In 2017 he famously said, “Bitcoin is an index for money laundering – that’s all it is.”

Today, he says it’s an “international asset… [that will] transcend any one currency in currency valuation.”

If these two statements make your head spin, I can’t blame you.

But in a moment, it’ll become clear why this epic flip-flop could signal the start of the greatest bull market in history.

The about-face comes from Larry Fink.

If you’re not familiar with him, he’s the founder and CEO of BlackRock, the largest money-management firm in the world.

BlackRock boasts nearly $10 trillion in assets under management (AUM). And it’s the largest provider of exchange-traded funds (ETFs), with a 33% market share.

Aladdin, its portfolio risk management software, oversees over $21 trillion in assets.

Clients include Vanguard and State Street, the Japanese government, and top public companies such as Microsoft, Apple, and Google.

And BlackRock is an influential Wall Street player in Washington, D.C.

For example, Wally Adeyemo, a former chief of staff at BlackRock, now serves as the Deputy Secretary of the U.S. Treasury.

And former BlackRock executive Eric Van Nostrand serves as the acting assistant secretary for economic policy for the Treasury.

So there’s no doubt BlackRock is a major player in global finance and politics. When Fink speaks, the market listens.

A few years ago, he wasn’t so keen on bitcoin and crypto.

Not only did he call bitcoin “an index for money laundering”…

In 2018 he also said none of the company’s clients were interested in buying crypto.

Fast-forward to today, and it’s a different story.

A New Era of Finance

Despite all the volatility we’ve seen in the crypto market, Fink recently commented that “bitcoin is an international asset.”

He elaborated, “More importantly, because it’s so international, it’s going to transcend any one currency in currency valuation.”

On top of that, more and more of BlackRock’s investors have been asking about the role of crypto over the last five years.

For Fink and BlackRock, the role of bitcoin and crypto is now “digitizing gold.” And they believe crypto “has a differentiating value versus other asset classes.”

So it’s no surprise BlackRock filed an application with the U.S. Securities and Exchange Commission (SEC) for a spot bitcoin ETF in June. (More on this later.)

Here’s why I’m telling you this…

We’re seeing what I call the Great Pivot in crypto.

It’s a signal that Wall Street and traditional finance (TradFi) have accepted crypto… and the beginning of the merger between the two.

TradFi brings its scale, security, and regulations to crypto. And crypto brings transparent blockchains, inclusive decentralized ecosystems, and 24/7 operations to traditional finance.

No longer will Wall Street define crypto as a haven for criminals or magic internet money.

It’s the end of the “end of crypto.” And the Great Pivot will usher in a new era of finance.

We’ll look back at this time as a key inflection point for the crypto industry.

As we emerge from Crypto Winter, the TradFi giants are increasingly getting into the crypto space.

And that’s because asset managers like Fink view it as a “dream investment” for their institutional portfolios.

The Dream Investment for Asset Managers

There’s a number of short-term catalysts that will send bitcoin (and the overall crypto market) prices higher in the coming months… including the next bitcoin halving and the likely approval of a spot bitcoin ETF.

But there’s one trend that I believe will increase mass adoption over the long term.

To understand this trend, we need to think about bitcoin from the perspective of an institutional investor like Fink.

As an asset manager, he wants to generate the highest return possible for BlackRock’s clients while also keeping the risk low.

To that end, he’ll look at the correlations between the different asset classes in which BlackRock invests.

Before I get to that, let me explain what’s meant by “correlation.”

