Last week, I wrote about the wisdom of “watching the crowd” to see what investors think today.

I had just attended the Orlando MoneyShow, where some of the most popular sessions were about hedging the market and income investing.

It was clear that attendees were looking for ways to come out ahead during the next bull market…

But there wasn’t a lot of interest – by speakers or attendees – in “Maverick Investments” like collectibles.

Now, regular readers know we like Maverick Investments because they’re real, rare, and enduringly valuable. (You can read Daily editor Teeka Tiwari’s case for them right here.)

And when it comes to Maverick Investments, we’ve seen a great opportunity in collectibles this year… While both the stock and bond markets are down over 20% on average this year, many collectibles are setting record highs.

But there’s far more to alternative investments than the growing world of collectibles.

And while some alternatives performed worse than stocks or bonds in 2022, their return potential in the years ahead looks fantastic.

Our Top Maverick Investment For This Beaten-Down Market

Despite a difficult year, crypto is still our favorite Maverick Investment here at PBRG.

That’s true even as we’ve seen the second-largest global cryptocurrency brokerage, FTX, collapse and file for bankruptcy in the past week… sending bitcoin to a new 52-week low.

Why? We’re not bullish for the sake of being contrarian right now.

It’s because cryptos still offer investors the best chance for asymmetric returns… where the upside is far greater than the downside.

Think about it this way…

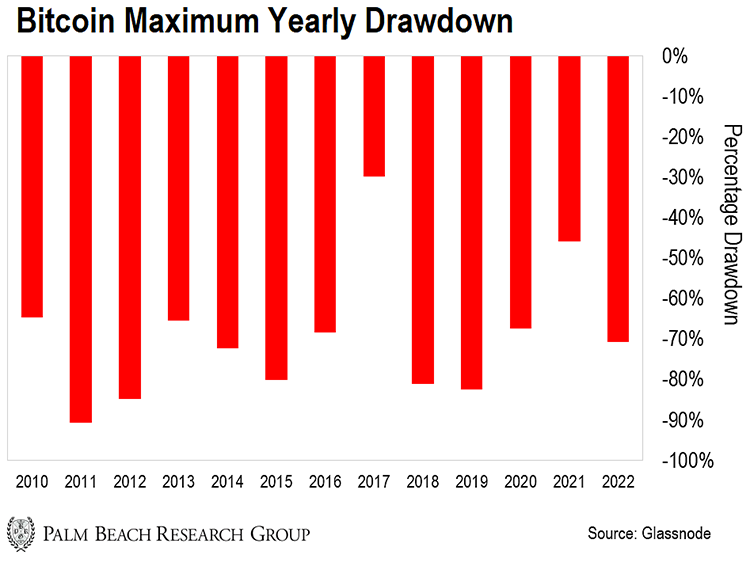

It’s true that cryptos tend to average a 50% pullback every year. And in bear markets, they can go down 70–80%, much like industry-bellwether bitcoin has done this year.

Take a look…

Bitcoin, the digital gold standard, is down 75% from last year’s highs… and many altcoins are down 90% or more.

But this extreme volatility means you get extreme gains as well…

And the gains will beat the losses over time.

That’s the key phrase. Over time. In a crypto bull run, folks expect big profits within a few days or weeks. But the real life-changing potential will take years to measure.

In 2016, for example, you had to go against the crowd to buy bitcoin around $400 and Ethereum around $18.

As I write this – even amid a broader crypto selloff – bitcoin has a 42x return for those buyers… while Ethereum has fared better, with 70x gains.

But as Teeka says, volatility is the price of admission for life-changing crypto gains…

So while it’s difficult to watch your crypto holdings fall 80–90% in a year… we’ve seen “the crowd” bail on crypto before, only to come rushing back in when the sector hit new highs further down the road.

The collapse of FTX will likely delay crypto investments by institutional and retail investors. But this latest fear just gives Maverick Investors a better buying opportunity in cryptos today.

Why This Beaten-Down Asset Is Different

In our November issue of the Palm Beach Letter, we discussed a crypto we expect to potentially move 10x higher in the next two years. (And that’s a conservative estimate.)

Nevertheless, MoneyShow’s speakers lumped nearly all crypto-related discussions into the same category as special purpose acquisitions (SPACs) and meme stocks.

The difference is that those investments had unique reasons for being overpriced…

Early SPAC deals in 2019 and 2020 led investors to see SPACs as a way to make a quick profit once a deal goes public.

And the crowd became so excited about SPACs that investors were paying $15 or more for shares of shell companies with $10 cash on the balance sheet.

As for meme stocks, message boards and internet forums have been used to pump small-cap companies as far back as the 1990s.

Prices jump quickly. But without a change in fundamentals – or an actual purpose or use – it’s never sustainable.

In contrast, cryptos are decentralized networks with no single individual or authority managing them. They’re working to solve problems that conventional financial systems and technologies can’t or won’t solve.

And today, it’s an asset class completely written off by the conventional investment crowd…

That spells a massive opportunity.

Bitcoin has created a peer-to-peer exchange network second to none, with nearly zero downtime since launching in 2009.

It has a hard cap of 21 million tokens. So it avoids the problems we see when central banks like the Federal Reserve print more currency.

And Ethereum has become the go-to crypto project for building smart contracts… a highly secure method of backing the ownership of trillions of dollars’ worth of assets.

Its recent Merge protocol drastically reduces the power needed to run the Ethereum network… And it also reduces the need to continually create new ETH tokens.

Teeka has helped thousands of subscribers become millionaires with investments in bitcoin and Ethereum over the years…

But even those gains have had to contend with a long crypto winter starting in 2018… and another brutal crypto winter this year.

Yet at the same time, we’re confident today’s buyers will be happy with their returns in the next 2 years… because as I mentioned above, we’ve been here before.

If you’re looking for an asset that’s so unloved by the crowd it’s ignored at one of the top investment conferences in the country, look no further than crypto.

Today’s prices make it the perfect time to start dollar-cost-averaging into big players like bitcoin and Ethereum…

Could crypto prices trend down in the months ahead? Possibly.

But as the stock market made new lows in September, bitcoin and Ethereum have only recently tested their summer lows… a selloff completely separate from their actual fundamentals.

Long term, Teeka sees bitcoin going to $500,000. From today’s price of about $17,000, that’s a 29x return… and I could see it hitting $1,000,000 in the years ahead – a 59x return.

That asymmetric potential – a high upside with a moderate downside – makes even the big-name cryptos a compelling investment today.

So until MoneyShow attendees are breaking down the doors to hear about crypto… I see it as the best way to go against the crowd.

Good investing,

|

Andrew Packer

Analyst, Palm Beach Daily

P.S. While the crowd is ignoring the long-term opportunity in crypto, they’re also missing a larger crisis on the horizon…

Teeka believes it’ll be 155x larger than the Lehman collapse that shook markets in 2008… and that it could destroy the financial future of investors worldwide.

To help our readers prepare, Teeka’s holding a special briefing this Wednesday at 8 p.m. ET.

He’ll tell everyone who attends about this “Next Lehman,” and even share a pick from his “2023 Recession-Proof Portfolio” – absolutely free.

Like the Lehman collapse, the fallout from this crisis will be felt in the market for years to come… and that’s one crowd you don’t want to be a part of.

To find out how to prepare yourself for the “Next Lehman,” click here to automatically reserve your spot for Teeka’s free event.