Palm Beach Daily

This Recession Indicator Shows the Opportunity of a Lifetime

We are witnessing something that has never happened before.

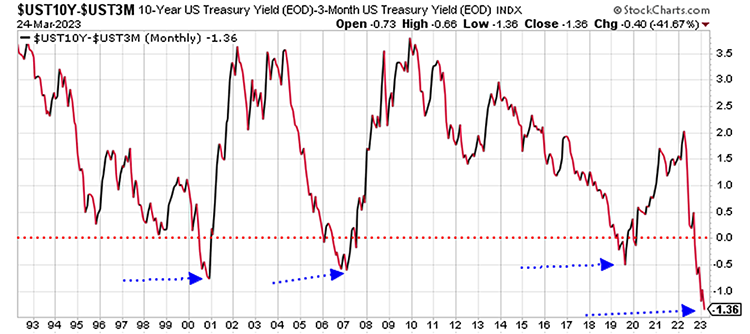

Look at this chart of the Treasury market yield curve…

This chart shows the difference in yield between the 10-year Treasury note and the three-month Treasury bill.

Most of the time, the yield curve is a positive number – the further you go out in time, the higher the yield.

A negative yield curve – where short-term bills offer a higher yield than long-term notes – often occurs prior to an economic recession.

Indeed, the first three blue arrows on the chart occurred just prior to significant declines in economic activity.

They also occurred just prior to significant declines in the stock market.

In fact, when the yield curve reached its most negative levels, stocks were closer to their bull market highs than they were to their bear market lows.

By the time the bear markets ended in December 2002 and March 2009 – and by the time the COVID-inspired sell-off ended in March 2020 – the yield curve was well off its lows and well into positive territory.

Today, the yield curve is at its most inverted level than at any other time in my lifetime.

That seems significant.

If the current situation plays out similar to previous occurrences, then the current bear market in stocks still has a way to go.

But that’s not a bad thing. As I mentioned to my subscribers back in early January, bear markets are good.

They correct the excesses that build up in the final stages of a bull market – when too much money chases stock prices higher and pushes valuations to unsustainable levels.

Bear markets are painful to those who are overly exposed, or perhaps even leveraged, to stocks.

But they create amazing opportunities for cash-rich investors who’ve been waiting patiently for a chance to put money to work in the stock market.

The problem is – as the old Wall Street adage reminds us – when it’s time to buy, you won’t want to.

It’s hard to buy stocks when they’re falling. It’s hard to buy when everyone else is selling, and when all the financial TV talking heads are preaching doom and gloom.

Most folks become paralyzed. They do nothing. And they let those amazing opportunities pass them by.

Don’t do that.

Take advantage of bear markets. Have the courage to buy stocks when they go on sale… when they’re trading at historically cheap valuations.

Don’t worry about trying to buy stocks at their absolute lows. Nobody does that consistently.

But if you can buy high-quality companies at valuations far below their historical averages, then you’ll profit over time.

Bear markets give you the chance to do that.

We’ll likely get that chance sometime in the next few weeks or months. And the time to prepare for it is right now.

The bottom of the bear market is coming.

It’s unlikely to look like any stock market bottom we’ve seen previously.

But for those folks who are ready for it, we’ll have a chance to make significant gains, over and over again, as it all unfolds.

I’ve put together my game plan, and I’m sharing it with folks in a special presentation on Wednesday, April 5, at 8 p.m. ET.

I’ll tell you exactly how I expect the next market bottom to play out, and the best sectors to profit from.

And I’ll even give away a free trade recommendation that has the potential to double your money in just a few days.

Don’t miss your chance to make life-changing gains when the market turns… Reserve your spot right here.

Best regards and good trading,

Jeff Clark

Editor, Market Minute