Palm Beach Daily

Web3 Is Facing a Political “Techlash” – and Finally Fighting Back

Since the beginning of the year, there’s been a lot of regulatory pushback against bitcoin and crypto.

-

The U.S. Securities and Exchange Commission (SEC) has sued major exchanges like Coinbase and Kraken.

-

The Commodity Futures Trading Commission has brought charges against crypto behemoth Binance for allegedly knowingly offering unregistered crypto derivatives products in the U.S.

-

In Congress, Democratic Sen. Elizabeth Warren of Massachusetts and her “anti-crypto army” are working on legislation to kill the industry…

-

And the Biden administration is proposing an insane 30% tax on bitcoin miners.

This type of “techlash” isn’t new. It happens every time a disruptive technology threatens entrenched interests.

We saw it in the early 1800s when Luddites smashed mechanized looms they thought threatened their jobs.

We saw it at the turn of the 20th century against the automobile, when some cities passed “red flag” laws that required a person to walk in front of “horseless carriages” waving a red flag.

Today, we see it as politicians call for greater regulation of social media companies like Alphabet, Meta, and TikTok.

Eventually, those industries created interest groups that fought on their behalf and paved the way for mass adoption. We’re seeing the same happen today in Web3.

Taking the Political Fight to Washington

Late last month, I attended the Consensus 2023 conference in Austin, Texas.

Consensus is one of the world’s largest, longest-running, and most influential gatherings of the crypto and Web3 communities. There’s always some major announcement coming out of the event.

One of the biggest came from Franklin Templeton. It’s a 75-year-old global investment firm with $1.4 trillion in assets under management.

At Consensus, it announced it will launch the first U.S.-registered mutual fund to use the blockchain to process transactions.

Other major announcements came from global investment firm KKR and global ETF issuer WisdomTree.

Both are traditional Wall Street titans with billions of dollars’ worth of assets under management. And both are launching new products on the blockchain.

The key takeaway here is that even after a year of terrible news in the cryptosphere, institutional money is starting to come back in.

But what really got me excited is what’s happening on the political side…

One of the biggest advocates of building a Web3 lobbying effort is Ryan Selkis, the CEO of popular crypto data and research company Messari.

Selkis is a founder of the Blockchain Association (BA). The group includes big-name members such as Ripple, Genesis, Dapper, Digital Currency Group, Kraken, and Circle.

Late last year, the association announced it will launch a political action committee (PAC). By its nature, crypto is non-partisan. So the PAC will endorse political candidates across the spectrum who support crypto.

In the past, Selkis said he’s seeking to raise $100 million for the PAC. At Consensus, he reaffirmed his goal to build a political war chest.

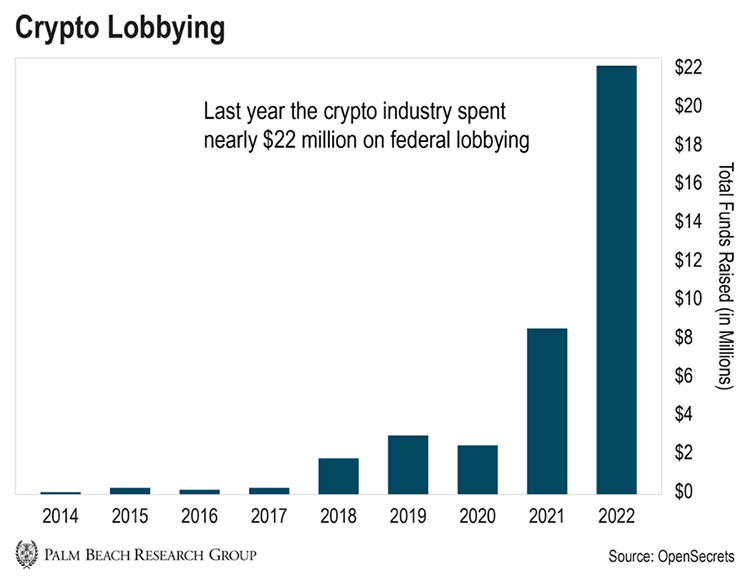

To put that in context, last year the crypto industry spent nearly $22 million on federal lobbying, according to the website OpenSecrets.

The crypto industry’s current outlay is less than 10% of the $372 million spent last year by the pharmaceutical lobby — the single biggest lobbyist.

But that $22 million is nearly half of what commercial banks spent on lobbying, and more than twice as much as what both the hotel and restaurant lobbies spent.

If Selkis reaches his goal of $100 million, that would make Web3 one of the most well-financed lobbying efforts in Washington.

This isn’t Selkis’ first foray into politics. In 2021, he announced he’ll challenge Democratic Sen. Chris Murphy of Connecticut for his U.S. Senate seat in 2024.

Another Web3 entrepreneur who has hinted he may throw his hat into the political arena is Mike Dudas, the former CEO and founder of crypto publication The Block.

To be clear, if they run, both Selkis and Dudas would be long shots to win political office.

Instead, their campaigns are issue-driven. They want to raise the profile of the Web3 community on Capitol Hill.

