Palm Beach Daily

Midterm Elections Generally Ramp Up Market Volatility

If you’re tired of reading about the midterm elections, I can’t blame you…

According to the ad tracker AdImpact, both parties have spent a record $6.4 billion combined on political ads so far this election cycle.

To put that in context, that’s more than the GDP of small countries like Aruba, Belize, and Montenegro.

You can’t turn on the television without watching candidates for local dog catcher to U.S. Senate tear each other down.

So it’s no surprise that 90% of Americans say the spread of misinformation is increasing extreme political views. It’s something both Democrats and Republicans agree on.

Look, we get it here at Palm Beach Research Group.

That’s why we don’t venture into divisive world politics. We’d rather focus on what unites us: Making money.

But often, what goes on in politics creates huge anomalies in the markets. And if you position yourself properly, you can recapture decades’ worth of average market gains in days – regardless of which side of the political aisle you stand.

When Elections Create Anomaly Windows

As we’ve written here in the Daily over the past few weeks, “Anomaly Windows” are brief periods in the market where the rules of investing turn on their head…

Boring blue-chip stocks that might return 10% a year on average briefly return hundreds of percent in a month or less… and investors get a shot at capturing years of wealth in a fraction of the time.

It’s a strategy PBRG subscribers have successfully used again and again… because when you know what to look for, it’s easier to prepare for the almost inevitable results.

You see, behind every Anomaly Window is an uptick in uncertainty. This can be volatility from global events, fears over a certain sector’s performance, or a shift in political winds.

And when the markets get volatile, most investors run… But the Anomaly Window strategy embraces these upticks in volatility to strike for upfront cash and outsized gains.

That’s exactly what we have unfolding in front of us today.

Every four years, the U.S. holds its midterm elections. And while not as high profile as the presidential election, the midterm elections have huge consequences for the nation.

This year, 35 Senate and all 435 House of Representative seats are up for reelection in an event that could potentially shift the balance of power in the U.S. Congress.

On top of that uncertainty, inflation is at 40-year highs… we’re seeing the largest war in Europe since WW2… and stocks are in a steep bear market.

So it makes sense if midterm elections have become an afterthought to you.

But make no mistake, this event has massive implications for the stock market… Enough so that it’s giving us a chance to generate years’ worth of gains in a matter of weeks.

We’ve Been Here Before

History shows that volatility tends to skyrocket in the weeks leading up to the midterm elections.

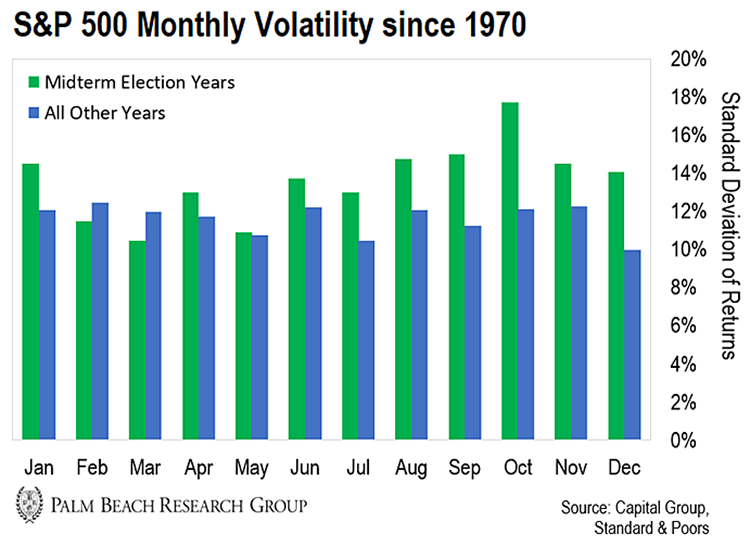

You can see that in the chart below. Since 1970, midterm election years have had a median standard deviation of returns of nearly 16%. That’s compared with 13% in non-election years.

Most of that volatility comes in September-November, as attention to the election builds up and falls.

This should come as no surprise if you follow the elections… Candidates are quick to use incendiary language about the country, their opponents, and the problems facing the U.S.

They tend to speak of grand policy aspirations that would hugely affect certain industries or companies (though they typically don’t come to pass).

But even with all that volatility, the period after midterm elections tends to be positive for stocks.

As the intensity and negativity of campaigning fade away, stocks usually form a relief rally…

Since 1931, the S&P 500 has averaged a nearly -1% loss through the end of September in midterm election years. Then it rallies hard through November and December, finishing the year with an average 5% gain.

That’s compared with an average gain of 7% through the end of September for non-midterm election years and an average full-year gain of about 9%… the perfect environment for our strategies to earn outsized gains.

So, how do we take advantage of this volatility?

We use something called the “Instant Cash Payout” strategy.

It’s a type of options trade you can use to quickly and safely generate hundreds or even thousands of dollars without buying a single stock.

With this strategy, shareholders receive a form of “insurance” on their shares…

Then we use a unique aspect of the options market and agree to buy those shares for a certain price and length of time in exchange for an upfront cash payout.

The elevated volatility increases the premium we can earn from this strategy… And the opportunity for higher income allows us to earn higher returns and put less of our capital at risk.

The increased average market performance closing out a mid-term election year also puts us in a good position to earn outsized gains from our strategy’s second step.

In fact, implementing our strategy in past midterm election years could have made you gains as high as 1,050%, 1,174%, and 1,700% on boring blue-chips like Coca-Cola, Whirlpool, and Caterpillar, respectively… all in 30 days or less.

Now, this strategy is a bit more work than just buying stocks outright… and it may take you out of your comfort zone.

Don’t let it.

As Daily editor Teeka Tiwari says, in terms of risk versus reward, our Anomaly Window strategy is one of the safest ways we know to earn outsized income when volatility is high…

Outsized Returns in 30 Days

Now that you understand our unique situation, you’re ready to start pouncing… And our Anomaly Window strategy is designed to help you capture 30 years’ worth of stock market gains in 30 days… Using just blue-chip companies.

And while past performance is no guarantee of future success, our record with this strategy gives us confidence that we can smash the market and deliver stunning returns…

For example, our subscribers have made gains as high as 422% and booked average gains of 84.3% across 36 trades using this strategy.

Today, you can join them. Here’s how…

This past Wednesday, Teeka hosted a live event where he revealed details on trading the coming Anomaly Window.

He even gave away his top 3 stocks to play this strategy… absolutely free.

For a limited time, you can watch a free replay of this event right here. And you’ll even get the name of those three stocks…

But remember, as we get closer to the midterms, there will be less time to prepare… and less opportunity to capture 30 years of returns in 30 days.

We can’t predict which party will win the coming midterms, but we can almost guarantee how the market will respond.

How you prepare for that outcome is up to you… And whether you’re a Democrat or Republican, I believe that’s something we can all agree on.

So click here to watch Teeka’s presentation and get started today.

Regards,

Michael Gross

Analyst, Palm Beach Daily