Palm Beach Daily

Three Key Reasons Bitcoin Could Go to $500,000

On May 1, the Federal Deposit Insurance Corporation (FDIC) seized First Republic and sold its $229 billion in assets to JPMorgan Chase.

It’s now the second-largest bank failure in U.S. history, taking that dubious title from Silicon Valley Bank, which failed in March.

And it’s the biggest bank collapse since September 2008, when Washington Mutual imploded during the Great Financial Crisis.

We’re not even halfway through the year, and already we’ve seen three of the four largest U.S. bank failures in history (First Republic, Silicon Valley, and Signature).

And the contagion continues to spread…

After the feds seized First Republic, regional banks PacWest and Western Alliance saw their shares slide as much as 75% and 64%, respectively.

(As of Friday, PacWest was in talks on a possible sale to another bank.)

Since the banking crisis began in March, we’ve seen a total of $538 billion in deposit outflows from regional banks, according to a report from Bank of America.

Some deposits went into the major national banks. Much more has gone to money market accounts or Treasury bonds, which offer higher annualized returns than bank deposits.

We believe a portion of it has flowed into crypto, too.

That helps explain bitcoin’s 50% price surge just a week following the collapse of Silicon Valley Bank and Signature Bank.

Its limited supply and self-custody solutions make it a compelling alternative to inflationary fiat currencies or trusting your capital in supposedly “safe” banks.

While the banking crisis has given bitcoin (and the entire crypto market) a short-term boost… There are two other catalysts I believe will carry it back to new all-time highs.

Plus, I’ll reveal details about an imminent banking change coming on June 1 that could open crypto to a $20 trillion market.

The Halving

The second catalyst for bitcoin is the next halving.

For those who need a refresher, the anonymous programmers behind bitcoin hardwired the halving into bitcoin’s code. It cuts the reward for mining bitcoin transactions on the network in half.

So, like clockwork, halvings are 100% guaranteed to happen.

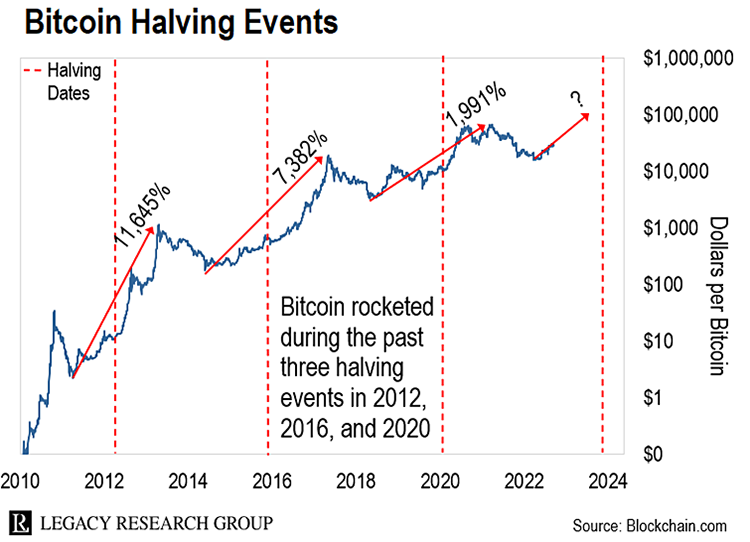

The first halving was in 2012… the second was in 2016… and the most recent was in 2020.

After every halving, we’ve seen bitcoin rise further…

After the first halving in November 2012, the block reward dropped from 50 bitcoins to 25. And the price went from about $12 to a peak of $1,100 by 2013.

The second halving occurred in July 2016. The block reward went from 25 to 12.5. That sent prices from $650 to a peak of nearly $20,000.

The third halving hit in May 2020. Prices went from $8,500 to over $65,000 at their peak.

While the halving is a bullish catalyst for bitcoin, the second year after a bitcoin halving is always a down year.

In 2012, bitcoin had its first halving. Prices soared in 2012 and 2013. But in 2014, bitcoin fell 61% for the year.

In 2016, bitcoin had its second halving. Prices rose in 2016 and 2017… and then dropped 73% in 2018.

In 2020, bitcoin had its third halving. Prices soared in 2020 and 2021… but in 2022, bitcoin lost 64%.

Each and every time, bitcoin bounced back…

As you can see above, the halving is a huge catalyst for bitcoin. If history is any indicator, the 2024 halving will push bitcoin to new highs and beyond.

There’s one final key trend in place that makes a continuation of the current rally likely…

The Bitcoin Hash Rate Is Growing

One measure of the strength of the bitcoin network is the hash rate. That shows the rising computational power needed to power the network.

Essentially, the hash rate shows the “network effect” of more individuals and institutions moving into bitcoin and other crypto assets.

Even amid the price collapse of BTC during the 2022 Crypto Winter, the network’s hash rate more than tripled from the 2021 lows to over 350 exahashes per second (EH/s).

This explosive growth of usage on the bitcoin network is a strong signal that we’re getting over the worst of last year’s sell-off.

According to Metcalfe’s Law, the bigger the network of users, the greater the value of the network.

Think about Amazon, for example. The network effect triggered enormous growth for the tech giant.

As more people signed up for Amazon’s Prime membership, its share price climbed from around $300 in 2014 to an all-time high of over $3,700 in 2021.

That’s a 12x gain in just a few years.

Bitcoin’s adoption is on the same trajectory as other groundbreaking technologies.

According to former Google engineer Michael Levin, bitcoin’s current adoption rate puts it on track for 1 billion bitcoin users by 2025… about half the time it took the internet to reach the same milestone.

That’s why over the coming years, we expect a single BTC will be worth $500,000.

A Different Type of Bank Run Is Coming to Crypto

As this banking crisis worsens, we believe more people will come into bitcoin…

But there’s an even bigger bank run on the horizon you’re not hearing about in the mainstream media. Daily editor Teeka Tiwari believes it could happen as early as June 1.

Earlier this year, the Hong Kong Securities and Futures Commission announced that, starting on June 1, crypto exchanges in the territory can service retail investors.

China’s financial system has about $19.47 trillion in assets under management.

The website CoinGeek said this new rule “will attract capital, particularly from China, by making Hong Kong a possible home for digital asset exchanges to operate legally.”

And according to The Wall Street Journal, more than 20 crypto and blockchain companies from mainland China, Europe, Canada, and Singapore have told the government they’re planning to establish a presence in Hong Kong… while over 80 firms have expressed interest in doing so, according to official figures.

Last week, Teeka hosted an urgent online strategy session to give you all the details about this new banking regime. You can stream the replay right here.

He also discusses details about three new coins we’ve never recommended before. And Teeka will even gave away his entire crisis-proof portfolio during the session for free.

It’s a portfolio that should do well no matter what happens with the banking crisis. All you have to do is attend to get it. No strings attached.

Just click here to stream the replay.

Regards,

Andrew Packer

Analyst, Palm Beach Daily