Historically, when new asset classes evolve, institutions come first, and retail investors come second.

Think commodities, emerging markets, real estate, etc. Generally, institutions get in early and make massive gains… while Main Street gets the leftovers.

But when crypto came along, it turned that order upside down. For once, Main Street came first, and Wall Street came second…

Today, it’s estimated that about 80 million Americans own some form of crypto. And crypto exchange Coinbase has more users than traditional brokerages Charles Schwab, E-Trade, Interactive Brokers, and TD Ameritrade combined.

At the same time, Fidelity, Guggenheim, and JPMorgan have recently changed their tune on bitcoin. They either offer bitcoin services or plan to invest in it…

Top hedge fund managers like Bill Miller, Paul Tudor Jones, and Stanley Druckenmiller have added bitcoin to their portfolios…

Billionaires like Mark Cuban, Elon Musk, and Jack Dorsey are flocking to it. Wall Street heavy hitters like Goldman Sachs are expanding their crypto trading desks…

And now, a new layer of Wall Street is pouring billions into the crypto market: publicly traded companies. And as institutional demand for bitcoin continues to rise, the price of bitcoin and other cryptos will follow.

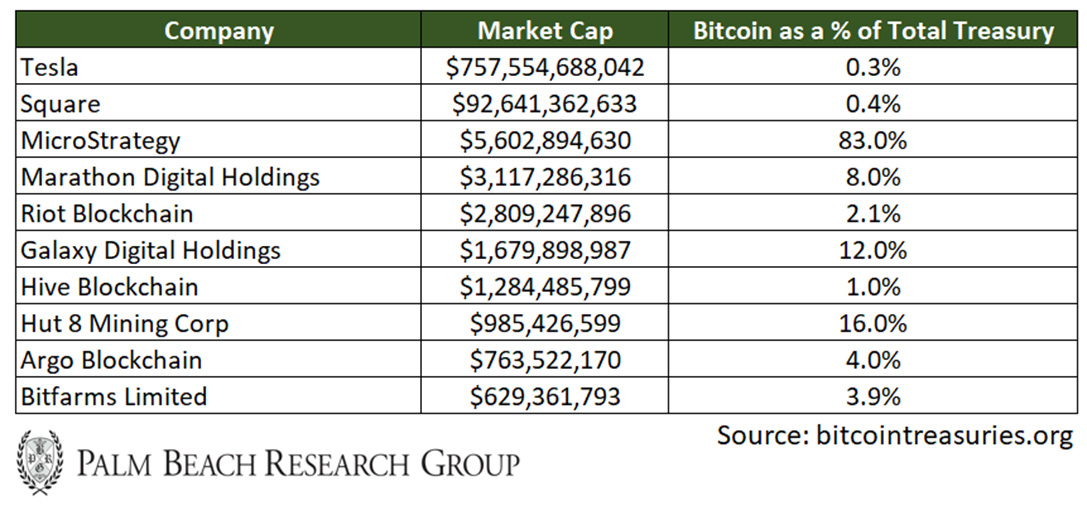

Here’s a list of the top 10 public companies that have added bitcoin to their balance sheets since 2019:

Why are these companies adding bitcoin to their balance sheets like never before?

As Daily editor and world-renowned crypto expert Teeka Tiwari says, it all comes down to the dollar…

A “Superstar” Currency

Since the outbreak of the pandemic in March 2020, it’s estimated the Federal Reserve and Congress have spent a combined $9 trillion to rescue the U.S. economy.

That number is likely to grow as the government turns to spending money on infrastructure and job creation.

And as more and more currency units are added, the rest of the dollars we hold will be worth less and less.

So to protect the value of their money, institutions have been turning to bitcoin.

In the last year, names like Tesla, Square, and MicroStrategy have invested more than $3 billion combined into bitcoin alone…

Morgan Stanley is now giving some clients access to bitcoin funds… Goldman Sachs recently filed with the SEC for the creation of an exchange-traded fund with exposure to bitcoin… and as longtime readers know, these firms are only the beginning.

For years, Teeka has been predicting mass institutional adoption of crypto.

Here’s Teeka in August 2020:

I believe crypto adoption will be as widespread as internet adoption – maybe even more so. For instance, the World Economic Forum estimates crypto’s underlying blockchain technology will store 10% of the world’s GDP. That’s about $8.6 trillion – by 2027. Right now, the entire crypto market cap is just $350 billion. When hundreds of millions of people get easy access to crypto, you’ll see the entire space just explode in value – just like internet stocks in 1995.

The bottom line: The institutional world can no longer ignore cryptos. And this is just the tip of the iceberg.

The Next Trillion-Dollar Coin

Despite the significance of these publicly traded companies adding bitcoin to their balance sheets and offering it to their clients, we don’t suggest you buy them for their bitcoin exposure.

And for everyday investors, Teeka says bitcoin is no longer enough to fund your future retirement…

When he first recommended bitcoin in 2016, its market cap was just $6 billion. But this year, bitcoin became the first crypto to top $1 trillion.

During this time, Teeka’s subscribers had the chance to book gains as high as 16,327% – enough to turn $1,000 into $164,270.

Now, at about $53,000 each, bitcoin can still 10x or 20x your money from here… And according to Teeka, we’ll see that happen.

As much as I love bitcoin… As much as it’s been a gift to me and the readers who’ve stuck with me since 2016… I’ve got bad news. The type of wealth those readers have had the chance to accumulate in the past… that’s over. Unless you’ve got hundreds of thousands of dollars to invest… you’re not going to grow rich investing in bitcoin now… It’s too late.

Don’t get me wrong, the party isn’t over. We could easily see bitcoin rise 10–20x from here… I also stand by my earlier predictions that the cryptocurrency market could go to $2 trillion. And I don’t think $20 trillion is out of the question… But if you want the opportunity to see incredible gains… you’re going to have to go beyond bitcoin.

The good news is you’re about to get a second chance… Because behind the scenes, the smart money is now going all-in on another coin.

This coin will take the entire crypto ecosystem to the next level… and it’ll pull up smaller coins 25x and even 50x higher along the way…

Remember, bitcoin gave rise to hundreds of other cryptos called altcoins. And some of the altcoins Teeka has recommended have gone up as high as 15,806%, 22,525%, and 156,753%.

But now Teeka says we’re on the verge of another monster altcoin run. It’s all thanks to Crypto’s Next Trillion-Dollar Coin.

And on Wednesday, March 31, at 8 p.m. ET, Teeka will reveal – for free – the name of Crypto’s Next Trillion-Dollar Coin.

You may have missed the boat on bitcoin’s biggest profits… But there’s still a chance to set yourself up for life-changing gains with Crypto’s Next Trillion-Dollar Coin.

Click here to reserve your seat today.

Regards,

|

Chaka Ferguson

Editorial Director, Palm Beach Daily

P.S. If you sign up today, you’ll also receive access to three training sessions to help you prepare you for the biggest crypto story no one is talking about.