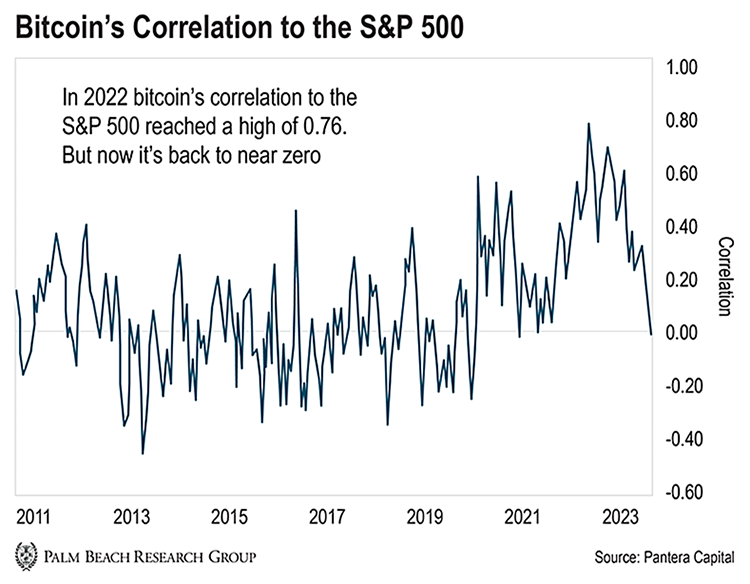

In finance, correlation measures the degree to which two securities move in relation to each other. The values range from -1 to +1.

-

Negative 1 shows perfect negative correlation. The assets move in the opposite direction.

-

Positive 1 shows perfect positive correlation. The assets move in the same direction.

What managers want to avoid is a portfolio of highly correlated assets.

While a portfolio like that will do well when the asset classes are rising, it’ll get crushed when the tide turns.

That’s why the 60/40 portfolio is popular. It consists of a 60% allocation to stocks and a 40% allocation to bonds.

The stock allocation gives you growth potential. But, of course, the stock market can go through drawdowns. So you balance it out with bonds, which are relatively stable and less volatile compared to stocks.

For most of its history, bitcoin has had little correlation to other risk assets such as the S&P 500.

That changed, however, over the course of 2022. At one point bitcoin’s correlation to the S&P 500 reached a high of 0.76.

And some worried the dynamic had changed. That investing in bitcoin and the blockchain wouldn’t be much different than investing in large-cap tech stocks.

Fortunately, this was just an anomaly.

You can attribute the high correlation to the over-leveraged, centralized crypto firms that blew up during the year like Three Arrows Capital, Celsius, Voyager, and FTX.

And as you can see from the chart below, bitcoin’s correlation to the S&P 500 is back to near zero.

That’s great news.

Bitcoin and altcoins are a new asset class. Bitcoin has high historical returns. And it’s not correlated to other risk assets such as stocks.

For a portfolio manager, that’s a dream investment.

And it’s that thought process, along with the Great Pivot, that will take bitcoin and the crypto markets to new all-time highs.

Again, look no further than BlackRock. It recently put together a report on portfolio optimization and asset allocation with bitcoin.

Covering the last decade, it found the optimal bitcoin allocation was a massive 84.9%.

Now, we don’t expect portfolio managers to rush out and allocate 85% of their portfolios to bitcoin. But it should open the door to portfolio managers considering bitcoin for their portfolios.

We’ve been preaching the virtues of allocating part of your investment dollars to crypto for years. Now even BlackRock is driving a narrative that bitcoin is a must-have for any portfolio.

And as bitcoin goes, so does the rest of the crypto market.

Right now, Daily editor Teeka Tiwari believes a tiny subsector of the crypto market will see an influx of capital from the Great Pivot.

These are cryptos that will benefit from a new trend: the development of a digital dollar.

You see, the Federal Reserve recently launched a program that could lead to a mandatory recall on the U.S. dollar.

According to Teeka, this program could replace the dollar with a new digital version that will be radically different from what you have in your bank account right now.

He’s put together a briefing to explain what this new digital dollar regime means for you and your money… including the name of a crypto project also set to profit from its rollout.

Plus, he’ll also show you the one move you must make when your bank tells you it’s moving all your cash into this new digital dollar. You can watch it for free right here.

Regards,

Greg Wilson

Analyst, Palm Beach Daily