I’m holding a special briefing called The Final Collapse.

During this event, I’ll tell you what will trigger the “Final Collapse” of the dollar’s buying power and reveal the one asset I believe will skyrocket because of it.

The last time the dollar had a similar crisis, my readers had a chance to make 27 times… 56 times… and even 850 times their money – in less than two years.

Friends, most people will sit on the sidelines and watch their purchasing power evaporate. But you don’t have to do that. You have a chance to protect yourself right now.

So come join me on Wednesday, November 8, at 8 p.m. ET and discover how to come through this storm far wealthier than what you were when you entered it.

Let the Game Come to You!

Big T