And the movement is starting to bear fruit…

Also at Consensus, House Financial Services Committee Chairman Patrick McHenry (R-N.C.) said his committee and the House Agriculture Committee plan to introduce comprehensive legislation on blockchain soon.

Another politician who attended Consensus was Republican Sen. Cynthia Lummis of Wyoming.

Dubbed the “Crypto Queen” for her backing of the asset class, Lummis introduced the bipartisan Responsible Financial Innovation Act, aimed at creating a regulatory framework for the industry, last year with Sen. Kirsten Gillibrand (D-N.Y.).

The Web3 community is also increasing its influence with politicians.

Nearly two-thirds of the crypto industry’s 278 lobbyists are Washington insiders, including former members of Congress… and they include both Democrats and Republicans.

While the Web3 community is raising funds and enlisting former politicians to take on D.C., it’s also creating a new grassroots movement.

One that can become a single-issue voting bloc.

A New Crypto Grassroots Movement

Today, 300 million people have exposure to crypto across the globe. But according to a former Goldman Sachs fund manager, that number will be 5 billion people by 2030 – over half the entire global population.

Many of these users will come from the millennial (ages 27-42) and Gen Z (ages 11-26) demographics.

They’ll account for two-thirds of the U.S. workforce by 2030, according to the Department of Labor. And they increasingly see crypto as a voting issue.

Here’s why that’s so important politically…

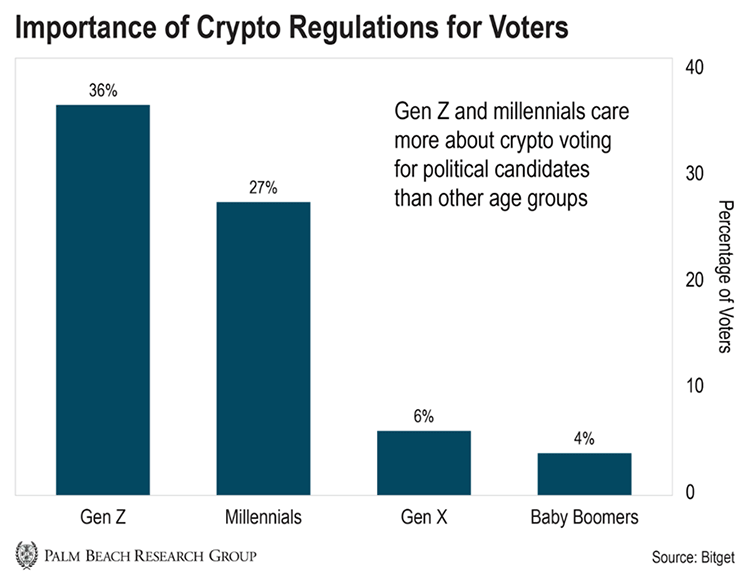

Crypto exchange Bitget recently surveyed nearly 255,000 adults from 26 countries. And it found that Gen Z is the age group most likely to care about crypto regulations while voting for political candidates.

According to the survey, 36% of Gen Z respondents said they saw promises regarding crypto as an important factor in elections. Gen Z was followed closely by millennials at 27%.

Another survey conducted by Global Strategy Group and Fabrizio, Lee & Associates, found that 44% of voters across the U.S. could be described as “crypto voters” – those who own or are considering owning digital assets.

A subset of 17% of those voters already own crypto, which is “an extremely competitive group of voters that both Democrats and Republicans have been pitching in recent elections,” the poll conductors said in a statement.

This younger cohort of crypto users will coalesce into a grassroots movement. Politicians won’t be able to disenfranchise a group that large and expect to maintain political power.

What You Can Do

Look, I understand if you’re concerned about the “techlash” against crypto and Web3.

But we’ve seen this before with other disruptive technologies… So it’s no surprise that Web3 is undergoing its own techlash.

I’m not saying the Web3 industry doesn’t need regulations. After the FTX and Celsius debacles, there’s a definite need for rules to protect consumers from fraud.

I want regulators to clamp down on bad actors like FTX and others who scam the public. What I don’t want to see are regulations that kill off this asset class or chase it offshore.

Men and women like Ryan Selkis, Mike Dudas, and Cynthia Lummis are patriots who want to see blockchain survive and thrive in the United States.

They want America to be at the forefront of this technological revolution – just like Silicon Valley was at the forefront of the Web2 movement.

I believe their lobbying efforts and the grassroots movement they’re building will eventually turn the tide against the anti-crypto sentiment coming out of Washington.

These guys would rather code and develop great networks than spend money on lobbying. But they realize they’re in an existential fight to keep Web3 surviving and thriving in the United States.

And what can you do? It’s pretty simple: Get out and vote!

Make sure that Congress sees the energy behind this crypto grassroots movement. We’ve always had the power to affect change. And the time is now.

Regards,

Graham Friedman

Analyst, Palm Beach Daily

P.S. While the United States is creating a hostile regulatory environment for crypto, Daily editor Teeka Tiwari recently obtained critical intel that a new banking regime is set to take effect June 1.

According to Teeka, this banking regime could open the doors to $20 trillion investable capital into the space.